Stock Exchange: Where Do You Go For Trading Ideas?

The Stock Exchange is all about trading. Each week we do the following:

- discuss an important issue for traders;

- highlight several technical trading methods, including current ideas;

- feature advice from top traders and writers; and

- provide a few (minority) reactions from fundamental analysts.

We also have some fun. We welcome comments, links, and ideas to help us improve this resource for traders. If you have some ideas, please join in!

Review: Are The Momentum Bulls High?

Our previous stock exchange asked the question: Are The Momentum Bulls High? We noted the market had climbed considerably higher this year, and some bulls were becoming increasingly confident. But we also reminded readers not to forget the importance of position sizing. Further, we highlighted new trades by our momentum models, which had just stated dipping their toes back into some trading positions after sitting on the sidelines for a few weeks for risk management purposes.

This Week: Sources for Trading Ideas, Psychological Support and Camaraderie

Are you a 100% self-taught trader? Chances are, you’ve had some support and important influences along the way. And even if you grind it out daily as a lone wolf trader sitting in front of your monitor (or smart device), it can be helpful to have a few “go to” sources for trading ideas. We have many, for example, one of our favorites is the always insightful TraderFeed by Dr. Brett Steenbarger. His site is essentially a trading psychology resource center chock-full of good advice, such as his most recent post: Tough Advice For Aspiring Traders.

The SMB Training Blog is another fantastic source full of lessons from the trading desk, and so is legendary trader Charles Kirk’s private membership The Kirk Report, both of which we have quoted in the past

Of course, there are other prolific fountainheads of ideas such as stock screeners (if you know what to screen for) and Twitter (if you know who to follow). What are a few of your favorite trading sources?

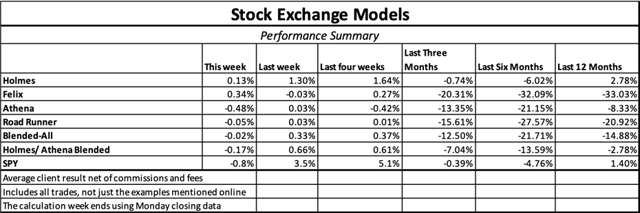

Model Performance:

We are sharing the performance of our proprietary trading models, as our readers have requested, as shown in the following table:

Controlling Risk:

We find that blending a trend-following / momentum model (Athena) with a mean reversion / dip-buying model (Holmes) provides two strategies, effective in their own right, that are not correlated with each other or with the overall market. By combining the two, we can get more diversity, lower risk, and a smoother string of returns.

Since many clients combine the trading models with our long-term fundamental methods, they have additional diversity of methods without the need for short-term timing.

For more information about our trading models (and their specific trading processes), click through at the bottom of this post for more information. Also, readers are invited to write to main at newarc dot com for our free, brief description of how we created the Stock Exchange models.

Expert Picks From The Models:

Note: This week’s Stock Exchange report is being moderated by Blue Harbinger, a source for independent investment ideas.

Holmes: I sold my shares of AutoZone (AZO) on Monday. As you know, I am a data-driven trading model, and my specialty is “dip-buying.”

Blue Harbinger: Not bad, Holmes. I recall you explaining your rationale when you bought the shares back in early January. Looks like this one worked out quite profitably for you.

Holmes: It did, thank you. And as you also know, I typically hold for about 6-weeks, so this trade was pretty typical for me.

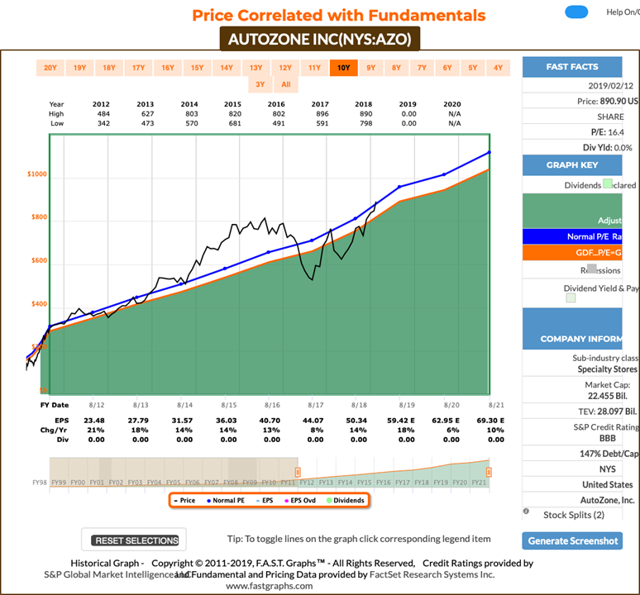

BH: Here is a look at some long-term fundamental metrics for this automotive replacement parts and accessories company, if you are interested.

Holmes: As usual, thanks for the data; it’s always interesting to me, but a little too long-term focused. I am a trader, not an investor. There is a difference

Blue Harbinger: I am a long-term investor, not a shorter-term trader, so I know the difference. Thanks for sharing that perspective. And how about you, Road Runner–any trades to share with us this week?

Road Runner: You bet. As you know, just last week I started to dip my toe back into some trades after sitting out for a few weeks because of market conditions. I am a momentum trader, I typically hold for about 4-weeks, and this week I bought shares of PayPal (PYPL).

