High Flyers At Much Lower Altitudes

Stocks with extreme valuations have taken a serious haircut since the space peaked on February 22nd. On that date, 59 stocks in the Russell 3000 had a price-to-sales multiple north of 100x. That group had a median price-to-sales multiple of more than 311x on that date. Today, those 59 stocks have a price-to-sales multiple that’s 53.6% lower than it was on February 22nd. That compares with a median price decline of 25.4% among the 59 stocks, or -22.5% weighted by market cap. In other words, while prices in this group have been hit very hard, their valuation has compressed substantially more.

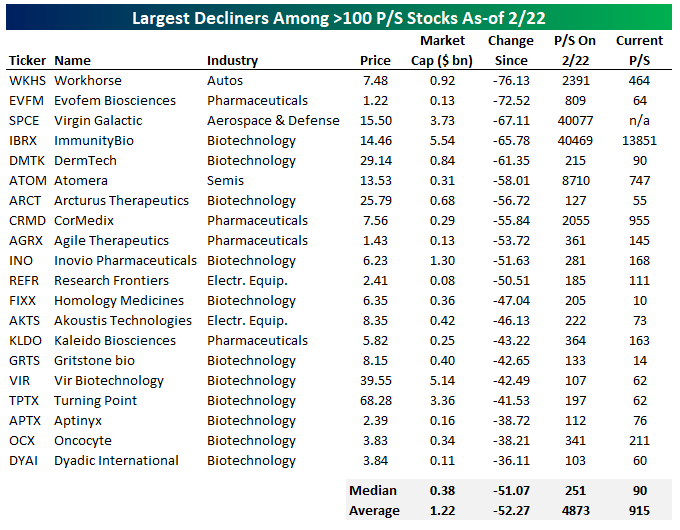

Below we show the 20 stocks out of the 59 that have seen the largest drops in price since February 22nd. Among this worse-performing subset, the median stock has plunged 51%, in line with the median 58% drop in price-to-sales since February 22nd. Despite the huge drops in prices over the last few months, these names are still very aggressively valued at a median price-to-sales multiple of 90x. Virgin Galactic (SPCE) has actually seen an infinite price-to-sales multiple after reporting zero revenue in its most recent quarter. From a valuation perspective, it’s still hard to call any of these stocks attractive.

Click here to view Bespoke’s premium membership options for our best research ...

more