3 Cinches – Nikola, QuantumScape, And The SPAC ETF

Probabilities

I am not sure of much of anything. I quantify all of my investments with their upsides, downsides and probabilities. All of my decisions fit in the legal standards of preponderance of evidence, clear and convincing, or beyond a reasonable doubt. But there are almost always some doubts. I do not blindly trust my own information or judgment. Instead,

My working assumption is that the average potential counterparty is at least as well informed, at least as smart, and at least as hard working as I am. So that eliminates any opportunity for me to invest based on the theory that I am informed, smart, or diligent. Also, there are trading commissions and taxes. So net of fees and after tax, I assume that the natural state of an investment is to turn a dollar into slightly less than a dollar.

Then, there is the matter of cheating. If only one in a hundred investors are effectively cheating (and assuming that they win every time that they cheat), getting cheated massively impacts the value of an investment dollar. While the average potential counterparty might not be too smart, hard-working, or well informed with either legal or illegal information, the likelihood is much higher when it comes to a counterparty that enthusiastically seeks you out for a transaction.

Without an edge, this is a loser's game - it is "fair" or circular, allowing a participant to churn through a dollar to get a dollar of expected value before paying trading commissions. For me, costs also include fund auditors, fund tax advisors, onshore administrators, lawyers, personal accountants, office support, and office supplies including about five hundred pages of paper per day that I go through just to keep up with SEC filings that I read.

Over the past year, my probability-weighted ideas have mostly worked out, some didn’t, and a few are still up in the air. There have been only three examples of ideas with 100% certainty. Here they are.

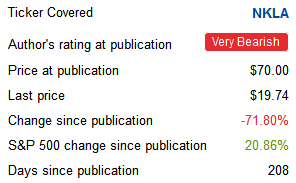

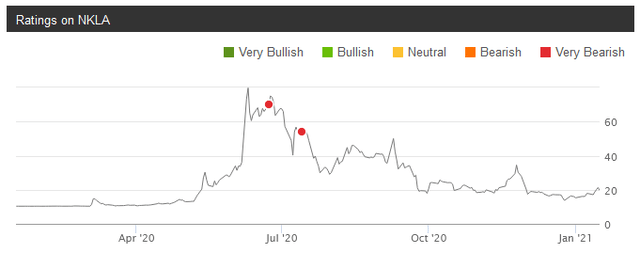

Sell Nikola.

The first was that if you owned Nikola (NKLA) equity that you should sell it.

I wrote that,

Here is where I normally say things like, “think for yourself, do your own work and buyer beware.” But in this case, don’t think for yourself, skip the work, and throw care to the wind.

Sober, clean, sane people with incentives and inside information had recently valued this at $10 in an arm’s length transaction. The public markets rejected that with a thesis that the real value was 7x that amount. In absolute terms, this is bold. But in relative terms, it is impossible. Their warrants could get the same equity for under $40. Everyone who owned the stock should sell; anyone who wanted to hang onto any exposure could keep the cheaper warrants. StW’s price alert was set at $20 (since triggered) then reduced to $15 (since triggered as well).

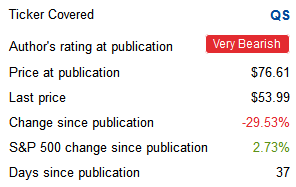

Sell QuantumScape.

The second was that if you owned QuantumScape (QS) equity that you should sell it.

I was unsubtle,

Today’s QuantumScape (QS) is in a virtually identical situation [to NKLA] in terms of the anomalous disconnect between the equity and warrant price. At the risk of plagiarizing myself, my reaction is the same: sell your QuantumScape. Definitely. Today, they cost over $60 per share. Sell them.

This is not my typical style; I usually have caveat sections that innumerate the many ways my hypotheses can be wrong. But in this case, the absolute value – as with Nikola, 7x where incentivized insiders recently valued it – was dubious. The relative value was certainly wrong. Publishing helped correct the mispricing, tightening it from over 50% to under 20%, but there is still some more to go.

Sell the SPAK SPAC ETF.

The third is that if you own the (SPAK) SPAC ETF you should sell it. Last March, a diversified basket of SPACs yielded almost 10% to their trust value, never mind their (spectacular, as it turns out) equity upside. Their warrants have since more than tripled. But today a diversified basket of SPACs trade at over a 20% premium to NAV, many as of their first day in the secondary market. Great news for any of us participating in the IPO pop, but pricy for subsequent buyers. This ETF puts most of its capital in deSPACed equities. It is convenient, but dangerous. What should you do instead? It is fine to steer clear of SPACs. But I, for one, love them. Instead of investing after they’ve appreciated, you can invest before by buying in or, if necessary, shortly after their IPOs.

