Stock Exchange: Will You Adjust Your Strategy, Or Go Down With The Ship?

The Stock Exchange is all about trading. Each week we do the following:

- discuss an important issue for traders;

- highlight several technical trading methods, including current ideas;

- feature advice from top traders and writers; and

- provide a few (minority) reactions from fundamental analysts.

We also have some fun. We welcome comments, links, and ideas to help us improve this resource for traders. If you have some ideas, please join in!

Review: Do You Pretend To Understand The Market?

Our previous Stock Exchange asked the question: Are You Trying to Be Right or Successful? Because, as a trader, being right and being successful are not the same thing. We suggested our readers not stubbornly focus on being right all the time, but rather relentlessly focus on being successful, even if it means being wrong sometimes.

This Week: Will You Adjust Your Strategy Or Go Down With The Ship?

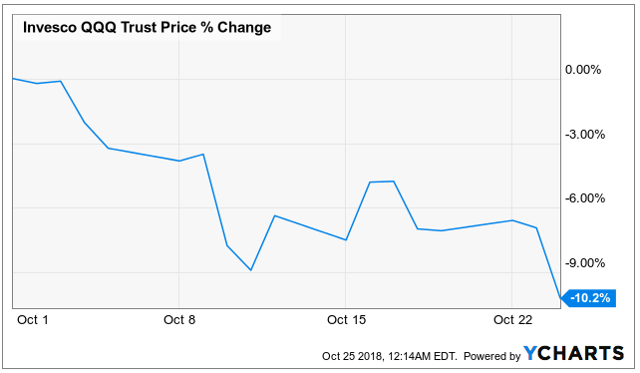

As infamous boxer Mike Tyson once said, “everyone has a plan, until they get punched in the face.” And with the recent indiscriminate marketwide sell-off, many traders are feeling like they’ve just been punched in the face.

And the question now becomes: “do you have the intestinal fortitude to stick to your long-term plan, or are you making adjustments?” And the answer, in our view, depends on the details of your long-term plan–assuming you have one!

For example, if you are a momentum trader, you may believe the powerful uptrend of the last few months has abruptly ended, and it’s time to bail on this market (if you haven’t already). However, in reality, the details are a little more complicated than that. Take for example, the details of this recent exceptional article (as usual) by Dr. Brett Steenbarger, in which he suggests traders consider how volume is moving price. Specifically, there is important information about the power of market moves by considering the underlying volume dynamics, not just market prices.

However, price and volume alone are still not enough in many cases, and some traders recognize the importance of adjusting their trades based on current volatility levels, as Michael at MartinKronical reminds us in this excellent post: The Benefits of Adjusting Position Sizes.

And if you’re still not on board with the notion of adjusting your strategy, you might consider TrendFollower’s recent note titled: Daniel Kahneman and Jeff Bezos Make the Case for Trend Following, in which Bezos states:

When we make mistakes, and we’ve made doozies, like the Firephone and many other things that just didn’t work out–we don’t have enough time for me to list all of our failed experiments, but the big winners pay for thousands of failed experiments.

So have you adjusted your strategy based on current market conditions?… Are you determined to stay the course?… Or perhaps you are taking the Rip Van Winkle approach, and just sleeping through this recent marketwide mess? We’ll have more to say on this later. But first…

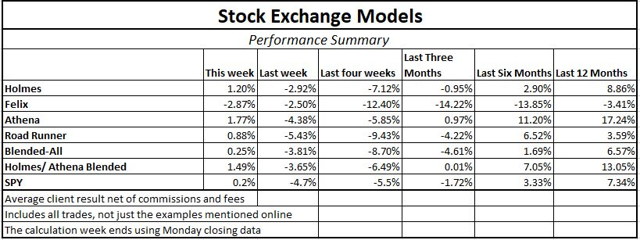

Model Performance:

We are sharing the performance of our proprietary trading models, as our readers have requested, as shown in the following table:

We find that blending a trend-following / momentum model (Athena) with a mean-reversion / dip-buying model (Holmes) provides two strategies, effective in their own right, that are not correlated with each other or with the overall market. By combining the two, we can get more diversity, lower risk, and a smoother string of returns.

For more information about our trading models (and their specific trading processes), click through at the bottom of this post for more information. Also, readers are invited to write to main at newarc dot com for our free, brief description of how we created the Stock Exchange models.

Expert Picks From The Models:

Note: This week’s Stock Exchange is edited by guest contributor Blue Harbinger, a source for independent investment ideas.

