New Stock Buy: Bank Of Hawaii

Bank of Hawaii Corporation (BOH) is a 120-year-old regional financial services company with $16.9 billion in assets. Through its subsidiaries, the company provides a broad range of financial products and services to businesses, consumers and governments in Hawaii, Guam and other Pacific Islands. The company’s principal subsidiary, Bank of Hawaii, provides banking and investment services through its 69 branch locations, 382 ATMs, online and mobile banking services and 24-hour customer service center.

EFFICIENT BANK

In 1893, Peter Cushman Jones, a 60 year-old businessman, persuaded his two close friends to join him in organizing a new bank in the Islands. Four years later, with $400,000 in capital, Bank of Hawaii became the first chartered and incorporated bank to do business in the Republic of Hawaii, operating from a two-story wooden building in downtown Honolulu.Today, Bank of Hawaii is the second largest bank in the state with $17 billion in assets offering a broad range of financial products and services through three business segments: Retail Banking, Commercial Banking and Investment Services & Private Banking. The bank also offers services to government entities in Hawaii.

Bank of Hawaii operates in a unique competitive landscape where the top four banks control more than 80% of the regional market, providing the bank with a sticky, low-cost deposit base that reduces its sensitivity to pricing pressure as interest rates rise. In addition to its low-cost deposit base, Bank of Hawaii is a low-cost operator, evidenced by its 2017 efficiency ratio (non-interest expense divided by total revenues) of 55.7%, which places it among the country’s most efficiently run banks. The conservatively-managed bank maintains a pristine balance sheet with solid asset quality and robust liquidity and capital levels, far exceeding regulators’ requirements.

PROFITABLE GROWTH

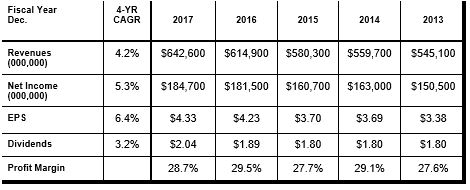

During the past five years, Bankof Hawaii has banked profitable growth with revenues compounding 4% annually, net income growing by 5% annually and EPS increasing at a 6% annual pace. During the period, average loans and leases have increased at a 12% annual clip to $9.3 billion while average deposits have grown by 6% annually to $14.5 billion. Return on average equity averaged a profitable 15.2% over the last five years. Credit quality steadily improved with non-performing loans declining over the past five years from $40 million to $16 million.

GROWING DIVIDENDS

Since becoming a public company in 1972, Bank of Hawaii has paid uninterrupted quarterly dividends to shareholders increasing at a 3% annual pace during the past five years. During 2018, Bank of Hawaii increased its dividend twice to $2.48 per share with the dividend currently yielding a solid 3.1%. Management remains committed to returning cash to investors in excess of that needed to fund operations.Indeed, Bank of Hawaii’s strong year -to-date free cash flow of $187 million enabled it to return nearly $140 million to shareholders through dividends of $73 million and share repurchases of $67 million at an average cost of $84.03 per share.Since 2001, the company returned a total of $2.14 billion to shareholders through share repurchases at an average cost of $38.92 per share with $52.1 million remaining under the current authorization.

THIRD QUARTER

2018 General economic conditions in Hawaii remained positive during the third quarter of 2018. Total visitor arrivals increased 7.2% while total visitor spending increased 8.8%. The statewide unemployment rate was 2.2%. With the strong local economy as the backdrop, net income for the third quarter of 2018 increased 24% to $56.9 million with EPS increasing 26% to $1.36. The increase in net income reflects a drop in the income tax rate from 30.6% to 18.75% and a 6% increase in net interest income due to the shift in the mix ofearning assets to loans which generally have higher yields. Net interest margin increased 15 basis points to 3.1%. The return on average assets for the third quarter of 2018 was 1.33%, up from 1.07% in the same quarter last year. The return on average equity for the third quarter of 2018 was 18.1%, up from 14.9% in the third quarter of 2017. The efficiency ratio for the third quarter of 2018 was 55.1%, improving from 55.8% in the same quarter last year. Investors banking on attractive long-term returns should consider Bank of Hawaii, a high-quality market leader with an efficient cost structure, profitable growth and growing dividends. Buy.

Disclosure: None.