Copy My Trades: The Gap

State of the Market

After several months of hard selling, much due to hedge funds treading energy stock shorts as market longs, MLPIs such as (MLPI) and (AMPL) finally are looking like they have solid upward momentum. These companies are rather volatile but should be good long positions on the energy industry for the rest of the month. As the market struggles at resistance, these offer an opportunity to outperform the market.

This week we will see the end result of the first five trading days in January, which has extremely good predictive power for the rest of the year in an election year. Thus, where the market ends on Wednesday will give us the frame for the rest of the year. If we see the SPY pull below 323.54, expect a correction or crash during this year; if we see the SPY above this number, though, expect the rest of the year to be good.

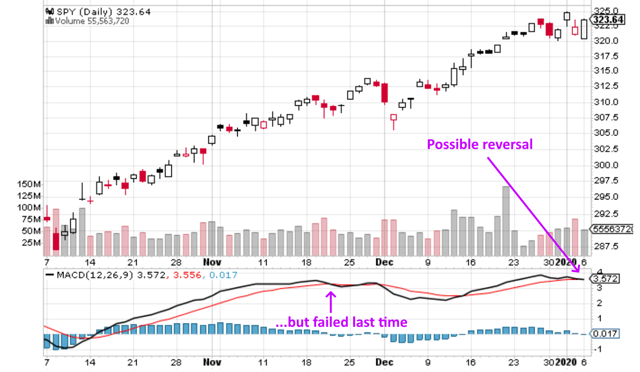

The current rally is uncertain, and that’s the only thing certain now. The momentum has dissipated, and we are seeing at least a sell sign in the MACD, if not a reversal. It’s better to side with safety for now, as this signal is quite reliable.

Still, today I don’t have a general market prediction, and futures are flat. However, the ISM nonmanufacturing index and factory orders will be updated at 10am, which could move the market one way or the other. If the market falls today, you might want to dip-buy, as whoever or whatever is manipulating the markets has consistently pushed markets back up after these dips.

The options market is positioning itself in a fearless way, with speculative calls pointing to hopes that the market will push higher. Calls seem overpriced right now, and puts seem cheap. The ISM numbers today should be a catalyst for either side, as they have been pointing to a recession; a reversal of that trend could help the bulls, while worse-than-expected ISM could trigger a selloff.

Overall, investors remain optimistic, but the risk/reward is in favor of the bears, at least in the US. Emerging markets are looking increasingly bullish but are perhaps simply lagging behind the US rally (I wouldn’t buy in now). Consumer confidence and manufacturing nevertheless are implying that the optimism in the market is misplaced.

As I’ve stated several times in the past couple weeks, gold is unlikely to reverse. It’s a safe bet for the current market, but I would recommend gold over gold miners, as the latter does better when the market is strong. I’d recommend a look at the gold fund (DGL) if you are interested in taking a long position.

The bond market is still seeing a lot of buying in spite of the political news pointing to market risks. Bond investors are typically more informed than equity investors, and their confidence tells us that we shouldn’t worry too much about the news. Still, remain cautious; the best bet right now is a sideways play that benefits from volatility movements.

Today’s Trade

The bulls have made it clear that they own this market at the point. Even the fear of a third world war couldn’t stop their buying. Still, I remain cautious and thus want to go with a sideways play on a stock that is unlikely to move much over the remainder of the week. We will look at some directional plays later this week.

For this, I am opening a calendar put spread on The Gap (GPS), which rarely moves in January. The play follows:

- Sell Jan10 $18 put

- Buy Jan17 $18.50 put

I plan to open at market open and close out the trade on Jan10, either by letting the short put expire (if it’s out-of-the-money) or just by closing the entire position (if the short put is in-the-money). This strategy is opened at a net debit, profits when GPS stays in a tight trading region, and gives you downside exposure into next week, if you want it. You can always close the short put early if you see the market beginning to take a dive; the fact that our long put is more in-the-money gives this strategy a bearish tint.

Happy trading!

Disclosure: I have no positions in any stocks mentioned, but may initiate a short position in GPS over the next 72 hours. Get My Newsletter more