Better: SPAC IPOs

You can buy units consisting of one common share and a fraction of one redeemable warrant to purchase one common share at $11.50. A Special Purpose Acquisition Corporation (“SPAC”) raises capital through an IPO, but it has no operating business at the time. The capital is placed in trust and invested in cash and US Treasuries while the management team has approximately two years to merge with a private company, thus taking it public. This is an alternative to a traditional IPO for private businesses looking to enter the public markets.

You get free principal protection

Protect your downside and your backside. The SPAC structure unique among equity investments. One’s assets remain in trust until the management can complete a deal. After two years, if a deal cannot be completed, investors have the right to redeem their capital plus interest. If a deal is announced, the investor still has the right to redeem their shares for the cash held in the trust or they can sell the shares in the public market (if they do not wish to own the business being acquired). While this is technically a fully tradeable share of equity and warrants, because one can redeem their shares for cash, the underlying risk exposure is to the US Treasury portfolio that sits with the trustee. This makes the structure far more like a 2-year zero coupon bond than a traditional share of equity where one is economically exposed to the ups and downs of a business’s earnings. Unlike a bond, however, an investment in a SPAC has the upside of equity ownership in the business if management is able to find an attractive target.

You get equity update/treasury downside

These are better than bonds. Since SPACs are structured as equities, they can be a bit deceiving. The SPAC structure, because of its underlying US Treasury exposure, is actually more relevant for investors as a diversifier to a more traditional fixed income portfolio than as an equity portfolio. In a global low interest rate environment, holding cash is challenging and one must take on a substantial level of risk to earn any return from a bond portfolio. Whether investors are adding credit risk or duration risk to a bond portfolio to increase returns, neither seem appealing today.

Capture deal premium

Pop! Most days, these just sit there clipping Treasury yields then every once in a while go bananas when a deal hits. We view SPACs as an additional tool for investors to add a third diversifying return factor to a bond portfolio. SPAC returns are generated by earning the small yield from the treasury portfolio in the trust account and adding to that the return potential when management announces a merger. When a SPAC announces a deal, the market price of the equity and warrant may increase beyond the value of the assets in the trust account as the market values the new business. SPAC returns can be traced to the premium a company gets from the public market over its private market valuation.

Increased quantity and quality

There are more SPACs than ever before and they are getting better deals than ever before. In 2019, there were 59 SPAC IPOs which raised about $13 billion, an increase of 30% from the prior year. 2020-2021 numbers obliterate that previous record. We first began following SPACs prior to the financial crisis. Since then, we have seen a significant increase in the quality of the sponsors behind the SPAC listings, particularly over the past two years (the sponsor is the company or individuals that fund the SPAC and are responsible for identifying a private company to acquire).

Market-based IPOs

We need more companies to invest our money in. The number of publicly listed companies declined 50% over the past 20 years. SPACs serve as one tool for private companies to enter the public markets as an alternative to a traditional IPO. This may be especially relevant in this era as private equity and venture capital look for liquidity as funds mature. Covid-19 also creates some interesting opportunities for SPACs where they can use their cash to recapitalize private companies that entered this period with too much debt.

A free peek better than the SPAK SPAC

Pay $10 per unit of a combination of equity and warrants. You are fully protected by the trust value and you can hang onto warrants that from time to time get enthusiastically swept up in a frothy market. You get a free peek. If you don’t like the business that the SPAC buys, then sell or redeem for trust value without losing any original invested capital. If you like it, keep whatever combination of the equity or warrant is a good value. Heads you make a little money; tails you can make a lot. If you lack access to IPOs, invest with someone who has access or if necessary buy them as close as possible to $10 in the secondary market that everyone has access to.

Conclusion

If you own NKLA, QS, or SPAK, sell them. Take the money and run. Buy virtually anything else with the money instead. Buy their cheap(er) warrants. Buy SPACs in or near their IPOs. Buy a cheap bottle of wine for all I care. But if they are in your portfolio, you are being suboptimal.

(And yeah I said it: suboptimal. That’s my version of fighting words. Innumerate bull trolls welcome to post their “nuh-uh” counter thesis in the comments. But warning: I’m not trying to convince you to change. I don’t want you to ever change. Your market orders are my exits.).

TL;DR

Too long; didn’t read? If you own NKLA, QS, or SPAK, you really shouldn’t.

Members of Sifting the World get exclusive ideas and guidance to navigate any climate. Get started ...

more