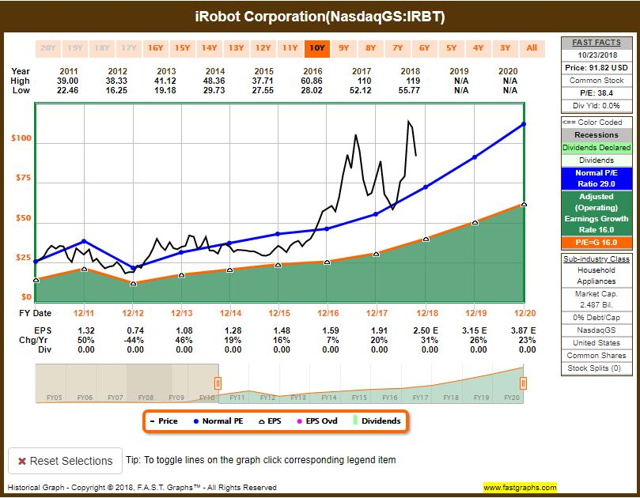

Holmes: This week I purchased iRobot (IRBT) on Wednesday, 10/24. What do you think about that?

Blue Harbinger: Bold move, Holmes. It takes guts to buy on a dip like we’ve been experiencing. But then again, that is your strategy–you are the dip-buyer among the group.

Holmes: That right. I am a dip-buyer. Technically speaking, I am a technical trader, I am a dip-buyer, and my typical holding period is around 6 weeks.

BH: I am slightly entertained because you are a technical model, not a human, and you bought a company that designs and builds robots. I am tempted to wonder if you have something against human beings, Holmes.

Holmes: Nothing personal, but human beings are emotional and often irrational. For example, humans tend to make a lot of mistakes when the market gets volatile like it has this month. On the other hand, I am completely objective and I don’t have the non-sensical emotions that prevent many humans from buying when the market sells-off (because they are too afraid!).

BH: I appreciate the points you’ve made about staying objective and being a contrarian dip-buyer, but how about considering the fundamentals too. iRobot just beat earnings estimates on 10/23 (the day before you bought), and revenue is climbing. Here is a look at the FastGraph.

Holmes: I am aware of that, but thanks anyway for the feedback. I’ll be out of the trade before the long-term fundamentals play out. Anyway, how about you, Felix–any trades this week?

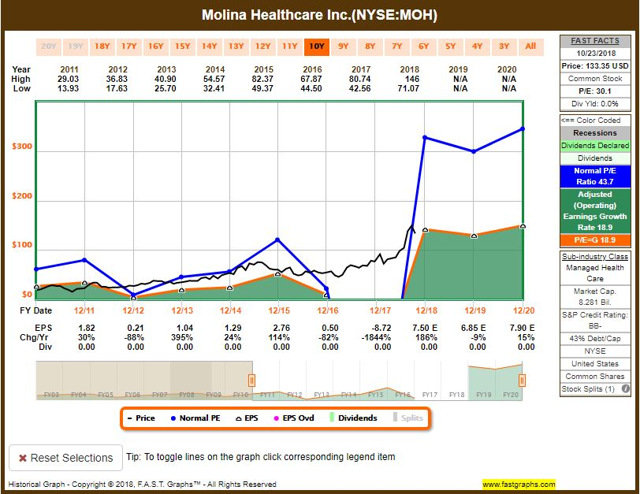

Felix: This week I purchased Molina (MOH). Ever heard of it?

BH: Hi Felix. Yes. Molina is a healthcare services company with an $8 billion market cap. Why do you like it?

Felix: I like Molina because it has strong momentum on its side. And as you know, my typical holding period is 66-weeks, considerably longer than the other traders.

BH: 66-weeks seems a little more palatable compared to the much shorter time periods for many of the traders in this report. The shares have been doing quite well since the last sell-off in the Spring, as you can see in the chart above, so maybe they’re resume their upward momentum trend once this current bout of volatility subsides. It seems there is plenty of negative news right now, but that also seems to be largely noise, and the economy remains strong. But from a more company-specific fundamental standpoint, here is a look at the FastGraph.

Felix: Interesting. Thanks for that perspective. And how about you, Road Runner–any trades for you this week?

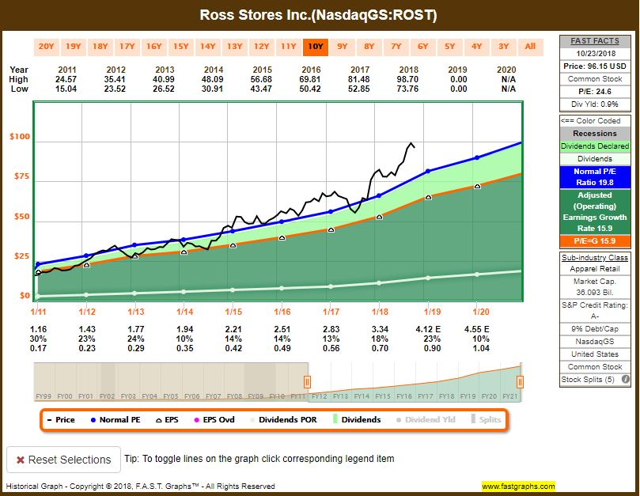

Road Runner: As you know, I like to buy stocks in the lower end of a rising channel, and I just recently purchased shares of Ross Stores.

