Stock Exchange: Are You Trying To Be Right Or Successful?

The Stock Exchange is all about trading. Each week we do the following:

- discuss an important issue for traders;

- highlight several technical trading methods, including current ideas;

- feature advice from top traders and writers; and,

- provide a few (minority) reactions from fundamental analysts.

We also have some fun. We welcome comments, links, and ideas to help us improve this resource for traders. If you have some ideas, please join in!

Review: Do You Pretend To Understand The Market?

Our previous Stock Exchange asked the question: Do You Pretend to Understand the Market? We noted that there are plenty of media pundits ready with plausible explanations after every market sell-off, but if they really understood the causes, why’d they wait until after the sell-off to explain? However, as market wide volatility increases, traders should also be careful to recognize the heightened risks.

This Week: Are You Trying to Be Right or Successful?

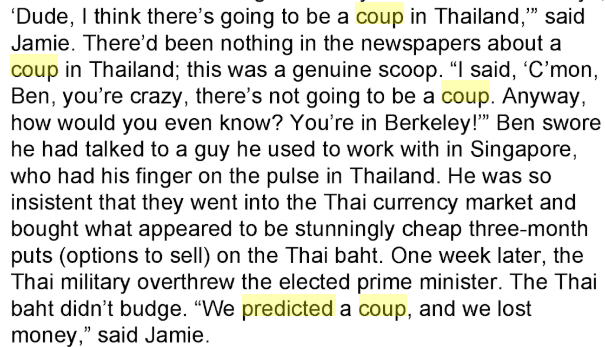

When markets get volatile, as they have over the last two weeks, it’s important to ask yourself: “Do you want to be right or successful as a trader?” Not sure what we’re talking about? Here is an excerpt from the Michael Lewis book about the financial crisis “The Big Short” where they correctly predicted a coup whereby the Thai military overthrew the government, but they still LOST MONEY betting against the Thai currency:

The first point is that just because you’re right, that doesn’t mean you’ll be a successful trader. And the important takeaway (from the next passage in the book) is that:

They had more losers than winners, but their losses, the cost of the options, had been trivial compared to their gains.

Basically, it’s okay to be wrong sometimes, so long as your winners are bigger than your losers.

For more perspective, The SMB Training Blog reminds us in their recent list of 8 Keys to Profiting as a Trader During Volatile Market Conditions:

Do not expect to be perfect… You are going to miss trades.

Still not sure what we mean? Here is a video from Steve Jobs whereby he explains (see: 0:48/2:15):

I don’t really care about being right, I just care about success.

Perhaps Jobs would have made a great trader. And a hat tip to Finance Trends for sharing this video in their recent article: On Being Wrong… and Profiting Anyway.

The point is that, as a trader, you shouldn’t be stubbornly focused on being right all the time, it’s okay to be wrong sometimes (as long as your losers are less than your winners); and remember to take what the market gives you instead of stubbornly focusing on what you are so certain is “right.” Being right and being successful are not the same.

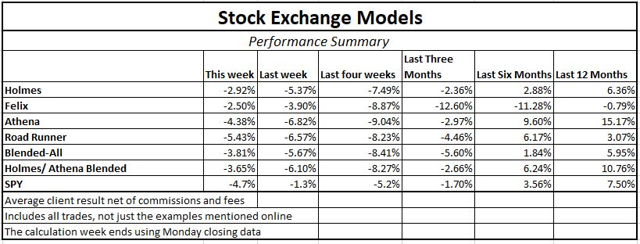

Model Performance:

We are sharing the performance of our proprietary trading models, as our readers have requested, as shown in the following table:

We find that blending a trend-following / momentum model (Athena) with a mean-reversion / dip-buying model (Holmes) provides two strategies, effective in their own right, that are not correlated with each other or with the overall market. By combining the two, we can get more diversity, lower risk, and a smoother string of returns.

For more information about our trading models (and their specific trading processes), click through at the bottom of this post for more information. Also, readers are invited to write to main at newarc dot com for our free, brief description of how we created the Stock Exchange models.

Expert Picks From The Models:

This week’s Stock Exchange is being edited by guest contributor, Blue Harbinger (Blue Harbinger is a source for independent investment ideas).

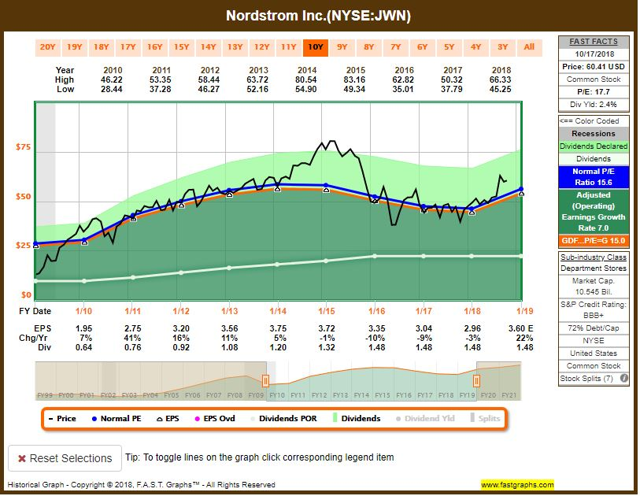

Holmes: This week I sold my shares of Nordstrom (JWN). If you recall, I purchased them for around $60 per share near the end of September, and I sold them higher at around $62 earlier this week.

