High And Low Performers In 2018

On this last day of 2018, I wanted to review DivGro's best and worst performers of the year. Unlike last year, when DivGro contained lots of winners, this year is a mixed bag.

On this last day of 2018, I wanted to review DivGro's best and worst performers of the year. Unlike last year, when DivGro contained lots of winners, this year is a mixed bag.

Of the 49 positions I owned throughout the year, 18 are trading up and 31 are trading down. With more positions down than up, it is unsurprising that these positions are down 5.6%, on average.

The largest losses are from Ford Motor (F), down 39.6% since January 2018, and Altria Group (MO), down 30.2% since January 2018. On the other hand, Netflix (NFLX) returned 33.1% this year, and Omega Healthcare Investors (OHI) returned 28.1% in 2018.

By the way, these returns do not include dividends.

Here is a chart showing the 2018 performance of stocks I owned throughout the year:

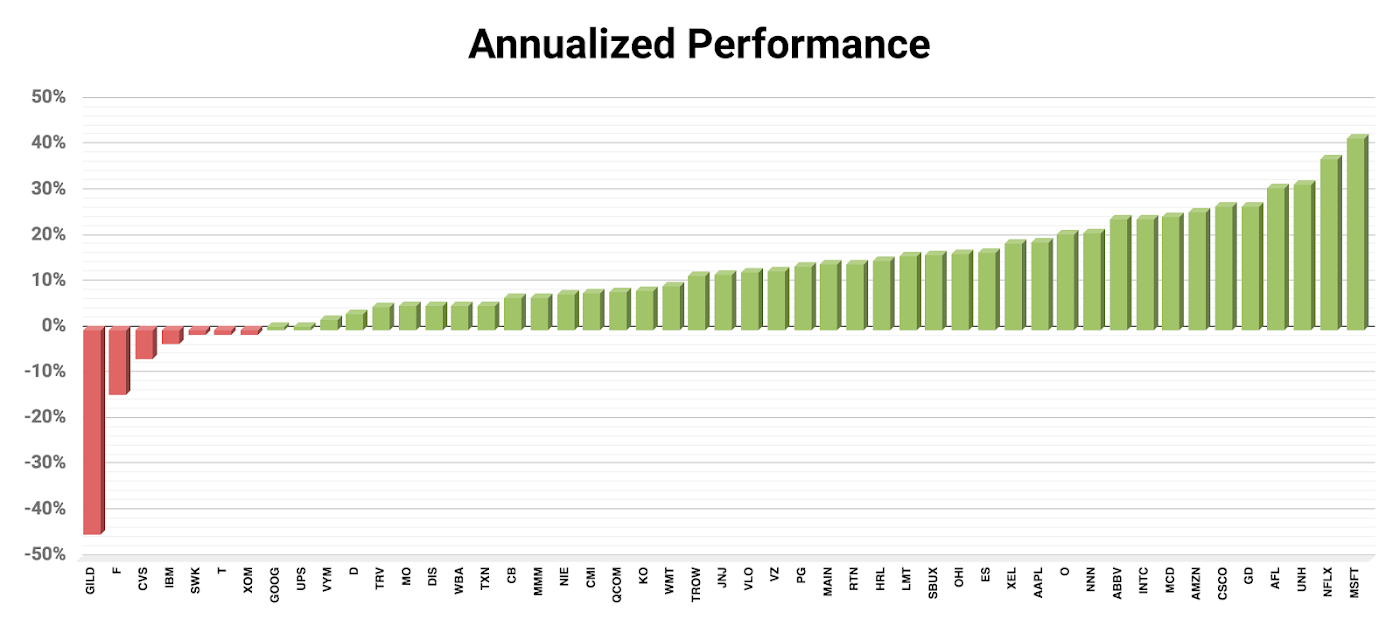

That chart is not a pretty, for sure. Fortunately, these stocks have a longer history in my portfolio, so looking at their annualized returns makes for more pleasant-looking chart:

The returns in the Annualized Performance chart do include dividends.

I have three positions with triple-digit percentage returns:

- Aflac (AFL) — overall returns of 101.3%

- McDonald's (MCD) — overall returns of 105.9%

- Microsoft (MSFT) — overall returns of 131.4%

Let's look at the bottom seven and top seven performers of 2018. These are stocks I owned on 2 January 2018 and that I still own today.

Here are the bottom seven DivGro performers:

DivGro Bottom Seven Performers of 2018 |

||

|

Ticker |

Company |

Total Return |

| F | Ford Motor | -39.6% |

| MO | Altria Group | -30.2% |

| SWK | Stanley Black & Decker | -28.9% |

| IBM | International Business Machines | -26.3% |

| T | AT&T | -26.0% |

| CMI | Cummins | -24.5% |

| GD | General Dynamics | -21.6% |

I first invested in F in 2014 and added to my position a few times, arguing that F is a great stock for options trading. Unfortunately, the stock has performed poorly. F's regular and special dividends (and my options trades) have somewhat made up for the losses, but I'm still in the red overall.

