How To Identify Low Risk Buy Points In A Strong Uptrend

A runaway bull market?

With the NASDAQ in a raging bull market and trading at fresh all-time highs, you may be tempted to chase the price of leading stocks in fear of missing out on the next monster gainer.

At one time or another, you probably have paid up to buy a hot stock that “can’t miss” and promises to deliver a 20-40% gain in just a day or two.

It’s okay; I have occasionally been guilty of this too.

Once in a while, buying at seemingly “overbought” levels actually works, even for new traders operating in their first bull market (ignorance is bliss).

However, I have learned from nearly two decades of trading experience that undisciplined buy entries will eventually be punished, and you will quickly be put into place by the trading gods.

Although all momentum traders should know better, chasing the price action of surging stocks is a major issue that continues to dog the performance of traders’ portfolios.

What you really need is… a low-risk method of buying leading stocks in a nosebleed bull market.

Fortunately, I have a simple and effective solution for this dilemma that I’m excited to share with you here.

If you’re a short to intermediate-term swing trader of stocks, keep reading for juicy details that will put you on the path to greater trading profits with less risk.

Also, be sure to read all the way to the end, where I analyze the charts of two fiery stocks now setting up for potential buy entry.

Discipline Pays Dividends

Lose your ego and get disciplined, you must!

Although it may seem obvious, you must realize personal discipline and patience are key ingredients to my delicious recipe for buying leading stocks while the market keeps rallying to new highs.

If you are a new trader, simply following the rule-based approach of our proven trading system can immediately stack the odds in your favor, while also improving your chart reading skills.

If you’re an intermediate to advanced trader who is struggling with discipline, you may need to check your ego at the door in order to quickly improve and return back to good form.

As a trader, you must learn to deal with the unknown in order to be a successful stock market speculator.

But dealing with the unknown means many elements of stock trading are beyond your control.

As such, you must therefore focus on what you can control, which is your buy entry point.

Start With The “Big Picture” View

When I was a new trader, I made the mistake of spending too much time focusing on the daily and intraday chart time frames.

It seemed logical because those 15-minute, 60-minute, and daily charts clearly showed me where the action was.

However, I eventually realized that longer-term weekly charts did the crucial job of smoothing out day to day price volatility and presenting an objective “big picture” of the dominant trend.

Therefore, if you’re not already doing so, you should immediately add the analysis of weekly chart time frames to your trading arsenal.

Simply The 10-Week MA

As an avid believer in applying the KISS methodology to trading, I primarily base my weekly chart analysis on the 10-week moving average (10-week MA).

Nearly the same as a 50-day MA (on a daily chart), the 10-week MA does a stellar job of showing you the intermediate-term trend in relation to the longer-term trend of a weekly chart.

To avoid chasing buy entries, you merely scan for charts where the price action is not extended too far above the 10-week MA.

If it is, then you should simply pass on the setup.

For example, if the weekly chart is showing a share price gain of 30-40% or more over the past 4 to 5 weeks, and the price has not touched the 10-week moving average during that same time period, you should forget about buying now and move to the next chart.

You might think that trading has to be more complex than this, but I assure you this “no nonsense” method of stock picking is powerful and effective.

The Nitty Gritty

In the words of 20th century adman Frederick R. Barnard, “One picture is worth ten thousand words.”

So, let’s look at the weekly charts of some hot stocks to show you in detail how the 10-week moving average can help keep you determine the most ideal time to buy.

Below, I have also shared with you my handy 4-question checklist for buying, as well as my analysis of two stock charts currently setting up for actionable breakout entry.

But first, here are the charts of a few strong stocks that you would not want to buy now, based on my previous explanation of the 10-week MA being overextended.

Steer Clear

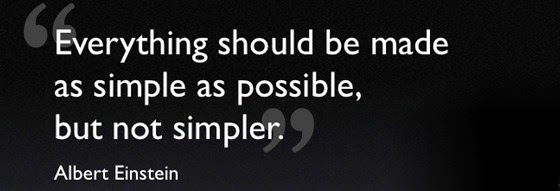

Tempting traders with a 150% gain over the past five weeks, Chinese internet stock Yirendai ($YRD) has been on fire, but presently offers a negative risk to reward.

As of the second week of July, YRD was trading more than 30% above its 10-week MA, and it has remained at least 20% above it since then.

Buying at such extended levels could certainly yield more upside, but the risk of a significant near-term correction gives the trade an unappealing risk to reward ratio at current levels:

If a stock had a huge move over the past week or two, it may seem obvious that it’s too far extended to buy now, but make sure you are looking back further, in order to see just how extended the stock really is.