Blue Harbinger: That’s not a bad trade, especially considering the ugly conditions we’ve be experiencing in the markets recently. Why’d you decide to sell, Holmes?

Holmes: I am a technical trader; more specifically, I am a dip buyer. And my typical holding period is around 6 weeks. But when market conditions become less favorable, I’m increasingly likely to exit my position, and in this case it was at a profit.

BH: I find two things interesting about your trade, Holmes. First, with all the gloom and doom headlines about Sears going bankrupt, I am surprised you were willing to venture into this retail segment. And second, I am noticing you appear to have purchased right after Nordstrom announced strong earnings in mid-August. Were you looking for some kind of momentum following the announcement?

Holmes: First of all I am a trader, not a long-term investor, so the slow death of Sears (and it’s long-term impacts on the space) is less interesting than the shorter-term setup on the trade. Second, I am a dip-buyer, not a momentum trader. Felix is a momentum trader.

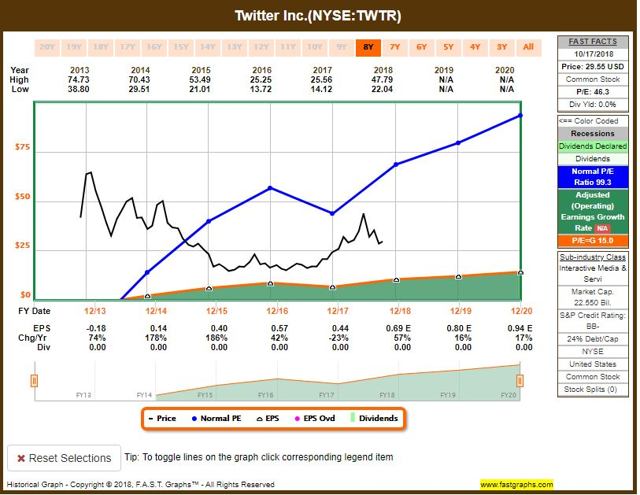

Felix: I am a momentum trader, and I purchased Twitter (TWTR) on Friday 10/12. Are you a big Jack Dorsey fan, BH?

BH: Hi Felix. Yes- Jack Dorsey is the founder of Twitter, and he also founded Square (SQ). Personally, I like Square more because it has way more long-term upside in my opinion, and it just sold-off–the whole “buy low” opportunity thing, ya know. But Twitter is interesting.

Felix: That’s great you’re into long-term opportunities, but I’ve had a lot of success with shorter and mid-term trades. My typical holding period is 66 weeks. Does that mean your time horizon standards?

BH: 66-weeks seems a little more palatable than 6-weeks, but it’s still a little short compared to a market cycle. Here is a look at the Fast Graphfor Twitter.

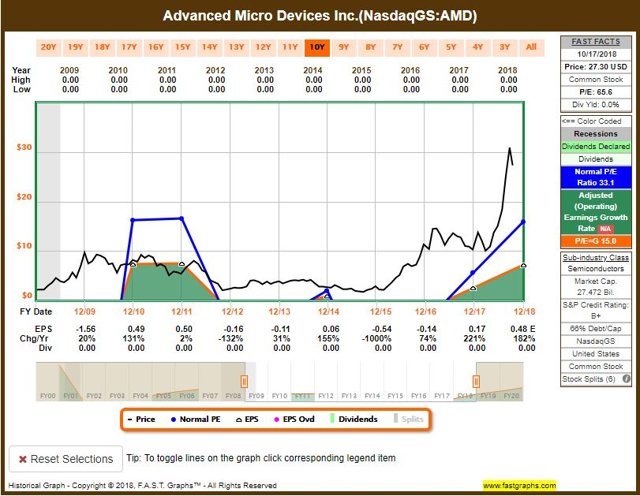

Felix: Yawn. Thanks for that perspective. Now that you’ve put our readers to sleep, hopefully we can wake them back up with the following ranking. I ran the S&P 400 Mid-cap index through my model, and my top 20 are include below.

BH: Thanks for sharing, Mr. 66-week momentum. Those ideas are appreciated. And how about you, Road Runner–any trades to share this week?

Road Runner: As you know, I like to buy stocks in the lower end of a rising channel, and our current market conditions are attractive for my strategy. For example, this week I bought Intelsat (I)–in the lower end of a rising channel.

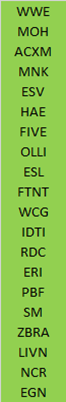

Blue Harbinger: Interesting trade. Personally, I like the idea of buying in the lower end of a rising channel, but only after I have completed my detailed fundamental long-term analysis. Do you like the satellite services business that Intelsat provides? Here is a look at the Fast Graph.

