Huge December Payrolls Miss: 140,000 Jobs Lost, Worst Month Since April

As previewed earlier when we said "December Payrolls Preview: Brace For A Very Ugly Number", as a result of the second wave of COVID shutdowns economists expected a sharp slowdown in December job growth in the U.S., with more than a quarter of those surveyed - including Goldman - predicting a negative print. Yet as Bloomberg notes, while the data is "almost certain to show an ongoing loss of labor-market momentum -- indeed, it could reveal outright job losses -- one could argue that it’s already outdated." After all, a fresh stimulus package was passed towards the end of last month, and there is every chance of a further one in the months to come. Moreover, the prospect of vaccine-related normalization still hovers in the future, even if the current reality of the pandemic looks fairly grim. Finally, with this the last payroll month under the Trump admin, it is hardly a secret that the BLS would look to have a kitchen sink month where the upward "government massaged data" over the past 4 years catches down to reality.

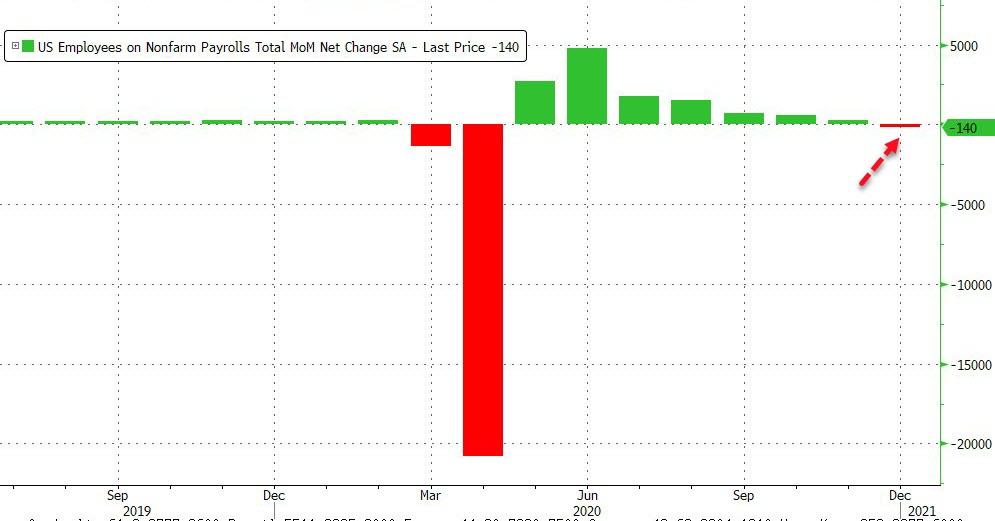

With all that in mind, it was still a surprise just how ugly the December print was, with the BLS reporting that a whopping 140K jobs were lost last month, the first monthly job loss since April's record drop...

... on consensus expectations of a 50K print (although Goldman's -50K forecast was close), resulting in a 190,000 miss to expectations. The -140K print was worse than all but three of 66 forecasts in the Bloomberg survey.

.jpg?itok=OYVnNZzI)

Employment declines were concentrated in leisure and hospitality, private education, and government were partially offset by gains in professional and business services, retail trade, construction, and transportation and warehousing. Also due to the harsh weather in December, workers unable to work due to bad weather was 111K.

It appears that the post-COVID recovery is stalling about halfway on the way up to the pre-COVID record highs.

.jpg?itok=A_kW6CuO)

In terms of prior month revisions, the change in total payrolls for October was revised up by 44,000, from +610,000 to +654,000, and the change for November was revised up by 91,000, from +245,000 to +336,000. With these revisions, employment in October

and November combined was 135,000 more than previously reported, although that number is largely irrelevant as a result of the late-year lockdowns.

Notably, the job losses were almost entirely concentrated in leisure and hospitality. The sector saw employment decline by 498,000 last month. Three-quarters of the decrease came from food services and drinking places (-372,000). Employment also fell in the amusements, gambling, and recreation industry (-92,000) and in the accommodation industry (-24,000). Since February, employment in leisure and hospitality is down by 3.9 million, or 23.2 percent.

.jpg?itok=qHyEJQ-B)

That said, while the Establishment survey was ugly, the Household survey showed a slightly better picture, with the number of employed actually rising by 21K from 149,809K to 149,830K while the number of unemployed was virtually unchanged at 10.7 million.