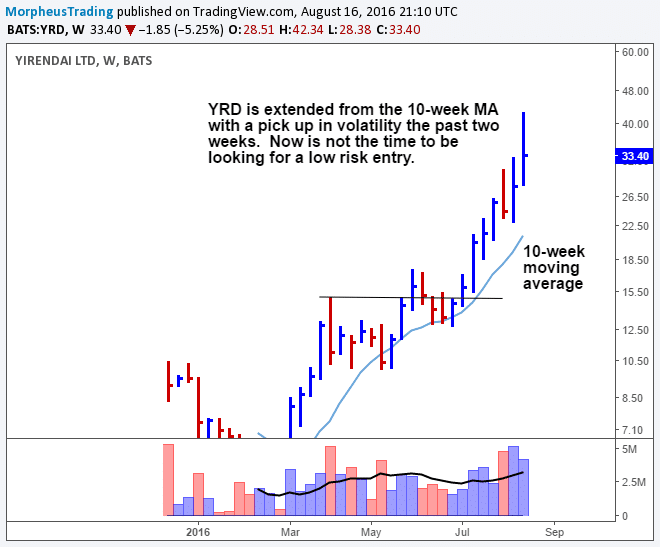

Case in point is recent IPO Acacia Communications (ACIA), which broke out on the week of July 12 to close 40% above the first print of its 10-week moving average.

At that point, the stock was already extended and needed a few weeks of sideways action for a low-risk buy entry to develop.

That consolidation followed and the stock broke out again, making it once again too extended to buy now:

The two examples above may seem obvious to you, but many traders nevertheless buy stocks even when they are 20 – 40% or more above their 10-week MA.

While it will work once in a while, such buy entries immediately put you in a position of weakness and should be avoided (go to Vegas if you want to shoot craps).

All Clear Here

Since the idea is to avoid buying stocks that are too far extended above their 10-week moving averages, when exactly should you buy strong stocks based on the weekly charts?

Generally, the best entries present themselves when an uptrending stock is consolidating in a tight range, near its 10-week MA.

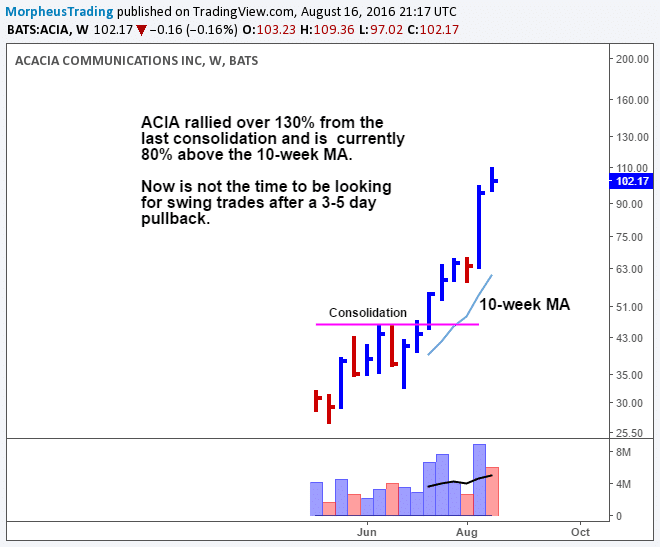

Weibo (WB), another Chinese tech stock, has been trending nicely and is an excellent example of how the 10-week MA can help to provide you with low-risk buy entries of strongly uptrending stocks.

Before going on a big run in recent weeks, WB formed two tight-ranged consolidations just above its rising 10-week MA.

Highlighted on the chart below, notice the bases of consolidation that formed in May, and again in June, before the stock zoomed higher over the past few weeks:

Although WB is currently too extended to buy now, the preceding consolidation patterns from May and June, with the 10-week MA just below, gave the “all clear” signal before the stock began surging higher.

Again, you should avoid charts where the price is extended far above the 10-week MA and hasn’t touched it for several weeks or more; wait for a better setup to develop and move to a different stock.

The 4-Question Checklist

Here are four easy questions to ask yourself when evaluating the weekly chart of a potential stock to buy:

Additionally, right before a stock breaks out and rockets higher, there is typically a period of volatility contraction and declining volume within the base of consolidation (learn about basing and consolidation patterns here).

If you can answer “yes” to the checklist questions above, you may have the next big winner on your hands.

This is especially true if you fine tune your buy entry by drilling down to shorter time frame analysis.

Put These Two Stocks On Your Watchlist

As promised, here are two stocks that are primed for buy entry based on my 4-question checklist above.

Stick them in your trading watchlist now, so that you don’t miss the breakouts that may be just around the corner.