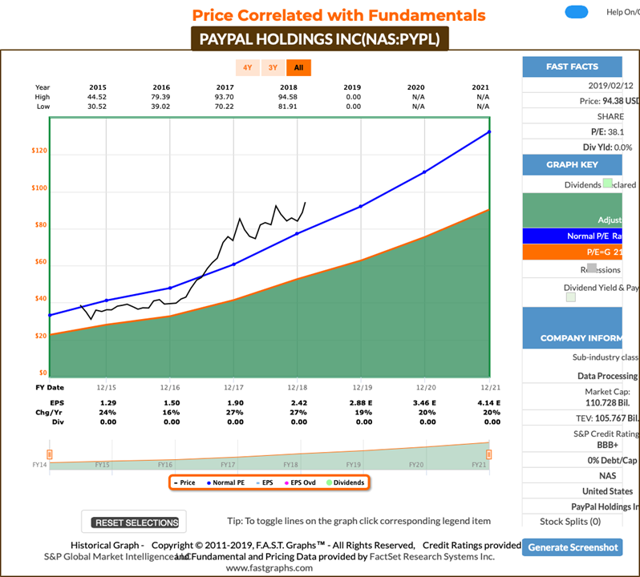

BH: I like PayPal’s business because it has such a large (and expanding) total addressable market. It’s basically a digital payments processing company, and that’s a good place to be with a strong growing economy. However, I’ve got to admit, I have used PayPal to process payments for multiple online businesses, and there are better, smarter, newer solutions out there. For example, I like a company called Stripe much better than PayPal (because Stripe is simply a better solution). And while we’re on the topic of payment processing and FinTech companies, I believe this is a fantastic space. For example, Square (SQ) is a growing powerful behemoth. Also, I like a company in headquartered in our home state of Illinois called Paylocity (PCTY) that processes payroll for small and mid-sized companies (I own it, and it’s been on fire). Also, here is a look at the Fast Graph for PayPal.

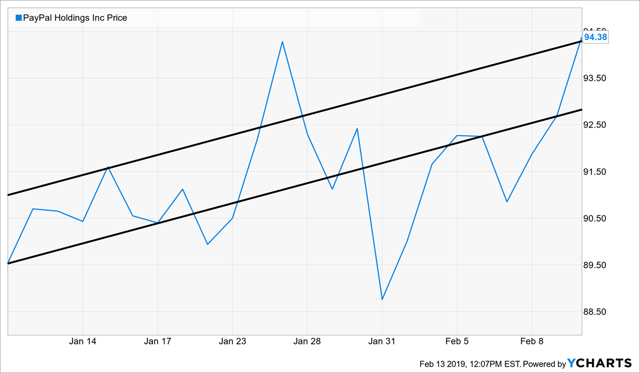

Road Runner: Settle down BH. You’re talking about long-term fundamentals, and I am a trader, Again, I typically only hold for about 4-weeks. Anyway, so you have a better idea of my process, I like to buy stocks in the lower end of a rising channel. Here is a look at what I am talking about for PayPal.

BH: Okay, Mr Momentum-Based Technical Trading Model. Did you see the S&P 500 finally broke above the closely watched 200-day moving average? That’s a big deal to you technical traders, right?

Road Runner: It is, but it’s a little more complicated than that. Maybe you should stick to the long-term investing for now, BH.

BH: I will. But I like to pay attention to technicals too. So thanks for the lesson. Anyway, how about you, Athena–any trades to share this week?

Athena: This week I purchased shares of Coty Inc (COTY). This company creates branded beauty products.

BH: Interesting trade, Athena. That stock has been on fire in recent trading sessions after a solid earnings beat. I know you are all “proprietary” about your trading process, but I am starting to get the feeling that when you say you are into momentum, you’re really talking about earnings momentum as much as price momentum.

Athena: I typically hold for around 16-weeks, and if you’d like more information about my trading process, you can request it using the link at the end of this report.

Blue Harbinger: Alrighty then. Thanks. And how about you, Felix–do you have anything to share with us this week.

Felix: This week I ran the stocks of the Nasdaq 100 through my technical trading model, and I have ranked the top 20 for you in the following list. As a reminder I am a momentum trader, but I hold for a longer time period than the other models–typically around 66 weeks.

BH: I see lots of interesting names on that list; Netflix (NFLX), Skyworks (the chipmaker) and Starbucks (where I happen to be sitting right now) are all interesting. Thanks for being a good source of trading ideas.

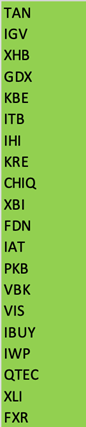

Oscar: I have some ETF rankings to share. As our resident sector/ETF rotation model, this week I ran our Comprehensive and Diverse ETF universe through my model, and the top 20 are ranked in the following list.

Conclusion:

With the sheer number of trading information sources available, it’s easy to get overwhelmed. Just like it’s important to select a trading style that fits your needs, it’s also important to do the same with trading information sources. What are a few of your favorite sources for trading ideas?

We have a new (free) service to subscribers to our Felix/Oscar update list. You can suggest three favorite stocks and sectors. We report regularly on the “favorite fifteen” in each ...

more