The Remarkably Simple Strategy Behind One Of The Best Performing Hedge Funds Of 2020

Earlier this week we noted a new scientific report which confirmed what we have been saying for much of the past decade: that in the new abnormal, hedge fund flows matter more than fundamentals, data, newsflow, and virtually all other market variables, with one concrete exception: central bank liquidity injections (and occasionally, drains).

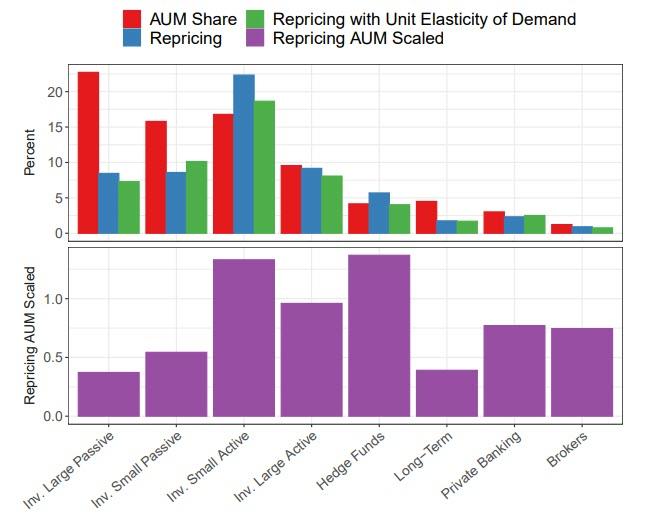

As the research paper titled "Which Investors Matter for Equity Valuations and Expected Returns?" found, hedge funds exert far more power on equity prices than most other classes of investors, while the passive cohort are among the least influential. The paper's conclusion, as per Bloomberg: "The fast money has more than three times the impact on equity valuations, per dollar under management than long-term investors like pension funds."

"The influence of hedge funds is remarkable given their relatively small size," the authors wrote. Smaller investment advisors had the second-greatest impact on price, and proved even more influential across a host of other characteristics, the authors found. “Small, active investment advisors are most important for the pricing of payout policy, cash flows, and the fraction of sales sold abroad."

(Click on image to enlarge)

One immediate question that followed from this research is "if it is that easy to manage money, why aren't there funds who have perfected this copycat strategy"?

As it turns out there are. As Bloomberg reported just hours after we published the above report, a machine-learning hedge fund backed by PE giant Blackstone has been on a serious growth spurt after generating a 20% gain in this year’s wild pandemic markets.

Bayforest Capital - which we regret to inform all unemployed hedge fund analysts and portfolio managers, employs just five people in London - is set to oversee $235 million in managed accounts over the coming month, a remarkable, six-fold increase compared with just $45 million at the end of 2019. It also plans to launch a fund for institutional investors later this year.

The firm run by Theodoros Tsagaris, a quant who previously worked at Tudor, GSA Capital, and BlueCrest Capital, has impressed outside investors with a record of positive gains every month in this year.

How does the fund do it? Simple: it figured out long ago what we confirmed earlier this week, namely that "Hedge Fund Flows Are All That Matter." Tsagaris credits Bayforest’s success to algorithms surfing fast shifts in capital flows in real time. As Bloomberg details further, with a system trading futures based on the behavior of different investors and an average holding period of just eight days, the portfolio has managed to make money even as markets swing from despair to exuberance.

"We’re receiving billions of data points every day and we adapt our algos based on the new information," Tsagaris told Bloomberg in an interview. Translation: 'we are just doing whatever the price-setters are doing at any given moment.'

Think of it as central-bank inspired momentum... on steroids.

Tsagiris' hope is to grow his fund three more times and oversee $750 million by the end of the year, an ambitious goal for a firm that started trading in March 2018 with almost no capital. But that goal is certainly looking attainable now that the $6 billion Blackstone Alternative Multi-Strategy Fund last month announced it’s allocating to Bayforest, joining sub-advisers including D.E. Shaw and Two Sigma.

A Bayforest strategy of following capital flows holds particular appeal in a volatile market jumping from record losses to historic gains. That’s especially so for systematic investors whose directional bets have been crushed by rapid shifts in bull and bear regimes. Investing styles that follow flows can range from trading ahead of index rebalancing to buying shares touted on websites followed by day traders.

And yes, in case anyone was wondering, long-term, "buy and hold" investing is dead. Bayforest is also among a short list of quant funds this year that attribute their triumph to shorter holding periods and more adaptive trading signals, even as skeptics - i.e., those who takes PPP funds and pretend they manage money when all they really do is convince their LPs that central banks will bail them out - that constantly churning portfolios may not pay off in the long run.

Oh and yes, Tsagaris is not an actual trader: his academic training is on harnessing computing power to "decipher" noisy markets; his doctorate dissertation at Imperial College London was on building adaptive algos from data streams. Because that's what "markets are now: algos frontrunning and adapting to other algos.

He says Bayforest’s advantage is its ability to continually suss out new patterns, allowing it to adapt even when market participants try to hide their tracks by changing how they trade.

"What we are seeing is amazing alpha in areas that were not evident before," he said, referring to the shifts in capital flows in both investing apps like Robinhood and exchange-traded funds. Translation: with everyone else scrambling to discover the Golden Grail of manipulated, centrally-planned markets, the answer is staring everyone in the face: always do what the majority is doing... as long as it is frontrunning central banks.

Oh, and for anyone still confused, this means that traditional buy and hold, investing - value or otherwise - is long dead and buried.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more