Hedge Fund Liquidations Soar To Highest Level Since 2015

Global hedge fund data reveals a massive liquidation of funds was seen in the first quarter of 2020, marking the highest level of fund liquidation since 2015, as coronavirus market gyrations led to steep losses and soaring redemptions, according to Reuters, citing a new HFR Global Hedge Fund Industry Report.

HFR released the report on Tuesday that shows 304 funds liquidated in 1Q20. This was the highest level of fund liquidation since the fourth quarter of 2015 when 305 funds shut down. Shown below, the number of closures in 1Q20 is about 50% higher than the last quarter in 2019.

(Click on image to enlarge)

h/t Bloomberg

Even before the pandemic, hedge funds suffered eight straight months of redemptions, the longest stretch since the financial crisis.

During the market turmoil in late February and March, money managers were severely bruised by collapsing asset prices, lockdowns, economic paralysis, and high unemployment. HFR showed investors pulled $33 billion out of hedge funds in the first quarter, the fourth largest outflow in history.

Only 84 new funds were created in the first quarter, the slowest pace of fund creation since the fourth quarter of 2008. The decline in new funds began in the back half of 2019.

In total, HFR data shows 8,081 hedge funds, and 1,167 funds of hedge funds were seen across the world.

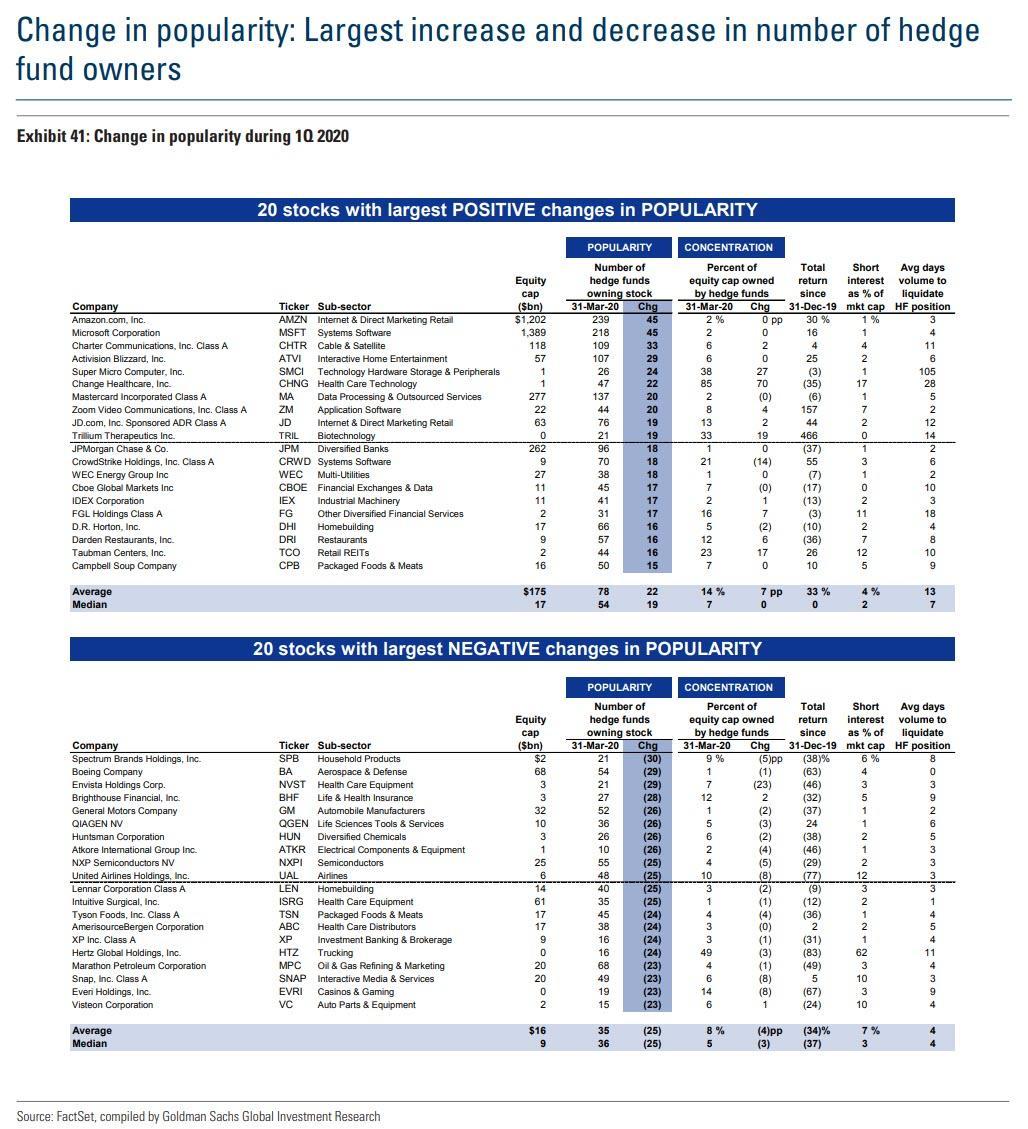

Readers may recall, hedge funds concentrated their portfolios even further into growth stocks after the virus pandemic sent equities into a tailspin (the investment thesis has been purely based on a Fed put).

(Click on image to enlarge)

h/t Goldman Sachs

Despite positioning, hedge funds have struggled to deliver returns to clients as retail daytraders on Robinhood are netting hundreds of percentages by bottom fishing bankrupted stocks, such as Hertz and Chesapeake Energy.

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more