I first invested in F in 2014 and added to my position a few times, arguing that F is a great stock for options trading. Unfortunately, the stock has performed poorly. F's regular and special dividends (and my options trades) have somewhat made up for the losses, but I'm still in the red overall.

Recently, I sold most of my F shares to harvest tax losses and to do a cost basis reset. I hope to reestablish my position before the next ex-dividend date.

MO is another stock that is struggling, as Altria tries to navigate a challenging regulatory environment and declining cigarette consumption in the United States. With recent acquisitions, the company is making strong moves into the e-cigarette and cannabis markets. While I think diversifying income streams is a good move, I have yet to study Altria's moves and their possible implications, particularly for MO's generous dividend.

MO is another stock that is struggling, as Altria tries to navigate a challenging regulatory environment and declining cigarette consumption in the United States. With recent acquisitions, the company is making strong moves into the e-cigarette and cannabis markets. While I think diversifying income streams is a good move, I have yet to study Altria's moves and their possible implications, particularly for MO's generous dividend.

Recently, I added 25 shares to round out my position to 200 shares. My MO position delivers $640 in annual dividend income.

Rounding out the bottom three is Stanley Black & Decker (SWK), a global provider of power and hand tools, mechanical access solutions, and electronic security and monitoring systems. A Dividend Champion with a streak of 51 years of higher annual dividend payments, SWK yields 2.20% at $119.74 per share.

Rounding out the bottom three is Stanley Black & Decker (SWK), a global provider of power and hand tools, mechanical access solutions, and electronic security and monitoring systems. A Dividend Champion with a streak of 51 years of higher annual dividend payments, SWK yields 2.20% at $119.74 per share.

The company is growing revenue sufficiently to afford its dividend, and management is aggressively pursuing acquisitions to diversify income streams. The payout ratio is quite low at 31% and Simply Safe Dividends consider the dividend to be Very Safe.

Now let's look at the top seven DivGro performers:

DivGro Top Seven Performers of 2017 |

||

|

Ticker |

Company |

Total Return |

| NFLX | Netflix | 33.1% |

| OHI | Omega Healthcare Investors | 28.1% |

| AMZN | Amazon | 26.3% |

| MSFT | Microsoft | 18.2% |

| HRL | Hormel Foods | 17.4% |

| NNN | National Retail Properties | 13.0% |

| UNH | UnitedHealth | 12.6% |

NFLX is one of my non-dividend-paying stocks or, as I like to call them, my future dividend payers. After making an all-time high of $423.21 in June, the stock has stumbled badly. At years-end, NFLX is down 37% from that all-time high!

NFLX is one of my non-dividend-paying stocks or, as I like to call them, my future dividend payers. After making an all-time high of $423.21 in June, the stock has stumbled badly. At years-end, NFLX is down 37% from that all-time high!

Given that NFLX do not pay dividends, why am I holding onto my shares given the poor performance since June? Well, I can't really justify my choice here, except to say that I don't think selling now would be a good move. I'm going to wait until the company reports earnings in January, and then decide what to do.

Last year, OHI was the second worst performer. This year, it is the second best performer! While I'm very happy with OHI's excellent performance, I trimmed my position in November. Before doing so, my position represented a portfolio yield of 5.95%. I consider that level too risky for a stock with a Dividend Safety Score of 43.

Last year, OHI was the second worst performer. This year, it is the second best performer! While I'm very happy with OHI's excellent performance, I trimmed my position in November. Before doing so, my position represented a portfolio yield of 5.95%. I consider that level too risky for a stock with a Dividend Safety Score of 43.

I'm happy with the size of my current position, and I think OHI will be fine in the long run. At least, in my view, the juicy 7.5% yield is worth the risk of owning the stock.

Rounding out the top three is another of my future dividend payers, Amazon (AMZN). Like NFLX, AMZN ascended to an all-time high in 2018 of $2,050.50 per share, before correcting to its current price of $1,501.97 per share, some 27% lower.

Rounding out the top three is another of my future dividend payers, Amazon (AMZN). Like NFLX, AMZN ascended to an all-time high in 2018 of $2,050.50 per share, before correcting to its current price of $1,501.97 per share, some 27% lower.

Somehow, I have even more confidence in AMZN's future than NFLX's. The company is the dominant force in e-commerce, while AWS is larger than its next four Cloud Computing competitors, combined. And with Amazon Prime and Alexa, the company has synergies for its commerce that perhaps are not yet fully appreciated.

Disclaimer: I'm not an investment professional or a licensed financial advisor. This blog represents my personal views and ...

more