Buying Opportunity Or Time To Sell? That's The Wrong Question

Summary

- Many investors are wondering if the recent market correction is just a buying opportunity or the beginning of a deeper bear market.

- Trying to predict the market is futile. Instead, you should make plans to protect your portfolio in different market conditions.

- Trend-following systems can be very effective at protecting your capital during big and ugly bear markets.

- With most of the stock indexes around the world trading below their 200-day moving average, the long-term trend for stocks as a global asset class is no longer up.

It makes a lot of sense to reduce market risk by raising cash and/or hedging your portfolio in the current environment.

It's no secret at all that many stock markets have been under considerable selling pressure lately. The big question we need to ask right now is whether this is just a short-term market correction (meaning a buying opportunity for long-term investors) or the beginning of a bear market.

Personally, I think that valuations are expensive, we are late in the economic cycle, debt levels are at historical highs around the world, and global liquidity is declining. Based on these factors, the risk vs. reward equation in stocks looks unattractive over the middle term.

But that's not the main point. Trying to predict the market is futile, and even the smartest professionals with massive amounts of intellectual and financial resources fail miserably in their attempts to forecast bull and bear markets.

As opposed to making market predictions, relying on objectively quantified variables with a solid track record of performance is a far sounder approach to protecting your capital through the ups and downs in the markets.

The following paragraphs will introduce different quantitative systems based on trend-following for portfolio protection. These kinds of systems are obviously not perfect or infallible, but the evidence shows that they can be remarkably effective at providing market protection through all kinds of environments.

Importantly, these systems are entirely rules-based, and they don't involve any kind of market forecast or prediction whatsoever. The main idea is that you can reduce your downside risk in bear markets by relying on cold-hard data and observable indicators.

The Trend Is Your Friend

One of the most popular sayings in the market is "the trend is your friend". Even if that is a cliché that doesn't make it any less true. There is plenty of statistical evidence proving that investors can optimize the risk vs. return equation in their portfolio and avoid big drawdowns by following the main trends in asset prices.

The following system is remarkably simple, yet effective. The market is considered to be in an uptrend if the SPDR S&P 500 (SPY) is trading above its 200-day moving average. Conversely, if the market-tracking ETF is trading below the 200-day moving average, then markets are considered to be in a downtrend.

The system only buys the SPDR S&P 500 when it's in an uptrend, and it remains in cash when the ETF is in a downtrend. The system makes any buy or sell decisions every 4 weeks, so it doesn't require a lot of work, and trading expenses should be negligible.

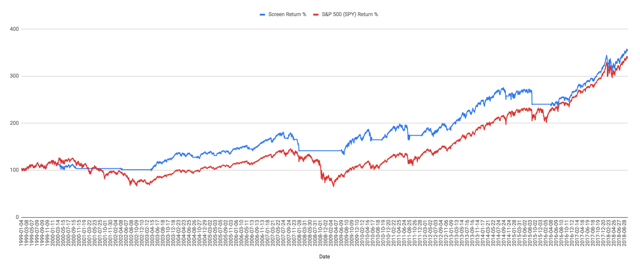

Data from S&P Global via Portfolio123

The table below shows the main performance statistics for the trend-following system in the SPDR S&P 500 versus a buy-and-hold position.

The trend-following system produces modestly higher returns at 6.63% per year versus 6.39% for the buy-and-hold investment. Importantly, the main advantage is that it substantially reduces downside risk, the maximum drawdown for the trend following system is -26.53%, less than half the maximum drawdown of -55.43% for a buy-and-hold strategy on in the SPDR S&P 500 ETF.

| Since 1999 | Total Return | Annualized Return | Max Drawdown | Sharpe |

| Trend-Following SPY | 255.08% | 6.63% | -26.53% | 0.49 |

| Buy-and-Hold SPY | 239.55% | 6.39% | -55.42% | 0.36 |

The system does a sound job at avoiding big drawdowns during deep bear markets and capitalizing on market gains during well-defined uptrends. However, a trend following system will in all probability underperform a buy-and-hold strategy in a scenario such as the one we have experienced in the past five years when market pullbacks were relatively shallow and ultimately buying opportunities.

The data shows how the trend-following system performed in comparison to the buy-and-hold position over the past five years.

| Past 5 years | Total Return | Annualized Return | Max Drawdown | Sharpe |

| Trend-Following SPY | 42.26% | 7.31% | -17.71% | 0.68 |

| Buy-and-Hold SPY | 65.10% | 10.55% | -13.34% | 0.92 |

The main idea is that trend-following can substantially reduce your downside risk during a deep bear market and protect your portfolio from potentially devastating losses. However, it's not realistic to expect a trend-following strategy to outperform all the time and in all kinds of market environments.

Trend-Following And Diversification

The trend following system based solely on the SPDR S&P 500 is arguably too simplistic since it only buys and sells a particular ETF. The benefits of trend following are much more important when seen in a broader portfolio context.

