Betterment Vs. Vanguard Vs. Wealthsimple Comparison

Robo-advisors, with their increasingly sophisticated algorithms and hands-off investment options, are growing in popularity. One of the biggest selling points of the robo-advisor is its ability to take something as complex as investing and simplify it so that even beginning investors feel well-supported and confident.

Many robo-advisors are flexible enough that investors can have a DIY, hands-on experience with their portfolios or can sit back and let the robo algorithms generate a portfolio. The three robo-advisors we’re looking at today – Betterment vs. Vanguard vs. Wealthsimple – are all great for people who want some human support for financial questions; they also offer more customizability for those who want it.

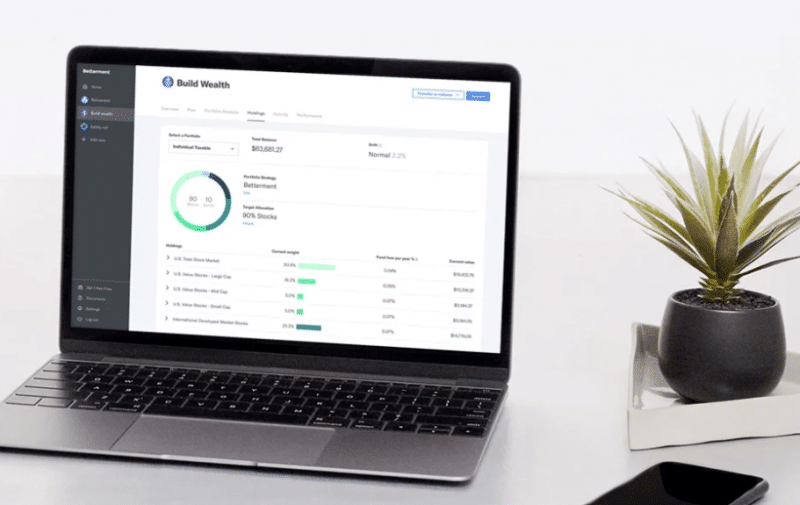

What is Betterment?

Launched in 2010, Betterment is one of the earliest robo-advisors. Betterment manages around $16 billion assets; this places it squarely in 3rd place for robo-advisors with the most assets under management—Vanguard, which we will cover soon, ranks 1st.

We appreciate the opportunity for all Betterment users, regardless of service-level, to text with financial advisors.

Betterment clients have access to all the robo-advisor staple services—tax-loss harvesting, account rebalancing, and diversified portfolios—as well as some more premium services, like access to human financial planners. Betterment EveryDay gives users access to high yield savings and cash management too.

Check out the Betterment site now.

What is Vanguard Personal Advisor Services?

The Vanguard robo-advisor is a member of the Vanguard Financial powerhouse and home of the first index fund. Vanguard Personal Advisor Services, hereafter Vanguard, manages over $112 billion assets, making it the largest robo-advisor around.

Vanguard makes heavy use of human financial advisors. Investors will start out working with a financial planner, and will have access to either a team of financial planners or a dedicated advisor over the lifetime of their relationship with Vanguard.

Although, Vanguards minimum investment amount of $50,000 is high for new investors.

What is Wealthsimple?

Wealthsimple, a Canadian-based robo-advisor, has been around since 2017. This robo-advisor is constantly improving its services and offerings; they also have over $4 billion in assets under management!

Some of Wealthsimple’s largest selling points include the company’s commitment to ensuring everyone has a chance to invest—from socially-responsible to Halal investment options—and the human financial planners which are available at all account levels.

Wealthsimple vs. Betterment vs. Vanguard—Top Features

| Wealthsimple | Betterment | Vanguard Personal Advisor Services | |

| Overview | Automated investment management robo-advisor platform, covering everything from portfolio allocation to automatic rebalancing, dividend reinvesting, SRI and Halal investing. | Goals-based digital investment manager with access to financial advisors and cash management. | A personally craftd robo-advisor investment portfolio guided by a human financial advisor. |

| Minimum Investment Amount | Wealthsimple Basic: $0 Wealthsimple Black: $100,000 Wealthsimple Generation: $500,000 |

No minimum for Betterment Digital. $100,000 minimum for Betterment Premium. | $50,000 minimum |

| Fee Structure | Basic: 0.50% AUM Black: 0.40% AUM Generation: 0.40% AUM |

Digital-0.25% AUM up to $2 million; 0.15% fee over $2 million Premium-0.40% AUM up to $2 million; 0.30% fee over $2 million. |

