Individual Investors Remaining Neutral

Last week, bullish sentiment as indicated by the of individual investors came in at the second highest level of the year at 40.29%. Declines this week seemed to have weighed on bulls as the percentage of investors reporting as bullish fell to 37.56%. That is back below the historical average of 38.2%, though, it is also not far away from where bullish sentiment has stayed for much of the year. This week’s level deviates slightly from the Investors Intelligence survey which saw bearish sentiment unchanged while optimism rose to the highest levels since October.

(Click on image to enlarge)

The bearish camp seems to have borrowed from the bulls as 21.83% of investors reported bearish sentiment versus 20.38% last week. This is a fairly small movement relative to what could be observed in the past couple of months. For example, last week and in the final week of March, bearish sentiment fell by over 7%.In other words, bearish sentiment seems stable around the lower end of the range from the past few years, now several percentage points below the historical average of 30.31%.

(Click on image to enlarge)

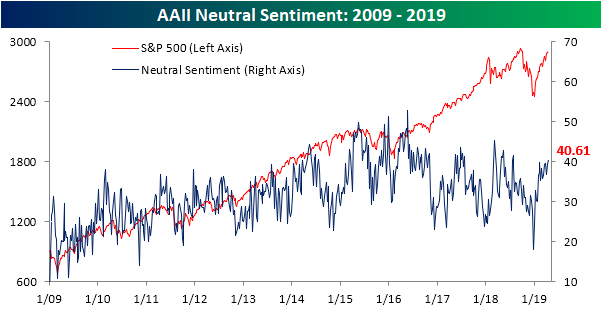

While bullish and bearish sentiment remains high and low, respectively, neutral sentiment is also very elevated. At 40.61%, the percentage of investors reporting neutral sentiment is now slightly over one standard deviation above the historical average. The last time this happened was in late July of last year.

(Click on image to enlarge)

Start a two-week free trial to Bespoke Institutional to access our Closer which includes our Market Timing ...

more