Genomic Health Is Positioned For Strong Returns

Genomic Health (GHDX) is a top provider of genomic-based diagnostic tests that help optimize cancer care, including addressing the overtreatment of the disease, one of the greatest issues in healthcare today. Genomic Health offers its tissue-based invasive breast, prostate, colon, and DCIS Oncotype DX tests as clinical laboratory services.

According to management, the company has prospective evidence from more than 63,000 patients demonstrating that the Oncotype DX Breast Recurrence Score test accurately predicts outcomes, and it calculates that access to Genomic Health tests that enables personalized treatment decision-making has saved the healthcare system approximately $5 billion in the United States alone.

Genomic Health is delivering solid results and benefiting from accelerating adoption, reimbursement, and revenue growth.

The National Institute for Health and Care Excellence (NICE) in the UK has recently issued its updated guidance, again recommending the Oncotype DX Breast Recurrence Score test for use in clinical practice to guide adjuvant chemotherapy treatment decisions for certain patients with early-stage breast cancer. In addition, NICE expanded its recommendation to include patients with micrometastases indicating that some cancer cells have spread to the lymph nodes.

In the words of Simon D H Holt, Honorary Consultant Surgical Oncologist, Peony Breast Care Unit at Prince Philip Hospital in Llanelli, UK:

"Oncotype DX is the only test that provides specific information about an individual patient's response to chemotherapy, correctly identifying the important minority of patients who will receive substantial treatment benefit and the majority of patients who will not benefit from chemotherapy. This test allows us to target treatment much more effectively and should be routinely used for all eligible patients."

data by YCharts

data by YCharts

Offering a similar perspective, in September of 2018 the German Institute for Quality and Efficiency in Health Care (IQWiG) concluded in its updated assessment of breast cancer gene expression profiling tests that only the Oncotype DX test has sufficient evidence to guide breast cancer adjuvant chemotherapy treatment decisions.

The company is also obtaining reimbursement wins in urology, including Medicare's final local coverage determination for use of the Oncotype DX AR-V7 Nucleus Detect test for men with castrate-resistant metastatic prostate cancer, effective in December of 2018.

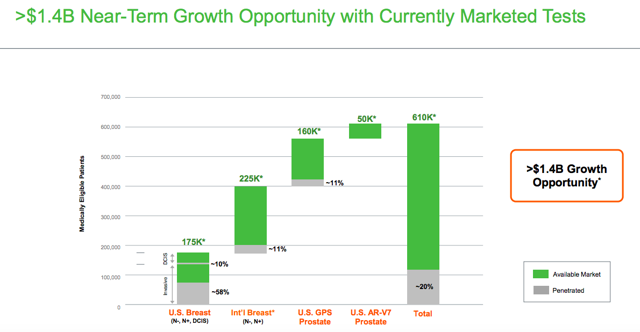

Genomic Health is aggressively betting on international markets for growth. Management estimates that the size of the growth opportunity considering only currently marketed tests is worth around $1.4 billion, proving plenty of room for expansion from current levels.

Source: Genomic Health

The Numbers

The company is delivering both vigorous revenue growth and expanding profitability. This is providing a double boost to earnings, because revenues are growing rapidly, and Genomic Health is also retaining a larger share of those revenues as profits.

Revenue during the third quarter of 2018 amounted to $101.3 million, an increase of 23% compared to adjusted revenue of $82.2 million in the same quarter of 2017. Non-GAAP profit came in at $13.3 million, a year-over-year increase of $12.2 million. The third quarter of 2018 was the 13th consecutive quarter of improved non-GAAP profitability for Genomic Health, proving that the business model generates expanding profit margins over time.

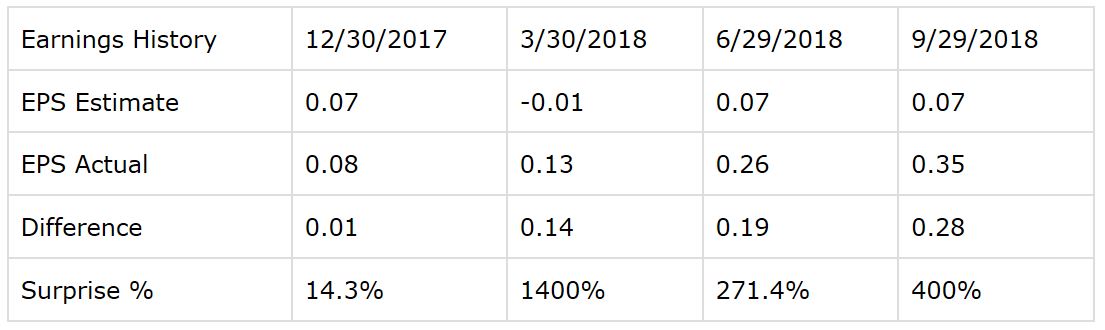

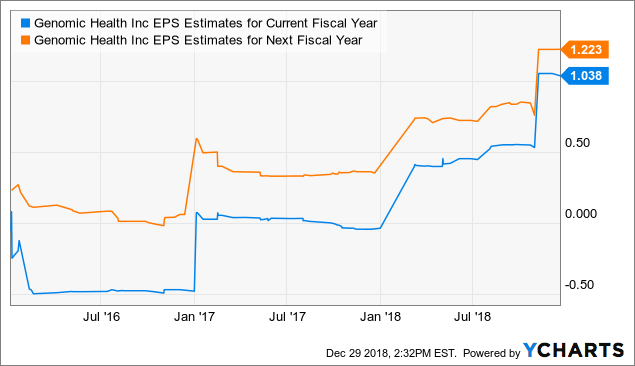

Being a rapid-growth company, it's hard to accurately forecast earnings for a company such a Genomic Health. But it's worth noting that the company has delivered earnings figures considerably above expectations over the four past quarters in a row.

