Infrastructure Bill Beneficiaries Index Up 18% In July

In my June Update article (see here) I reported that none of the 12 constituents in the munKNEE Infrastructure Bill Beneficiaries Index (-17.5%) had advanced during the month but commented that "one would expect the constituents to advance in the months - and years - ahead, so now it might be the ideal time to do your own due diligence and decide on which, if any, companies you think have the best prospects going forward," The Index did just that in July with ALL constituents advancing by a collective +17.8%.

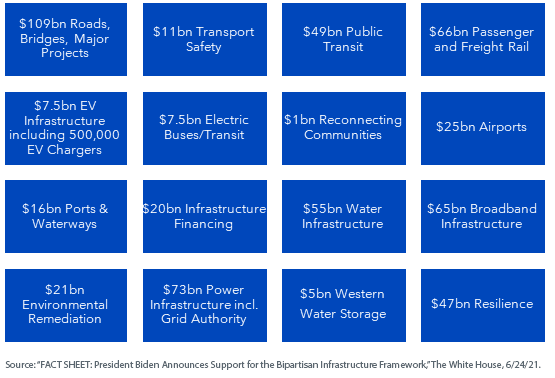

Last November, President Biden signed the Infrastructure Investment and Jobs Act (IIJA) into law, allocating $1.2 trillion of spending with $578 billion of new spending over the next decade (see below) of which funding of over $110 billion of spending across 4,300+ projects has already been awarded, announced, or initiated.

The munKNEE Infrastructure Bill Beneficiaries Index

Given the above, investors looking for exposure to infrastructure via public equities may want to consider investing in companies that generate a majority of their revenues from infrastructure-related business activities such as those in the non-tradable munKNEE Infrastructure Bill Beneficiaries Index as presented below, in descending order, for the month of July, and YTD:

- United Rentals (URI): UP 34.6% in July; DOWN 2.9% YTD

- As the provider of specialty equipment specifically designed for underground work and fluid treatment URI should benefit from business generated by the infrastructure bill.

- Nucor (NUE): UP 30.4% in July; UP 19.0% YTD

- As the largest domestic steelmaker in North America, the pent-up demand from automakers and other industrial buyers should benefit NUE considerably going forward.

- Martin Marietta Materials (MLM): UP 18.8% in July; DOWN 20.1% YTD

- As a producer of crushed sand and gravel products, ready-mixed concrete and asphalt, paving products and services, dolomitic lime for the steel and mining industries, and chemical products for use in flame retardants, wastewater treatment and assorted environmental applications MLM should be a major beneficiary.

- Eaton Corp. (ETN): UP 17.1% in July; DOWN 14.1% YTD

- As a major supplier of electrical components and systems ETN should benefit from the integration of wind and solar farms into the national grid.

- Vulcan Materials (VMC): UP 16.5% in July; DOWN 20.9% YTD

- As America's largest producer of construction aggregates such as crushed stone, sand and gravel, and a major producer of asphalt and cement VMC will benefit from future major infrastructure projects.

- Deere & Company (DE): UP 15.3% in July; Unchanged YTD

- As a major producer of earthmoving and roadbuilding and forestry equipment DE should see an increased demand for its machinery.

- Caterpillar (CAT): UP 12.5% in July; DOWN 4.1% YTD

- As the manufacturer of asphalt pavers, compactors, excavators, pipe layers, backhoes, etc., CAT will benefit from future major infrastructure projects.

- ChargePoint Holdings (CHPT): UP 11.9% in July; DOWN 20.7% YTD

- With the expected building of 250,00 customized charging stations CHPT should benefit considerably from their involvement.

- Freeport-McMoRan (FCX): UP 10.9% in July; DOWN 24.4% YTD

- Given that 43% of all copper mined is used in building construction, with another 20% used in transportation equipment, FCX should be a major benefactor.

- Brookfield Infrastructure Corporation (BIPC): UP 8.1% in July; DOWN 32.9% YTD

- With operations spanning utilities, transportation, energy, and even data infrastructure, BIPC should benefit enormously from business generated by the infrastructure bill.

- Oshkosh Corp. (OSK): UP 6.0% in July; DOWN 23.6% YTD

- As the manufacturer of specialty trucks used in heavy construction projects as well as cement mixers, truck mounted cranes, "cherry pickers" and other hydraulic lifting systems and being well placed to meet the demand for the electrification of the federal vehicle fleet OSK should prosper going forward.

- Crown Castle International (CCI): UP 5.9% in July; DOWN 13.5% YTD

- As one of America's leading wireless tower real estate investment trusts, CCI should benefit from the expansion of mobile data usage.

Despite the Index being up 17.8% in July only one constituent is up YTD (the Index is down 8.4%) suggesting that there is a lot of upside available going forward.

More By This Author:

July Update: Ancillary Pot Stocks Index Down 1.5%; Down 55% YTD

July Update: Psychedelic Compounds-Based Drug Stocks Index Up 23%; Remains Down 44% YTD

July Update: Plant-Based Food Stocks Index Up 19%: -51% YTD

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more