Sliding Fees: 0.30% AUM on assets up to $5 million 0.20% AUM on assets between $5-10 million 0.10% AUM on assets between $10-25 million 0.05% AUM on assets over $25 million |

| Top Features | Human finacial advisor advice. Socially Responsible Investing (SRI), and Halal investing consistent with Islamic principles. Typical rebalancing and tax efficient investing. VIP airport lounge access for Wealthsimple Black & Generation clients. High yield Wealthsimple Save and roundup. |

Digital and hybrid investment management (with financial advisor access) options. All investors can text with financial advisors. Socially-Responsible Investing, income and smart beta portfolios available. Tax loss harvesting available. | The human financial advisor drives the entire process. Together, you & the advisor create a customized investment plan. You can be as involved as little or as much as you'd like with your investments. The advisor monitors the plan. Rebalances your portfolio when needed. |

| Free Services | First $15,000 is managed for free, with signups through Robo-advisor Pros.com. | Free portfolio review. | N/A |

| Contact & Investing Advice | Phone or text, Monday through Friday, 8:00 am to 8:00 pm Eastern Time. Email 24/7. Phone consultations with Financial Advisors for all clients during normal business hours. Additional personalized services for Wealtlhsimple Black and Generation clients. |

Phone support M-F. Email support 7 days per week. Financial advisor access through text for all clients. Premium clients can speak with Certified Financial Planners. Specialty financial planning packages also available with CFPs. |

Available by phone Monday - Friday from 8:00 am to 7:00 pm EST Human financial advisor guides the process. Helps build portfolio with low fee funds & serves as investing coach. Accounts below $500,000 get team of advisors & those above $500,000 get a dedicated personal financial advisor. |

| Investment Funds | Diversified index funds from 10 different asset classes on regular portfolios, with six in the SRI portfolio; the Halal portfolio includes the stocks of 50 different companies. | Low fee exchange traded funds from diverse asset classes. | Low fee stock & bond mutual funds and ETFs selected from among the scores of Vanguard funds. |

| Accounts Available | Individual and joint taxable accounts; trusts; traditional, Roth, rollover and SEP IRAs. | Single and joint taxable brokerage. Roth, traditional, rollover and SEP IRA. Trust. | Individual & joint investment accounts. Roth, traditional, SEP, Simple & rollover IRAs. Trusts. |

| Promotions | First $15,000 is managed for free, with signups through Robo-advisor Pros.com. | N/A | N/A |

Betterment Top Features

- Socially-Responsible investing options

- Smart Beta portfolios

- Access to human financial planners at all levels

- Retirement savings calculator

- High yield savings and cash management accounts

Vanguard Top Features

- Access to human financial planners, including video chats with advisors

- Investments are selected from dozens of Vanguard funds including actively managed funds

- Sliding fees that benefit high-value portfolios

Wealthsimple Top Features

- Halal and Socially-Responsible Investing options

- Human Financial Planners available at all account levels; dedicated team of financial advisors available for Wealthsimple Generation accounts

- Savings options, including high-yield savings accounts and spare change roundups

Betterment vs. Wealthsimple vs. Vanguard—Who Benefits?

For basic investment management, financial advisors, tax-loss harvesting, and reasonable fees, Betterment and Vanguard win with lower investment management fees. Although small investors should start with Betterment, as the Vanguard robo advisor requires a higher minimum investment amount.

For smaller investors, Betterment and Wealthsimple are good robo-advisors .

Those with large investment portfolios benefit from Vanguard, as the sliding fee scale reduces fees significantly for accounts valued over $5 million. Vanguard Personal Advisors also incorporates financial planners into the entire investment process and so is great for those investors seeking extensive advisor access.

Investors who follow Sharia Law will benefit from Wealthsimple. This robo-advisor is one of only a few on the market that supports Halal investment principles.

If you don’t need Halal-compliant investments, but are still looking to help make a difference in the world, the socially-responsible investments available through Betterment and Wealthsimple can help you do this. Both Betterment and Wealthsimple robo-advisors allow clients to make investments in companies that change the world in some way, such as going green or utilizing ethical employment practices.

Wealthsimple vs. Betterment vs. Vanguard—Fees and Minimums

Wealthsimple Fees and Minimums

Wealthsimple has three plan options, designed to meet the needs of varied investors. Depending on your needs, available minimum investment, and the sort of financial support you’re looking for, you can choose from:

- Wealthsimple Basic. There is no minimum investment amount required. Investors will pay 0.50% AUM.