BH: I see the rising channel, but don’t you ever consider fundamentals in addition to technicals? For example, Ross Stores operates off-price retail apparel and home accessories stores, and earnings have been strong (revenues are creeping higher, and the company consistently has been beating Wall Street revenue estimates), but the fact that Ross Stores operates retail stores makes me nervous, considering the powerful growth in online retail to the chagrin of retail stores. Here is a look at the longer term price action and the FastGraph.

RR: Gee thanks, Blue–but I typically only hold positions for about 4-weeks, so the longer-term data you’re pointing out are less relevant to me.

BH: Okay, Road Runner, suit yourself. For your sake, I hope this sharp sell-off is just noise, and the eventual market snap-back will be even stronger than the sell-off, as it often is.

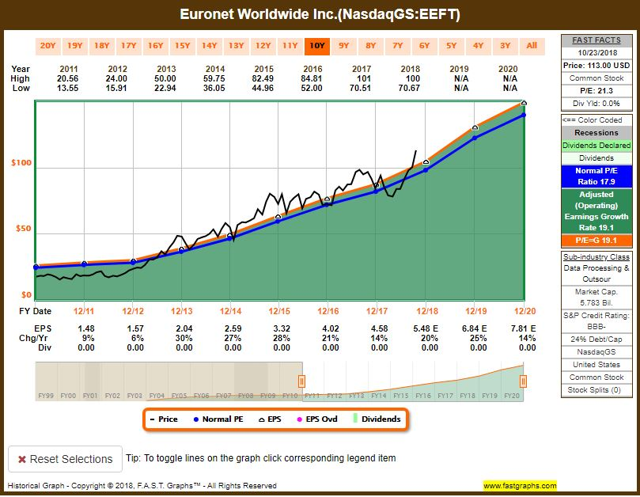

Athena: This week I purchased shares of Euronet (EEFT). Have you heard of it?

BH: Euronet does electronic payment and transaction processing solutions for financial institutions, retailers, service providers, and individual consumers. Things like EFT Processing, Epay, and Money Transfer, as well as payment solutions consisting of ATM cash withdrawal and deposit services, ATM network participation, outsourced ATM and POS management solutions, credit and debit card outsourcing, and card issuing, and merchant acquiring services.

Athena: Okay–that’s interesting. You know what else is interesting? My track record. Per the table earlier in this report, I am posting strong returns–better than the other models too.

BH: Athena–it’s not like you to brag, but congrats anyway. What is your strategy again?

Athena: I am an objective technical trading program, and I like momentum. My typical holding period is 17-weeks

BH: Thank you for that information. In return, here is some important data on this company from the FastGraph.

Athena: As a technical trader, I appreciate those charts, but the estimates go out a little far considering I usually only hold my positions for around 17-weeks.

BH: Thanks for sharing, Athena.

Conclusion

To be clear, we do NOT believe the market is a sinking ship. Even though the short-term technical health has recently been leaning bearish, the long-term strength is healthy and bullish. And if you are a trader, this latest bout of volatility has created continuing opportunities to make adjustments to your strategy (for example based on volume and/or volatility metrics), and thereby improve your overall chances for success.

Background On The Stock Exchange:

Each week, Felix and Oscar host a poker game for some of their friends. Since they are all traders, they love to discuss their best current ideas before the game starts. They like to call this their “Stock Exchange.” (Check out Background on the Stock Exchange for more background). Their methods are excellent, as you know if you have been following the series. Since the time frames and risk profiles differ, so do the stock ideas. You get to be a fly on the wall from my report. I am usually the only human present and the only one using any fundamental analysis.

The result? Several expert ideas each week from traders, and a brief comment on the fundamentals from the human investor. The models are named to make it easy to remember their trading personalities.

Stock Exchange Character Guide:

| Style | Average Holding Period | Exit Method | Risk Control | ||

| Felix | NewArc Stocks | Momentum | 66 weeks | Price target | Macro and stops |

| Oscar | “Empirical” Sectors | Momentum | Six weeks | Rotation | Stops |

| Athena | NewArc Stocks | Momentum | 17 weeks | Price target | Stops |

| Holmes | NewArc Stocks | Dip-buying Mean reversion | Six weeks | Price target | Macro and stops |

| RoadRunner | NewArc Stocks | Stocks at bottom of rising range | Four weeks | Time | Time |

| Jeff | Everything | Value | Long term | Risk signals | Recession risk, financial stress, Macro |

We have a new (free) service to subscribers to our Felix/Oscar update list. You can suggest three favorite stocks and sectors. We report regularly on the “favorite fifteen” in each ...

more