RR: Listen, Blue. It’s great that you like to do your detailed long-term fundamental analysis, but I continue to find my trading strategy to be more effective for me. My typical holding period is 4-weeks. And this one has plenty of momentum and the rising-channel dip I like.

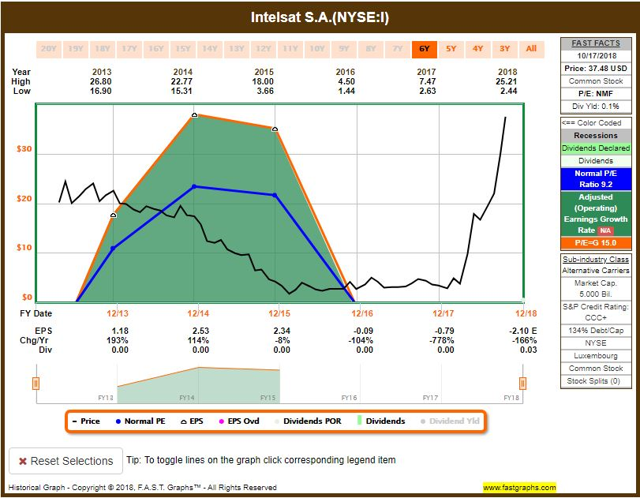

Athena: While you and Road Runner bicker about whose strategy is better, I’m going to do something productive and share a successful recent trade that I hope will be constructive. I purchased Advanced Micro Devices (AMD) at the end of August, and I sold (profitably) within the last week. Long-term investors have NOT been locking in too many gains lately, so it may be worthwhile for market participants to recognize there are many different market strategies that work in differing market conditions and participants.

BH: Congrats on your trade, Athena. Looks like it could have been a lot better if you’d have sold a little sooner–some of your gains got erased with the recent sell-off (but nice job nonetheless). I like AMD, but personally I like Nvidia (NVDA) more because it has the competing graphics processing chips, but it also has the growing data center chips business and the smart-car chip business on the horizon. Have you considered Nvidia?

Athena: Yes, I have considered Nvidia. I am a computer program, and I can process much more information, much faster, than your tiny human brain. But also recognize that my typical holding period is 17-weeks, so I’ll be out of this trade before the data center story plays out, and long before the artificial intelligence smart-car thing kicks into full force. I like momentum, and in the case of AMD, it was so strong, that I profited despite the recent big uptick in market volatility.

BH: Nice job, Athena. How about you Oscar–anything to share?

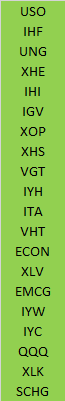

Oscar: This week I ran our “Comprehensive and Diverse ETF Universe” through my model, and my top 20 rankings are included in the following list.

BH: I see you still love oil (USO). I certainly have no idea where the price of oil is going but with recent Saudi Arabia tensions, and the ongoing threat of inflation, this could be a smart trade. And I know you are a momentum trader that typically holds for about 6-weeks before you rotate into a new sector–so that is good information to keep in mind too. Thanks!

Conclusion

If you are stubbornly determined to be right–all of the time, then trading may be a difficult endeavor for you. However, if you can recognize the power and freedom of being wrong, then you can learn from that, and you can progress towards making your losers much smaller than your winners. That’s often a tough lesson to learn, but it’s also been a path to success for many.

Background On The Stock Exchange:

Each week, Felix and Oscar host a poker game for some of their friends. Since they are all traders, they love to discuss their best current ideas before the game starts. They like to call this their “Stock Exchange.” (Check out Background on the Stock Exchange for more background). Their methods are excellent, as you know if you have been following the series. Since the time frames and risk profiles differ, so do the stock ideas. You get to be a fly on the wall from my report. I am usually the only human present and the only one using any fundamental analysis.

The result? Several expert ideas each week from traders, and a brief comment on the fundamentals from the human investor. The models are named to make it easy to remember their trading personalities.

Stock Exchange Character Guide:

| Style | Average Holding Period | Exit Method | Risk Control | ||

| Felix | NewArc Stocks | Momentum | 66 weeks | Price target | Macro and stops |

| Oscar | “Empirical” Sectors | Momentum | Six weeks | Rotation | Stops |

| Athena | NewArc Stocks | Momentum | 17 weeks | Price target | Stops |

| Holmes | NewArc Stocks | Dip-buying Mean reversion | Six weeks | Price target | Macro and stops |

| RoadRunner | NewArc Stocks | Stocks at bottom of rising range | Four weeks | Time | Time |

| Jeff | Everything | Value | Long term | Risk signals | Recession risk, financial stress, Macro |

We have a new (free) service to subscribers to our Felix/Oscar update list. You can suggest three favorite stocks and sectors. We report regularly on the “favorite fifteen” in each ...

more