- Wealthsimple Black. The minimum investment is $100,000. Investors will pay 0.40% AUM.

- Wealthsimple Generation. A minimum investment of $500,000 is required. Investors will pay the same 0.40% AUM as Wealthfront Generation clients, but will gain more features, such as comprehensive financial planning.

Betterment Fees and Minimums

Like Wealthsimple, Betterment offers various account levels. This makes Betterment a viable option for investors regardless of their investing experience and net worth. Investors can choose from two plan levels and la carte investment packages:

- Betterment Digital. There is no minimum investment required for Betterment Digital. Investors will pay account management fees of 0.25% AUM on accounts valued up to $2 million; accounts over this mark will pay 0.15% AUM.

- Betterment Premium. This plan requires a minimum investment of $100,000, and charges 0.40% AUM. Fees drop to 0.30% AUM when accounts are valued at $2 million.

- Financial Advice Packages. Investors can pay for individual financial advising sessions to discuss major lifetime milestones, such as planning for college, retirement, or buying a home. Prices begin at $199.

Vanguard Robo-Advisor Fees and Minimums

Vanguard requires a minimum investment of $50,000. Their fees are assessed on a sliding scale:

- .30% AUM on assets up to $5 million

- .20% AUM on assets between $5-10 million

- .10% AUM on assets between $10-25 million

- .05% AUM on assets over $25 million

This sliding scale makes Vanguard one of the lowest management fee robo-advisors on the market for high-asset investors.

Although, Schwab Intelligent Portfolios Premium recently launched a subscription-based model that charges $30 per month, regardless of assets under management, plus a one time $300 set up fee. This lowers the fee to .12% AUM for assets of $300,000.

Betterment Digital wins the lowest fee award. At this level investors can text with financial advisors and purchase a la carte financial planning packages for targeted financial planning.

Betterment vs. Vanguard vs. Wealthsimple—Deep Dive

Human Financial Planners

Wealthsimple gives their clients access to human financial planners at all account levels. Wealthsimple Generation clients can expect more VIP treatment in this area, with a detailed financial plan included.

Betterment also offers access to human financial planners for all plans, with varying levels of access.

Betterment Digital clients can text with financial planners, while Betterment Premium clients will benefit from Certified Financial Planners who can offer advice on investments held outside the Betterment platform. The Betterment a la carte financial planning packages are great for low-cost, targeted guidance.

Vanguard begins the client relationship with a human financial planner. All Vanguard Personal Advisor Services clients will have access to a team of financial advisors; however, the real benefits kick in for clients with at least $500,000 under management. Clients at this account level have a dedicated financial advisor for their account.

At higher AUM levels, there’s not a tremendous difference in this realm. Although for US investors seeking financial advising, we’d lean towards Betterment as all of the advisors are Certified Financial Planners, a well-regarded designation.

Click to visit the Betterment website.

Betterment vs. Vanguard vs. Wealthsimple—Tax-Loss Harvesting

Tax-loss harvesting is a near-given with robo-advisors on the market currently. All three of today’s robo-advisors offer tax-loss harvesting, making them virtually identical in this category.

Tax-loss harvesting is a strategy used in taxable investment accounts to offset investment gains with losses and lower overall tax payments.

Betterment offers tax-loss harvesting on their taxable accounts. While tax-loss harvesting is a good strategy for minimizing losses, Betterment claims that their strategy outperforms that of other robo-advisors by one percent.

Likewise, all taxable accounts held through Wealthsimple have tax-loss harvesting. This feature is automatically applied to Wealthsimple Black accounts; other Wealthsimple clients will need to “turn on” their tax-loss harvesting.

Finally, Vanguard Personal Advisor Services offers tax-loss harvesting on a case-by-case basis. One of the benefits of Vanguard’s tax-loss harvesting method is that investors have human financial planner oversight to help navigate the process.

Wealthsimple vs. Betterment vs. Vanguard—Investments

All three robo-advisors offer a diverse mix of investments with a few distinctions for each platform. We are comfortable with each of the robo-advisors investment choices.

Wealthsimple Investments

- US Stocks

- US Mid-Cap Value

- US Small-Cap Value

- Foreign Stocks

- Emerging Market Stocks

- Municipal Bonds

- US Inflation Protected Bonds

- USD Government and Corporate IG Bonds

- High-Yield Bonds

Wealthsimple offers a Halal or Sharia-compliant stock portfolio and socially responsible investment funds.

For Islamic investors, Wealthsimple is the clear choice.

