2020's Best Performing Hedge Fund Warns Of "Incredible Move" Around The Election

Sure, there are probably a handful of hedge funds who have generated even higher returns, but for the purpose of this post we are going off the latest HSBC hedge fund weekly report, according to which Boaz Weinstein's Saba Capital is the best performing hedge fund of 2020 with a staggering 72% YTD return.

(Click on image to enlarge)

And while some could chalk Weinstein's stellar return to luck, the reality is that he has read the tea-leaves of 2020 better than most of his peers, and certainly those who focus on credit and fixed income like the former Deutsche Bank relative value guru and prop trader.

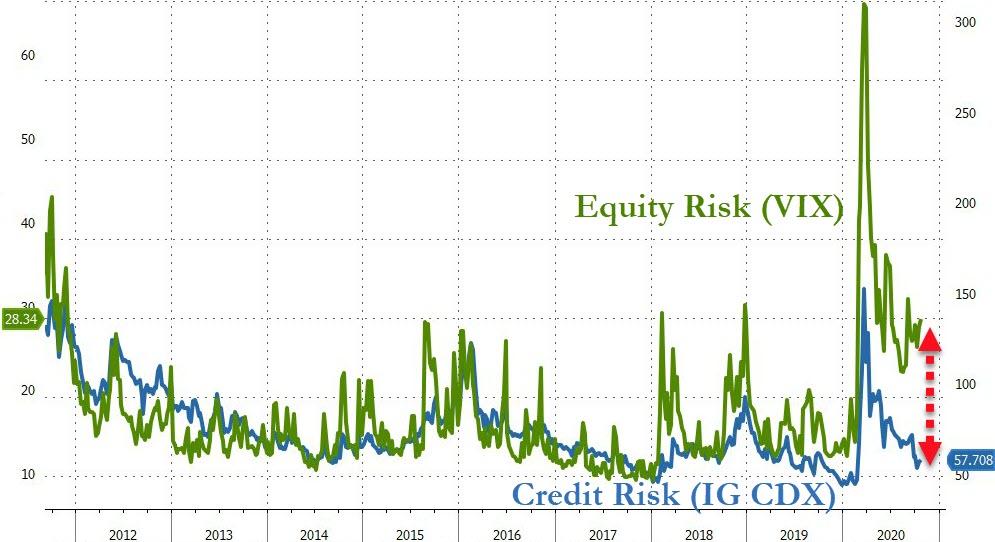

Which is, for lack of a better word, chilling because as Bloomberg reports, "never in his 22-year career has Boaz Weinstein seen such a disconnect between the complacency of credit investors and the anxiety of equity investors, and he predicts it could unravel in an “incredible move” around the Nov. 3 U.S. election."

Speculators Reverse Big Nasdaq Short

Speaking during a Bloomberg Front Row interview, Weinstein turned the fear factor up to '11', warning ominously that it feels "like a calm before the storm."

“Equity volatility is almost inescapably high. Is that a good form of insurance? The payoff profiles are nothing like they were back in January. Whereas in credit, we’re almost back to where we were in January.”

As the relative-value expert notes, "something has to give".

(Click on image to enlarge)

With so many “known unknowns" - such as the election outcome, the COVID-19 spread, and the pace of the economic recovery - a high degree of implied volatility in equities makes sense, Weinstein said. "The sanguine outlook for credit doesn’t, especially with yields low and defaults mounting."

“I find today the risk-reward profile of credit to be basically among the worst, relative to other things, I’ve seen in my career,” Weinstein said. "A VIX at 20 used to be quite a feat. Here we are at 30, and the credit market hasn’t blinked."

As a result of the gaping divergence between the VIX and credit spreads - the two had moved in tandem for years, but in August the two series blew out as the VIX started rising as spreads kept falling - Weinstein has pounced on the trade, betting on vol compression.

Finally, as Bloomberg reports, when pressed on the timing of the "incredible move," Weinstein suggested the election could be a catalysts but that any Fed reaction may delay the inevitable...

“What I’m doing right now is trying to think hard about a negative outcome in the market, and it won’t be because the Fed backs off - the Fed has really been holding the market up - but if the second wave of infections is even worse than people think, if we have a contested election, on and on,” he said.

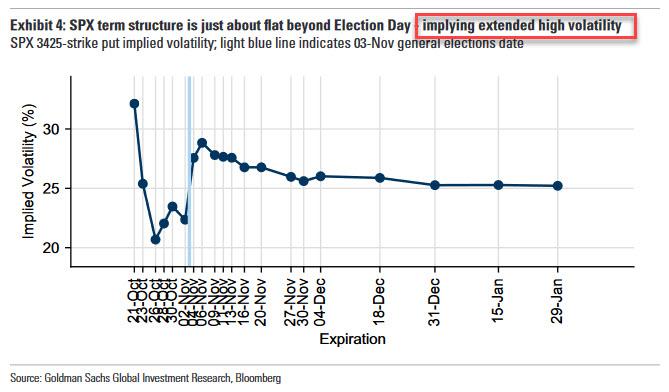

“Or even in ways that are unknown unknowns. The chance for a very significant move is there.”

Of course, it is possible that Weinstein is simply wrong, and painfully so, with his compression trade leading to massive losses: after all the very simple reason why credit vol has collapsed is that the entire corporate bond market is explicitly backstopped by the Fed - which is buying both IG and HY single bonds and ETFs in the open market - while stocks are still only implicitly supported by Powell, something we have discussed time and again. As a result, while equity vol can and probably will continue to be dangerously higher well beyond the election as the following chart from Goldman shows...

(Click on image to enlarge)

... it would take a crushing loss of faith in the Fed for credit vol to stage a similar dramatic move.

Furthermore, Weinstein has been quite bearish for a while: in July, the former Deutsche Banker warned that "markets are at an unstable place right now. I look out at the next five months, and there are lots of known unknowns,” pointing to everything from the course of the pandemic to the U.S. election and relations with China.

"There are dislocations today that are as large as they were three months ago" Weinstein said, predicting that there will be more moves to make as default rates mount.

Then again, Weinstein's results in 2020 speak for themselves: Saba has raised about $1.25 billion of new money since March and now manages $3.3 billion, evenly split among the flagship, a strategy offering tail-risk protection and a closed-end fund vehicle.

Watch the full interview here:

As we previously noted, to Weinstein - who became a chess "life master" at 16, a card-counting blackjack ace when he was 20, and CDS trader at 24 when he joined Deutsche Bank - it's not about the money but winning the game.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more