Intelligent Investing: Where To Invest During Economic Precarity

There have perhaps been fewer times in history where we should reconsider our investing strategies than today. With unprecedented health, crises come unprecedented economic precarity. The global economy has been shaken to its core as a result of the global pandemic - arousing the closure of shops, devastating effects on GDP and disposable income and has left investors with a rocky road to navigate.

As for the UK - she’s enduring the worst recession on record, as official records show. After a long period of economic prosperity, prompting investors to grow their appetite for risk, branch out, and diversify their portfolios further; we’re now in our first recession for 11 years. After GDP fell by 20.4% between April and June 2020 (the biggest slump ever), investors are looking for safe ways to position their portfolios.

A country falls into a recession if GDP falls over two consecutive quarters. In the UK, that’s the value of all goods and services added up, of which plunged by 20.4% in three months. To shed some light on this figure, the UK saw a 2.2% drop in the first three months of 2020. The Office for National Statistics attributes this directly to the halt in services, production, and construction.

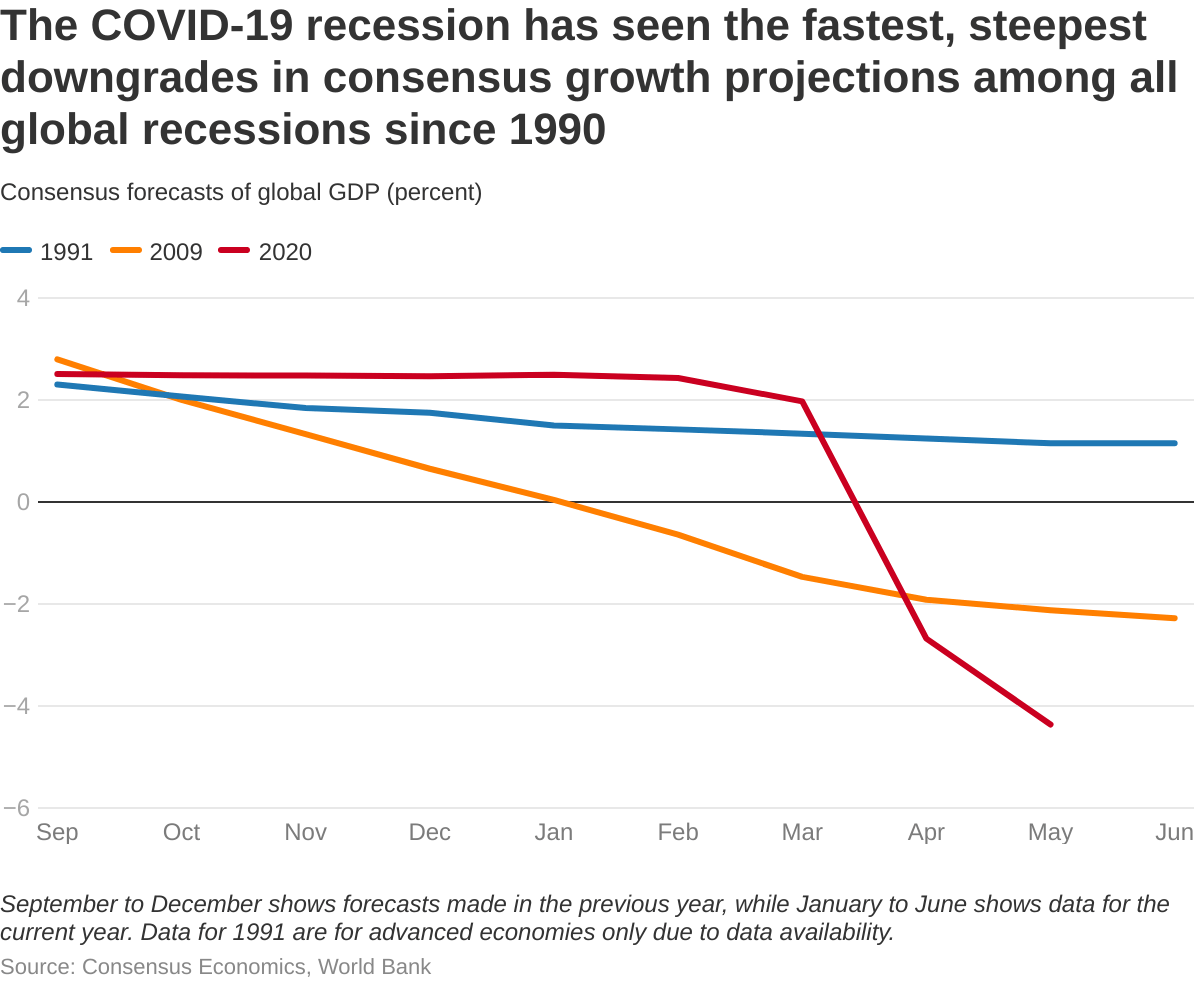

(Click on image to enlarge)