Betterment Investments

- US. Total Stock Market Stocks

- US. Large-, Mid-, and Small-Cap Value Stocks

- International Developed and Emerging Market Stocks

- US. High Quality Bonds

- US. Municipal Bonds

- US. Inflation-Protected Bonds

- US. High-Yield Corporate Bonds

- US. Short-Term Treasury Bonds

- US. Short-Term Investment-Grade Bonds

- International Developed and Emerging Market Bonds

Betterment also offers socially responsible investing, smart beta strategies and income-only portfolios.

Vanguard Investments

- Total Stock Market Index Fund

- Total International Stock Index Fund

- Total Bond Market Index Fund

- Total International Bond Index Fund

- Intermediate-Term Investment Grade Fund

- Short-term Investment Grade Fund

- Intermediate-Term Tax-Exempt Fund (for taxable accounts only)

The Vangurd robo-advisor also offers access to dozens of Vanguard fundsincluding niche index and actively managed funds.

We like Betterment’s income portfolio option for investors in retirement or saving for a short-term goal and smart beta is great for those who want to attempt to beat the market.

Depending upon your goals, you might prefer one robo-advisor over the other.

image credit; Photo by Anukrati Omar on Unsplash

Betterment vs. Vanguard vs. Wealthsimple—Retirement Planning

Bettterment’s retirement tools are comprehensive. Betterment will strongly appeal to investors who have holdings outside the Betterment platform. All these investments are taken into consideration when your retirement health is calculated.

Both Wealthsimple and Vanguard have limited retirement planning tools. Although financial advisors are available to discuss retirement topics.

Wealthsimple does not include retirement goal-setting tools in their features. Currently, Wealthsimple’s retirement calculator is only available for Canadian clients.

Vanguard’s investment offerings are diversified, lending themselves to a well-rounded portfolio. That being said, they do not offer much in the way of retirement planning outside of conversations with financial planners.

Betterment is the leader for retirement planning tools.

Visit the Robo-Advisor Selection Wizard.

Betterment vs. Vanguard vs. Wealthsimple—Security and Customer Service

All three robo-advisors use high-level security to protect you and your investments.

Clients can also expect good customer service hours from all three robo-advisors, which is a necessity in today’s busy world. Betterment takes the lead in this category, though, for their weekend availability.

- Wealthsimple: Phone help Monday-Thursday 9:00am-8:00pm and Friday 9:00am-5:30pm EST; Email available 24/7.

- Betterment: Phone help Monday-Friday 9:00am-6:00pm, Saturday and Sunday 11:00am-6:00 pm EST; Email available 24/7.

- Vanguard: Phone help Monday-Friday 8:00am-8:00pm EST.

Wealthsimple vs. Betterment vs. Vanguard—Which is Best? The Takeaway

On the most basic level, all three robo-advisors offer high-quality services, including access to human financial planners, tax-loss harvesting, and specialty investment options, such as Halal, socially-responsible, smart-beta, and actively managed investments.

For new and intermediate investors, seeking a comprehensive robo-advisor with cash management, diversified investments, and socially-responsible portfolios, Betterment is our pick.

For six- to seven-figure investors, seeking to use a robo-advisor with access to a suite of other financial services, like those offered at Vanguard, the Vanguard Personal Advisor is a solid choice. Although, investors need a minimum of $50,000 to start investing with Vanguard. That being said, investors who have over $25 million in assets will pay a miniscule amount in fees.

Betterment Premium and Wealthsimple Black are closely matched in terms of fees and minimum investment amounts, though investors who choose Betterment will see reduced fees for accounts valued over $2 million. Wealthsimple Black clients, receive airport VIP lounge access, for frequent travelers.

For best all-around robo-advisor Betterment is a solid choice for any investor. With no minimum investment required and some of the lowest fees on the market, Betterment offers an easy entry point into investing for all. They also reward larger investors with reduced account management fees. The fees won’t drop quite as low as Vanguard’s, but when combined with the advanced services Betterment is one of our favorite robo-advisors.

- Read the complete Betterment review.

- Direct access: Betterment website.

- Read the complete Wealthsimple review.

- Direct access: Wealthsimple website.

- Read the complete Vanguard review.

- Direct access: Vanguard Personal Advisor Services website.

Featured image credit; Photo by Marvin Meyer on Unsplash

Disclosure: I have an account with Betterment.

Disclaimer: I am a former portfolio manager, former university finance instructor, and successful investor committed to sharing my personal finance ...

more