New Stock Buy: General Dynamics

Recent portfolio addition:

General Dynamics (GD) is a global aerospace and defense company with leading market positions in business aviation and aircraft services; combat vehicles, weapons systems and munitions for the U.S. and its allies; IT services; command, control communications, computers, intelligence, surveillance and reconnaissance (C4ISR) solutions; and shipbuilding and ship repair. General Dynamics employs more than 100,000 people worldwide and generated $36.2 billion in 2018 revenue.

MARKET LEADER

Formed in 1952, General Dynamics has grown both internally and through acquisitions to become a market leader in the aerospace and defense industry.

Under the capable leadership of Phebe Novakovic, appointed as the company’s CEO and chairwoman in 2013, each business unit is responsible for its strategy and operational performance while the lean staff at corporate headquarters sets the company's overall strategy and is responsible for allocating and deploying capital. In 2018, 65% of General Dynamics’ revenue was from the U.S. government, 11% was from non-U.S. government customers and24% was from commercial customers. General Dynamics operates through five business segments: aerospace, combat systems, information technology, mission systems and marine systems.

The Aerospace segment, which generated 23% of the company’s 2018 revenue and 33% of its operating profits, offers a comprehensive fleet ofGulfstream business jets and worldwide aviation services. Combat Systems, which generated 17% of 2018 revenue and 21% of operating profits, provides combat vehicles including the Abrams tank and the Stryker combat vehicle, weapon systems, munitions, logistics support and maintenance services forthe U.S. and its allies. The Information Technology segment, 23% of sales and 14% of operating profits, was formed in 2018 concurrent with General Dynamics’ acquisition of CSRA. This segment provides IT solutions for defense, intelligence and federal civilian customers. Mission Systems, 13% of sales and 15% of operating profits, provides mission-critical C4ISR products and services. The Marine Systems segment, 24% of sales and 17% of operating profits, designs and builds submarines and surface ships for the U.S. Navy and Jones Act ships for commercial customers.

PROFITABLE GROWTH

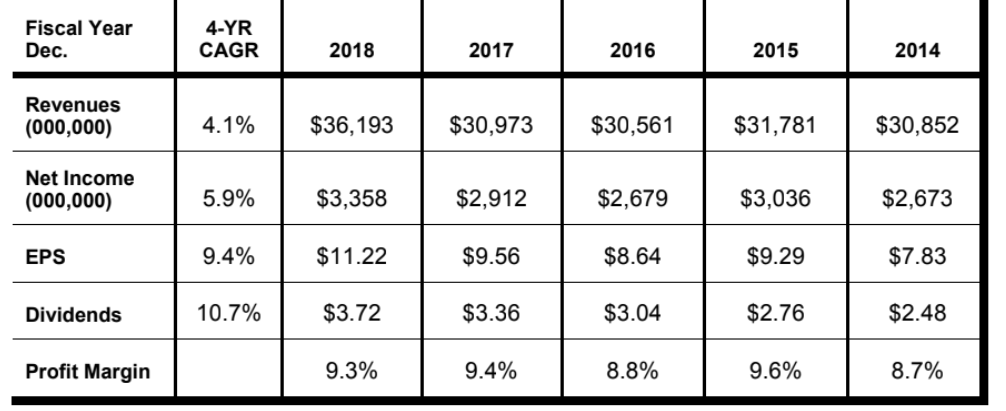

The company's sustained focus on continuous operational improvements has generated an exceptional 26.4% average return on shareholders’ equity during the past five years. Net earnings have compounded at a 6% annual rate since 2014 with EPS growing at an even faster 9% pace due to the

company’s share repurchase program.

The company's robust cash flow generation provides the fuel for share buybacks, dividends and a disciplined acquisition strategy to spur future profitable growth. During the past three years, the company spent $5.3 billion on share repurchases, reducing its share count by about 8%. Since 2014, dividends have compounded at an 11% annual clip with the firm raising its dividend by 10% in 2019, marking the 22nd annual increase.

During 2018, General Dynamics acquired six businesses for an aggregate cost of $10.1 billion, including $9.7 billion for CSRA, its largest acquisition to date. Combining CSRA with General Dynamics’ Information Technology business unit created a premier provider of next generation IT and cybersecurity solutions to the federal government. The acquisition is expected to be accretive to EPS and to free cash flow in 2019 and is expected to generate cost savings of about 2% of the combined unit’s revenues by 2020.

QUARTER RESULTS

General Dynamics reported third quarter revenue increased 7% to $9.8 billion with earnings from continuing operations increasing 6% to $913 million and EPS increasing 9% to $3.14. Third quarter revenue growth was lifted by the CSRA acquisition and a 23% increase in aerospace sales on initial deliveries of the new large-cabin G600 aircraft which entered into service during the third quarter. Total backlog at 9/30/19 was $67.4 billion, down slightly from last year, largely due to strong dollar currency headwinds. Despite the headwinds, General Dynamics ended the quarter with a book to bill ratio of 1. The company generated $1.1 billion in cash from operations in the quarter and free cash flow of $847 million, a 93% conversion rate. During the quarter, the company returned $295 million to shareholders through dividend payments and repaid $450 million in debt, ending the quarter with $974 million in cash

and net debt of $12.7 billion. Management’s focus for cash beyond internal investments and dividends is debt repayment with half the debt taken on to buy CRSA slated to be repaid by the middle of 2020.

With profitable growth, exceptional returns on shareholders’ equity, robust free cash flow and disciplined capital deployment, General Dynamics is a high-quality company. Investors seeking solid long-term returns should salute the General! Buy.