Home Construction Consolidating

On a day when major US equity indices were lower across the board, the homebuilder group staged a nice rally. Below we provide a check-up on the group.

From the March lows until the October high, the iShares Home Construction ETF (ITB) rallied over 170%, but since that high, the ETF has been in consolidation. As shown below, ITB has been fluctuating around its 50-DMA for the past few months making some higher lows and lower highs in the process. The past few sessions have seen some more moves above and below the 50-day with today’s 1.8% gain currently bringing it back above and positive on a year-to-date basis. Currently, ITB is now 6.23% below its October 15th closing high.

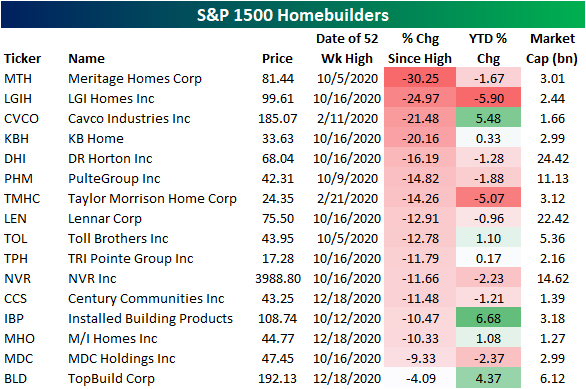

As for the individual homebuilder stocks, below we show the constituents of the S&P 1500 Homebuilders index and the story is mostly the same. After surging from the March lows through October, most of these stocks are down double digits from their respective 52-week highs. Similar to the FAANG names that have mostly traded sideways for the past few months, the homebuilders have quietly been experiencing consolidation as well.

Click here to view Bespoke’s premium membership options for our best research ...

more