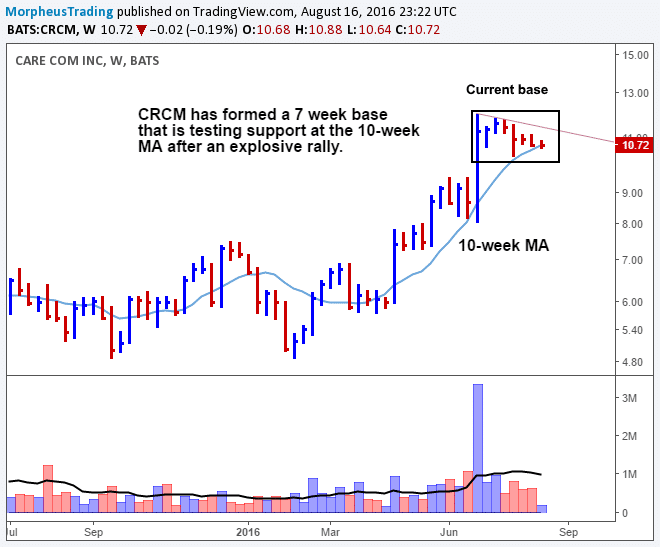

Care.com (CRCM)

CRCM is an example of a stock that is not too extended, having chopped around for seven weeks in a base that is currently testing support of the 10-week MA.

Notice that volume has dried up within the base, while volatility has been contracting, both of which are bullish signs:.

Based on the chart above, CRCM may provide a low-risk buy entry on a breakout above the descending trendline from the recent highs.

A protective stop could be placed just below the low of the current base, which is below key support of the 10-week MA as well.

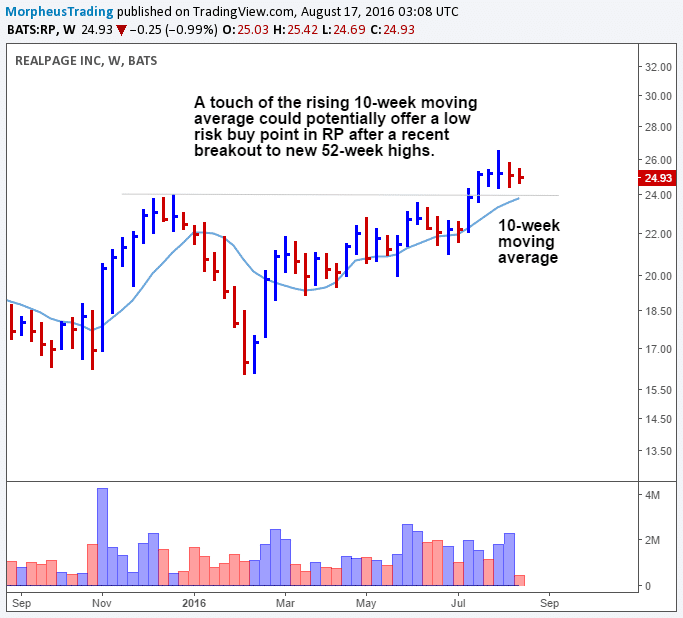

RealPage (RP)

Last month, RP moved off its 10-week MA and rallied to a new 52-week high on increasing volume (this is bullish).

At the peak of that rally, RP was trading roughly 20% above its 10-week MA.

However, the price has since settled into a consolidation pattern, with four consecutive weeks of tight closing prices on the weekly chart.

This correction by time, rather than price, has allowed the 10-week MA to rise up closer to the current price of the stock.

Take a look:

The price of RP may not move any lower before breaking out to fresh highs again, but a touch of the 10-week MA would be possible if the $24.50 area (low of the base) is broken.

Either way, RP may present an ideal buy entry on a breakout above the high of the short-term downtrend line (not shown) that has started forming off the August high.

As with CRCM, a protective stop can be neatly placed below convergence of the low of the base and the 10-week MA support level.

Conclusion

With leading stocks ripping to new highs every day, you now have a clear and objective way for filtering out the stocks that could still be considered for buy entry, versus those that are too far gone.

The weekly time frame provides you with a bird’s-eye view of the overall trend, while the 10-week MA is an awesome gauge to speed up your nightly research and scanning.

Be disciplined like a Jedi stock warrior and carefully review my 4-question checklist above before buying any stock for a short to intermediate-term momentum trade.

Both CRCM and RP have explosive potential in the coming weeks, so I humbly suggest you sign up for my nightly swing trading report to be instantly alerted if/when either stock triggers for buy entry.

Although this article discusses nothing groundbreaking, my simple approach works so well because it is easy to understand and implement.

A proper buy entry should put you into a position of strength immediately after entering the trade, and that is what this trading strategy is designed to do.

Admittedly, the charts above are pretty easy to read in hindsight; trading in real-time and with little experience can be challenging.

Still, if you commit to always taking a step back to analyze the “big picture” on the weekly charts, fantastic things will eventually start to happen on your way to ultimate trading success.

Disclaimer: Past results are not necessarily indicative of future results. There is a high degree of risk for substantial losses in trading securities. All data and material on this website and/or ...

more