My 'Fallen Angels' Favorites For 2020 Part 3: Pfizer

Read Part 1: My 'Fallen Angels' Favorites For 2020 Part 1: IBM

Read Part 2: My 'Fallen Angels' Favorites For 2020 Part 2: Kraft Heinz

------

Fallen Angel #3: Pfizer (PFE)

Pfizer has been left behind by many of its competitors - at least in the stock market. Of my 3 fallen angels, I or my clients own the first two. We own no PFE yet. Instead, in our portfolio, we hold both AbbVie (ABBV) and Bristol-Myers Squibb (BMY). Both have done very well for us this year. I plan to buy PFE because I think 2020 will be the year Pfizer shares rebound as these two have.

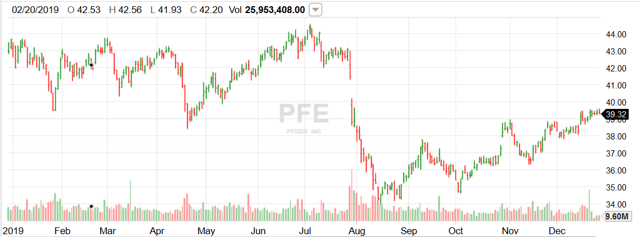

Shares were actually doing just fine in the market all the way through mid-year. Then, from July to September, the entire 3rd quarter, it plunged 20% in an up market! It has recovered somewhat but is still down for the year.

(Source: Fidelity.com)

The catalyst for the sudden fall was Pfizer’s announcement that the company was going to spin off its generic drug unit, Upjohn, to shareholders. Upjohn sells a number of now off-patent Pfizer drugs like Viagra, which still have good markets globally.

The second shoe to drop during that announcement was that Pfizer was planning to merge Upjohn with generic marketer Mylan NV (MYL), now headquartered in the UK, to create a new company to be called Viatris. (Where *do* they come up with these corporate names? Maybe it is supposed to be redolent of Viagra, one of its big sellers. To me, it is reminiscent of Vitalis instead, which provides a whole messier image...)

Following closely on the heels of a previous Pfizer announcement of a joint venture with GlaxoSmithKline (GSK) to operate its consumer division (just finalized in August), the investment and analyst community wondered if Pfizer was just drifting, wasting energy on corporate organization charts at the expense of spending its energy on research & development, or maybe just rearranging the deck chairs on the Titanic.

It is also a risk factor that in 2026, PFE will lose begin to lose patent protection for as many as five of its blockbuster drugs. But then, that happens all the time with quality ethical pharmaceutical companies.

They spend millions or hundreds of millions to research a medicine that meets patients’ needs, then develop it, then jump through the hoops of clinical trials, other interested regulators, and politicians looking to get their face in front of the cameras without having to call it advertising.

Sometimes, that R&D money is sunk as fast as owning a boat. But often enough to keep them profitable, the medical community and the regulators agree that the newest wonder drug is worthwhile. Those few hits make up for all the misses.

Pfizer already has a number of significant sales potential and patent-protected drugs out there, and more in the clinical trials pipeline. I will not show off my ability to read medical journals and press releases by rattling all of them off here! I see many other articles already available here and elsewhere covering each and every drug in the pipeline.

This reminds me of the Wall Street maxim I learned early on in my career: "Beware the analyst who can tell you how many railroad ties there are between New York and Boston, but can't tell you whether to buy the darned stock or not."

Trailing Merck (MRK), AbbVie, Bristol-Myers and most of their other key competitors in the marketplace, I think clearly the bad news is already out. Anything that looks faintly like a winning new drug or a brilliant new strategic partnership (or even a reappraisal by analysts of the heavily panned Upjohn-Mylan hookup) is likely to move the shares higher.

My guess is that Pfizer's research labs will come up with many more successes. On the immediate horizon, with pneumonia much in the headlines these days as it seems to be on the rise again, Pfizer’s Prevnar pneumonia vaccine looks like a winner. So does Ibrance for breast cancer. Anything that works to prevent a horror like breast cancer, or any other cancer for that matter, is sure to be well-received by the medical community and by patients.

I think 2020 will be the year that Pfizer’s value will be recognized. I expect the stock to rebound in line with that recognition.

Good investing,

JS

P.S. Speaking of recreational drugs, I am quite certain who will own that market in 5 years - and it isn't any of the current darlings. Next year, I'll make my case in a new article.

You will notice I have selected three 3 fine companies from three completely different sectors. I seek growth and value wherever I find it. As Robt Heinlein observed, "Specialization is for insects."

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in PFE over the next 72 hours

Disclaimer: I do not know your personal financial situation, so this is not ...

more