Portfolio Allocation Strategies For The Self-Directed Investor

Should self-directed investors initiate new investments or add to holdings in his or her portfolio according to a weighting mechanism? And should we automatically reinvest dividends or store the cash as dry powder in FDIC-insured money markets or sweep funds?

In this post, I share two standard options for portfolio allocation and why one method makes the most sense for the self-directed, buy-and-hold investor as well as discuss the valuation benefits of letting dividends go to cash.

Weighting Mechanisms for Capital Allocation

Market cap weighting is the most popular, if not controversial, portfolio weighing mechanism. Market cap or capitalization-weighted indexes assign component value by the total market value of its outstanding shares against the cumulative market cap of the investment basket. Thus, the largest market cap stock in the portfolio will have the most influence on overall performance.

Market capitalization is defined as the closing share price times the number of common shares outstanding.

Equal weighting a portfolio treats each component the same regardless of price, market cap, or investor sentiment.

There are other weighting mechanisms such as the free-float market cap- weighted, price-weighted, and fundamental weighted.

The S&P 500 Index, the benchmark for the Main Street Value Investor Model Portfolio, is free-float market capitalization weighted. With this method, a float factor is assigned to each stock to account for the proportion of outstanding shares that are held by the general public, as opposed to closely held shares owned by the government or company insiders.

The Dow Jones Industrial Average uses price weighting where the higher priced components receive the most weight. Fundamental weighting emphasizes metrics such as sales, book value, dividends, cash flow, and earnings.

Choosing a Portfolio Allocation Option

Keep in mind that investing using a market cap weighted allocation translates to following the crowd as the higher the market cap, the more popular the stock. Thus, I equal cap weight my family portfolio and the corresponding MSVI Model Portfolio as the best approach to measuring overall performances against my chosen benchmark, the S&P 500 Index.

In my family portfolio, I tend to equal weight, meaning I will buy the same amount of dollars per holding or the same amount of shares (thus, different dollar amounts.) My thinking is although I like all the stocks that I buy, I don't know which ones are going to outperform the most in the long-term.

Trying to bet which specific stocks or ETFs in your portfolio will beat the market over an extended holding period is akin to trying to predict who will win the Super Bowl, World Series, or March Madness in 2024 or 2029. Placing a speculative wager is probably the best we can muster.

However, placing bets and crossing fingers is not the ideal approach for the thoughtful, disciplined, and patient, self-directed investor. That is why I think equal weight works best for the buy-and-hold investor of the reasonably-priced, dividend-paying stocks of quality companies with compelling value propositions.

For example, if we buy five reasonably-priced stocks of well-managed, shareholder-friendly companies with excellent value propositions and low downside risk, the chances are good that a majority of the holdings – or at least three in this case– will outperform the benchmark.

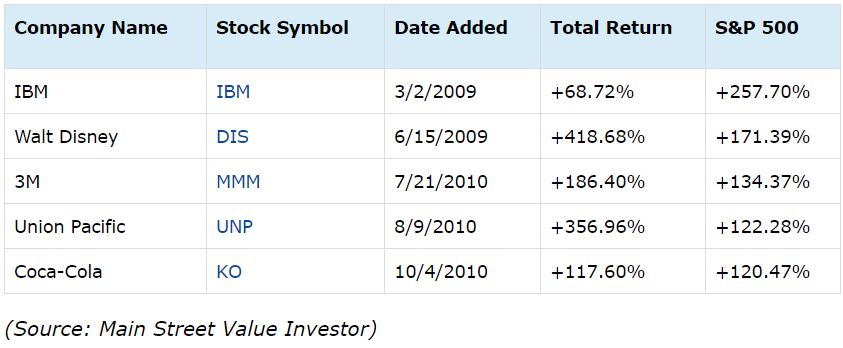

Here are the total return performances (adjusted for dividends and stock splits) of the five original holdings of the Main Street Value Investor Model Portfolio and the S&P 500 during the same holding period as of the year-end close on December 31, 2018.

My primary objective as a self-directed investor is picking the stocks of quality companies trading at reasonable prices that I believe have strong potential to outperform the S&P 500 benchmark over an extended holding period.

In the above sampling of the first five purchases in my current family portfolio, two stocks have performed much better than expected: DIS and UNP; two have done as expected: MMM and KO; while IBM did worse than anticipated.

I imagine most self-directed investors are surprised by the holdings that outperform and underperform the market in their portfolios during an extended holding period. We never really know until we do, although after the fact everything appears with 20/20 vision. Of course, IBM underperformed!

Nonetheless, if we adhere to the stocks of quality companies purchased at reasonable prices, the chances are excellent that the winners will outnumber the losers over time. Also, by equal-weighting, there is no need to foolishly overweight by speculating which holdings will ultimately outperform the targeted benchmark.

How Disciplined Value Investors Allocate Dividends

Disciplined value investors, regardless of whether working on Wall Street or living on Main Street, are often leery of automatic reinvestment programs for dividends and capital gains distributions.

I prefer to buy securities at my preferred price points and not on the whims of Mr. Market, as would be the case in automatic dividend reinvestment. The disciplined value investor allows dividend and capital gains distributions to settle as cash and then reinvests those funds when prices are attractive.

To be sure, the hands- and commission-free aspects of automatic reinvestment plans are appealing and may be the best course for the passive investor; but in terms of value, can be more expensive than reinvesting when the price is attractive.

Nevertheless, I pay modest discount broker commissions when voluntarily reinvesting precious dry powder into the equities of quality companies currently trading at perceived reasonable prices.

Whose Beach House are You Building?

It is common for the self-directed investor to overweight his or her favorite stocks in a portfolio. But how do we know which stocks will do better in the long run?

We can certainly make an educated guess based on our research and due diligence, but that would border on speculation. And if you believe as I do, keeping speculation to a minimum is perhaps the best approach to successful investing over the long-term.

In my experience and observations, a basket of equal weighted stocks of quality companies purchased at reasonable prices held for an extended duration is likely to outperform Mr. Market more often than not.

So why don't more investors follow the low-cost, equal-weighted, buy-and-hold, quality purchased at a reasonable price approach to portfolio construction?

Because the Wall Street fee machine cannot build beach houses solely on the minimal fees and commissions generated from the portfolios of long view value investors.

Thus, the Wall Street machine promotes and advocates the higher fee- and commission-generating investment models of active hedge and mutual funds, options, short-selling, arbitrage, technical analysis, momentum, trend following, high yield dividend, and other speculative, high turnover trading platforms that subsidize those Hampton beach houses.

As a more profitable alternative for the self-directed investor, I advocate pursuing the dream of building your own beach or lake house by taking a thoughtful, disciplined, and patient approach to portfolio construction, capital allocation, and dividend reinvestment.

Disclaimer: David J. Waldron's articles, blogs, and podcasts are for informational purposes only. The accuracy of the data cannot be guaranteed. Narrative and analytics are impersonal, i.e., not ...

more