2020 recession hits hardest since 1990. Source: (World Bank)

The last time the UK was in a recession in 2008-09 as a result of the banking crisis, it lasted for five quarters. With no definitive answers on the future development of the Coronavirus, there is no telling how long we’ll remain in economic stagnation. What’s for sure, is that despite the length, the aftermath will be just as devastating. Officials predict the recession to have a significant impact long after the virus is gone.

What does this mean for investors?

No one knows that the path to economic recovery will look like - making it even more difficult for investors to strategize accordingly. Most people are hoping for a V-shaped, swift recovery that will see things go back to normal once restrictions on businesses and consumers are lifted.

This is looking less likely than we had all hoped. However, the ONS reported an 8.7% increase in GDP for June 2020 a week after the Bank of England reported that the overall damage for 2020 would not be as bad as initially expected.

So, will we see a V-shaped recovery? Will the effects be drawn out longer? Is the BoE right in predicting a softer blow to the economy? There’s clearly a mixed and constantly changing outlook - meaning investors should prepare for all outcomes. The stock market remains to be the greatest prospect for growing wealth with a long term view - especially since saving rates are modest.

5 recession investment tips

1. Don’t panic

Follow the news but void any knee-jerk reactions. Don’t be tempted to sell investments but hold out, ride the inevitable bumps in the market, and don’t miss out on recovery in assets such as shares.

2. Spread risk

Diversification is more important than ever. Don’t overexpose yourself to downturns in any one area - rather, hold a mix of cash, fixed interest, and shares spread across global markets. Stay patient to avoid missing out on any upturns. The aim is to have a balanced portfolio where your money is spread across different asset classes and regions.

3. Keep costs low

Keep track of whether you are overpaying fees for holding funds. Intelligent investment apps like ARQ can help shed light on where you could potentially save money by notifying you when you are paying more than the average investor.

4. Look for cheap stocks

A gloomy economic outlook isn’t all bad for investors. The price of investments might remain depressed, but there could be opportunities to buy stocks at a bargain price. The goal is to look for undervalued companies that are likely to prosper in the future. With regards to the current climate, there are hundreds of companies that have been hit by lockdown but are likely to weather the storm.

5. Find your safety net

Gold is perceived to be one of the most reliable stores of value - especially during economic stagnation since its performance has little to do with the markets. What’s more, precious metals can help diversify portfolios by ensuring investments aren’t solely dependent on how stock markets are performing.

Investing wisely during an economic downturn

During a recession, most investors will want to avoid investing in companies that are highly leveraged, cyclical, or speculative - since these companies are at most risk of doing poorly during economic uncertainty. A preferred recession strategy would be to invest in companies that are well managed with low debt and strong balance sheets.

Counter-cyclical stocks experience price appreciation even in prevailing economic turmoils. They can be found in consumer staples, health care, telecoms, and utility sectors. Specific to this recession, stocks in companies that have seen a rise in demand like telecoms, online services, and health care are considered counter-cyclical.

Where to invest during economic precarity

Since recessions tend to be cyclical in nature - i.e. they come back around, some stocks go against this trend. It can be tempting to bear a recession without dabbling in stocks. However, investors may find themselves missing out on opportunities if they do. Someone has to do well out of a recession. After all, a recession is caused by something - so, what are the ‘solution companies’? Investors should consider developing a strategy based on counter-cyclical stocks with strong balance sheets in recession-resistant industries.

Strong balance sheets are incremental factors in a recession investing strategy. Steady business models and balanced books despite the economic whirlwind indicate strength and scope to grow. Examples of these types of companies include utilities, basic consumer goods, and defense stocks. These industries have an easier time managing the debt they do have and are less vulnerable to tighter credit conditions.

Study a company’s financial report - you have access to all the information. Determine if they have low debt, healthy cash flows, and are profitable as part of your investment making a decision.

Disclosure: Daglar Cizmeci is the co-founder of ARQ, which is recommended in this article.