Mega Squeeze Coming: Last Week Saw Biggest Hedge Fund Shorting Since May

Last week was an emotional roller coaster for every trader, and even though stocks closed almost unchanged from where they opened, what happened in the past five days was anything but smooth sailing, as the following daily wrap from Goldman's Prime Service desk reveals.

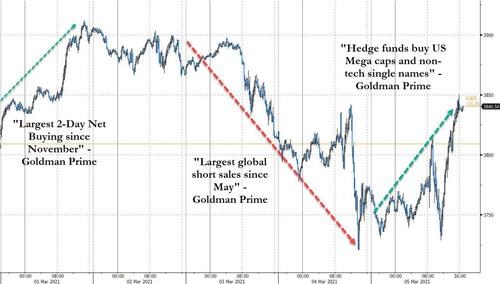

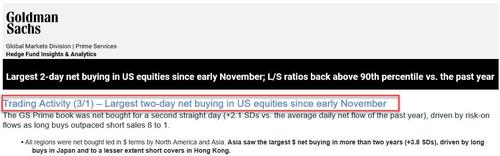

Starting Monday, when stocks soared in a relief rally from the previous Friday's tumble as yields stabilized, Goldman prime reported that the GS Prime book "was net bought for a second straight day (+2.1 SDs vs. the average daily net flow of the past year), driven by risk-on flows as long buys outpaced short sales 8 to 1."

Furthermore, "on a cumulative basis, the $ net buying from the past two days (Friday and Monday) was larger than any other two-day period since early November. While Friday’s net buying was driven by short covers in Macro Products, yesterday’s net buying was driven by long buys in Single Names."

Remarkably, according to Goldman's hedge fund facing division, "all regions were net bought led in $ terms by North America and Asia. Asia saw the largest $ net buying in more than two years (+3.8 SDs), driven by long buys in Japan and to a lesser extent short covers in Hong Kong." Meanwhile, just in the US, Goldman says buying outpaces short sales 5 to 1.

All of this changed the very next day when stocks stumbled amid renewed rising rate pressures and just a day after Goldman Prime saw a dramatic surge in buying. Whiplash set in with Goldman reporting the "largest global short sales since May," with the GS Prime book was net sold yesterday (-0.9 SDs vs. the average daily net flow of the past year), driven by short sales outpacing long buys 1.7 to 1."

The next day was one of confusion, with Goldman Prime reporting that its prime book was modestly net bought, "driven by long buys outpacing short sales 1.2 to 1," although North American markets were not on the buying agenda as "with the exception of North America, all regions were net bought led in $ terms by Europe and Asia."

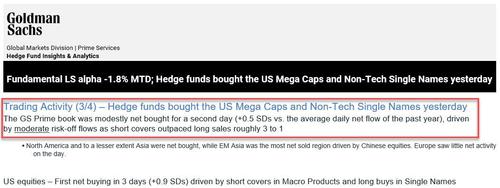

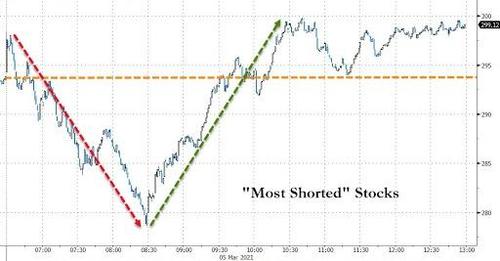

Which brings us to the end of the week, when shortly after the biggest shorting in almost one year by some hedge funds, other hedge funds have decided to approach with WallStreetBets attitude and start a squeeze, with GS prime reporting that "hedge funds bought the US Mega Caps and Non-Tech Single Names yesterday" as "the GS Prime book was modestly net bought for a second day (+0.5 SDs vs. the average daily net flow of the past year), driven by moderate risk-off flows as short covers outpaced long sales roughly 3 to 1."

As GS prime details, the end of the week saw:

"the first net buying in three days (+0.9 SDs) driven by short covers in Macro Products and long buys in Single Names" even as "ETF shorts decreased -0.8% (-1.4% week/week; +24% YTD), driven by covers in Small Cap and Health Care ETFs which outweighed continued shorting in Corporate Bond ETFs. 8 of 11 sectors were net bought – Health Care (long buys > short covers), Real Estate (long buys > short covers), Consumer Disc (long buys > short sales), Consumer Staples (short covers), and Energy (long buys + short covers) were among the most net bought. On the other hand, Info Tech (short sales > long buys), Materials (long-and-short sales), and Industrials (long-and-short sales) were the only net sold sectors."

Curiously, Info Tech stocks - i.e., the biggest winners of 2020 - were net sold for a third straight day. That said, in $ terms, the net selling in the sector was ~75% of Wednesday’s activity and driven by short sales outpacing long buys (i.e., there was no significant long liquidation).

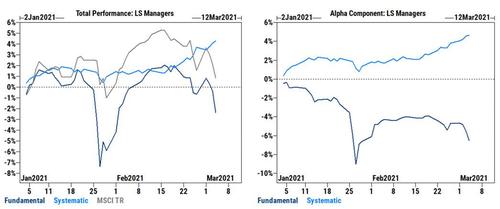

As a result of the whiplash, Goldman Prime calculates that "fundamental LS managers experienced another worst alpha day since Jan. 27, driven by sell-off in Momentum and Info Tech, and have lost 1.8% of alpha over the past three days."

What does all of this mean for markets?

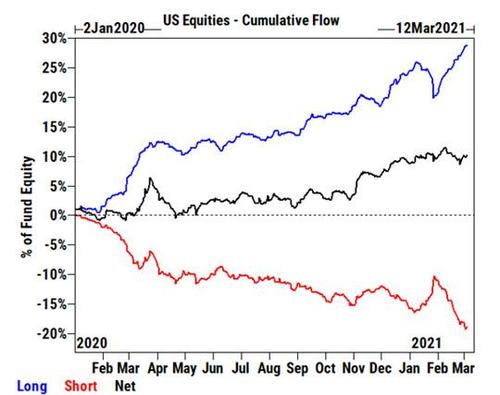

Well, in a week where stocks first spiked then tumbled only to reverse, and where substantial damage was done on HF P&L immediately after a furious burst of shorting -- it is likely that the short squeeze we observed on Friday is about to spread and force even more forced squeezes on Monday, especially now that the $1.9 trillion Biden bill has been passed by the Senate.

The only thing that could prevent a sharp spike in stocks in the overnight/tomorrow session is another burst higher in yields and bond volatility. So keep a close eye on both. However, should there be no fireworks, prepare for a continuation of Friday's meltup as hedge funds - especially Fundamental L/S funds - scramble to close their latest round of shorts and catch up to their sharply outperforming, systematic peers.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more