The unemployment rate was unchanged at 6.7%, on expectations of an increase to 6.8%. Of note: Hispanic Americans saw the biggest monthly increase in unemployment, the rate rising from 8.4% to 9.3%. At the same time, the participation for Black, Hispanic and Asian Americans also declined, while it rose slightly for White workers.

.jpg?itok=Fp_sueCy)

The labor force participation rate was unchanged at 61.5%.

.jpg?itok=XzvQXC5I)

Average hourly earnings for all employees on private nonfarm payrolls increased by 23 cents to $29.81, while average hourly earnings of private-sector production and nonsupervisory employees increased by 20 cents to $25.09. On a Y/Y basis, average hourly earnings increased by 5.1%, up from 4.4% and better than the 4.5% expected, which however was likely due to lower-income jobs being lost.

.jpg?itok=c00t3avt)

The average workweek for all employees on private nonfarm payrolls declined by 0.1 hour to 34.7 hours in December. In manufacturing, the workweek was unchanged at 40.2 hours, and overtime increased by 0.1 hour to 3.3 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls was unchanged at 34.2 hours.

A closer look at which industries were affected most in December:

- Employment in leisure and hospitality declined by 498,000, with three- quarters of the decrease in food services and drinking places (-372,000). Employment also fell in the amusements, gambling, and recreation industry (-92,000) and in the accommodation industry (-24,000). Since February, employment in leisure and hospitality is down by 3.9 million, or 23.2 percent.

- Employment in private education decreased by 63,000. Employment in the industry is down by 450,000 since February.

- Government employment declined by 45,000. Employment in the component of local government that excludes education declined by 32,000, and state government education lost 20,000 jobs. Federal government employment increased by 6,000.

- Other services lost 22,000 jobs, with over half of the loss in personal and laundry services (-12,000).

- Employment in professional and business services increased by 161,000, with a large gain in temporary help services (+68,000). Job growth also occurred in computer systems design and related services (+20,000), other professional and technical services (+11,000), management of companies and enterprises (+11,000), and business support services (+7,000).

- Retail trade added 121,000 jobs, with nearly half of the growth occurring in the component of general merchandise stores that includes warehouse clubs and supercenters (+59,000). Job gains also occurred in nonstore retailers (+14,000), automobile dealers (+13,000), health and personal care stores (+10,000), and food and beverage stores (+8,000).

- Construction added 51,000 jobs, but employment in the industry is 226,000 below its February level. In December, employment rose in residential specialty trade contractors (+14,000) and residential building (+9,000), two industries that have gained back the jobs lost in March and April. In December, employment also increased in nonresidential specialty trade contractors (+18,000) and in heavy and civil engineering construction (+15,000).

- Employment in transportation and warehousing rose by 47,000, largely in couriers and messengers (+37,000). While employment in transportation and warehousing overall is 89,000 lower than in February, employment in couriers and messengers has increased by 222,000 over the same period. In December, employment also grew in warehousing and storage (+8,000) and in truck transportation (+7,000), while transit and ground passenger transportation lost 9,000 jobs.

- Health care added 39,000 jobs. Employment growth in hospitals (+32,000) and ambulatory health care services (+21,000) was partially offset by declines in nursing care facilities (-6,000) and community care facilities for the elderly (-5,000). Health care employment is 502,000 lower than in February.

- Manufacturing employment increased by 38,000, with gains in motor vehicles and parts (+7,000), plastics and rubber products (+7,000), and nonmetallic mineral products (+6,000). By contrast, miscellaneous nondurable goods manufacturing lost 11,000 jobs over the month.

- Wholesale trade employment rose by 25,000 but is down by 251,000 since February. In December, job gains occurred in durable goods (+11,000) and nondurable goods (+11,000).

In retrospect, none of this will matter, because as noted up top, what matter is what happens next and how big the stimulus will be: as Bloomberg's Jeffrey Rosenberg said, “We’re looking past the near-term weakness towards the policy response, and that means better growth, and higher rates” for Treasuries. “I don’t think this report is going to take us off that trend."

And once again for the cheap seats, in case it is still unclear why this dismal number is ugly: as Bloomberg concludes, "for any economists who haven’t yet made a forecast for the size of the COVID-19 relief package that’s expected after the Biden administration takes office, this is likely to expand their estimate." So... $3 trillion... or $5 trillion... or $10 trillion... and will Bitcoin be $1 million next?

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more