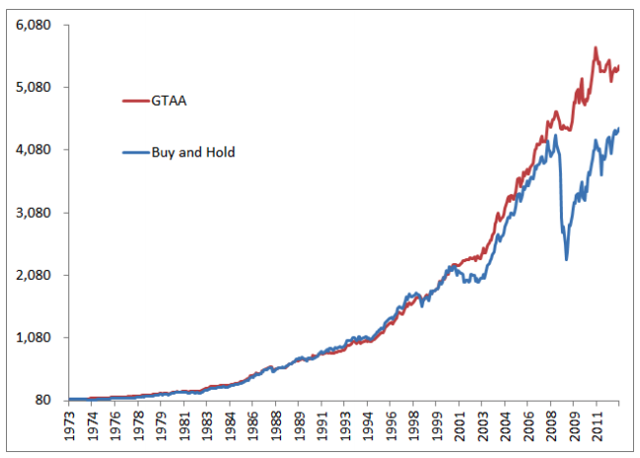

The chart below is from an extraordinary research paper by Mebane Faber entitled, "A Quantitative Approach To Tactical Asset Allocation". The chart compares the performance of a global asset class portfolio (GTAA) that buys only asset classes above the 10-month moving average (roughly 200 days) versus a buy-and-hold portfolio with those same asset classes.

Source: A Quantitative Approach to Tactical Asset Allocation

According to this data, a trend-following strategy would have produced a compounded annual return of 10.48% versus 9.92% for the buy-and-hold portfolio between 1973 and 2012.

Returns are marginally higher for the trend-following system, but the big game changer is the reduction in downside risk. The maximum drawdown for the buy-and-hold portfolio was a breathtaking 46%, while the trend-following portfolio had a much more manageable maximum drawdown of 9.54% during such period.

The reduction in downside risk when implementing a trend-following strategy on a diversified portfolio is quite powerful.

Simplicity Is The Ultimate Sophistication

We can extend this kind of strategy to a broad portfolio of ETFs representing different asset classes, sectors, and industries in order to fully benefit from trend-following and diversification together.

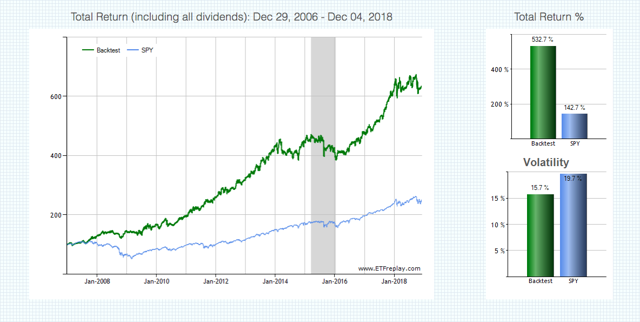

The following quantitative system is updated in real time for members in my research service, The Data-Driven Investor. It basically buys the top 3 ETF among a universe of more than 30 ETFs representing different asset classes and sectors. The 3 ETFs in the portfolio are basically chosen on the basis of their risk-adjusted returns. In a nutshell, the system simply buys the top 3 ETFs with superior performance when considering both returns and volatility.

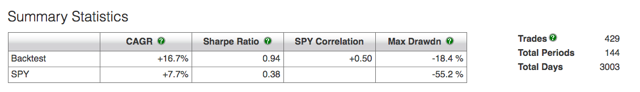

Since January of 2007, the system produced a cumulative gain of 532.7% versus 147.7% for the SPDR S&P 500 in the same period. In annual terms, the system gained 16.7% versus 7.7% for the SPDR S&P 500.

The system substantially outperformed the SPDR S&P 500 in terms of downside risk too. The maximum drawdown was 18.4% for the trend-following portfolio versus 55.2% for the SPDR S&P 500 in the same period.

Note: Maximum drawdown is measured as the greatest percentage drop from the high, based on daily closing prices.

Source: ETFreplay.com

Source: ETFreplay.com

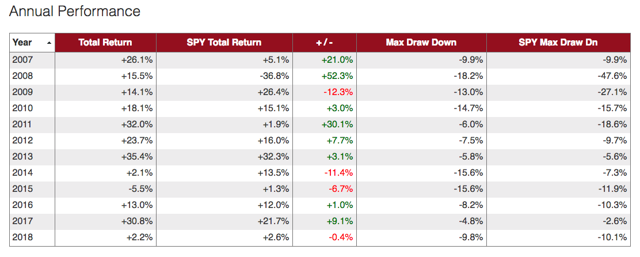

For more information, the table below shows the annual returns for the system versus the SPDR S&P 500 since 2007. It's interesting to note that in 2008 when global stock markets crushed down and the S&P 500 had a maximum drawdown of 47.5% - the Global Rotation system gained 15.5% by investing in safe-haven assets such as Treasuries and gold.

Source: ETFreplay.com

The system should be expected to do well in the long term, especially when there are well-defined trends, either up and/or down in different markets. However, in a year in which markets are mostly moving sideways, the system will most probably produce lots of false signals and disappointing results overall.

In other words, the system can be expected to outperform during big bear and bull markets such as 2008 and 2017, and it will probably generate disappointing numbers in sideways years such as 2015.

That being acknowledged, the point remains that rules-based and quantitative strategies based on trend-following principles can do a great job of protecting your portfolio in a challenging environment.

The Bottom Line

We all feel the urge to predict if the current market pullback is just a buying opportunity or the beginning of a deeper bear market. However, that's the wrong question since it's practically impossible to predict the stock market with consistency and precision.

Instead, the smart approach is having an investing strategy that can successfully navigate through all kinds of market scenarios. If the historical evidence is any valid guide, then relying on trend-following and diversification can be a powerful strategy to increase returns and protect your capital in bear markets.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in ...

more