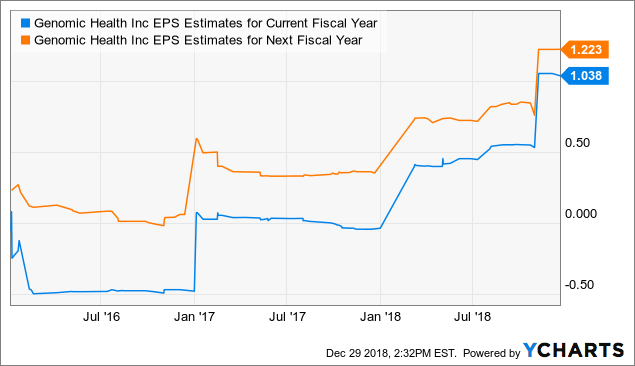

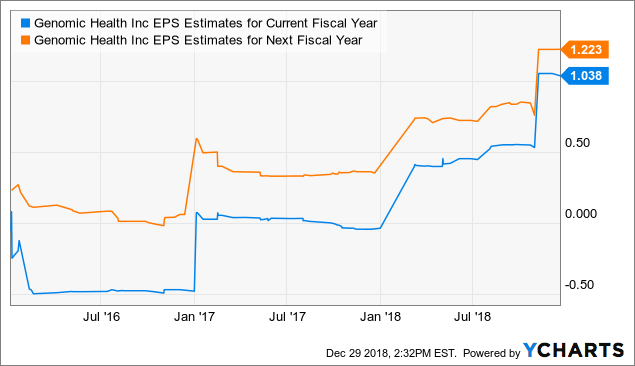

data by YCharts

data by YCharts

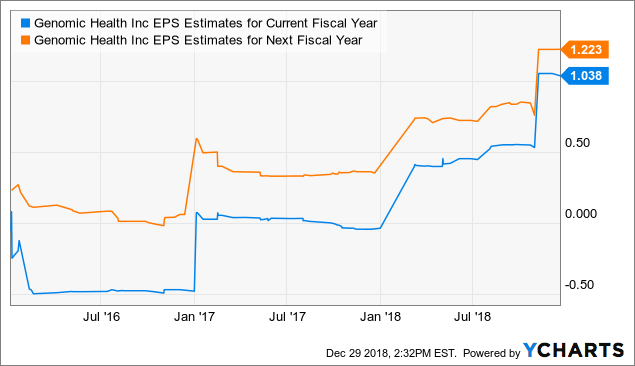

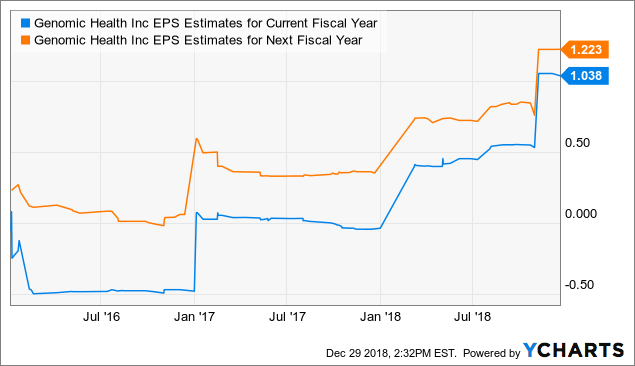

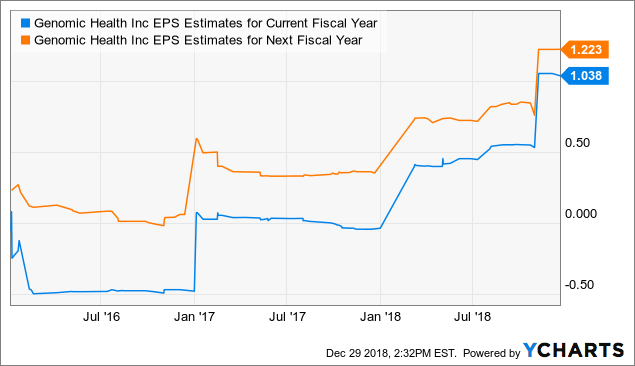

Since the company has considerable outperformed expectations in the recent past, Wall Street analysts have substantially increased their earnings expectations for Genomic Health in both the current year and next year.

data by YCharts

Price movements in the stock market don't depend on the fundamentals alone. The current price is reflecting a particular set of expectations about the business. If the company can beat those expectations and drive increased expectations about the future, this generally drives the stock price higher too. In other words, fundamental momentum can be a powerful driver for stock prices.

Looking at valuation levels, Genomic Health is certainly priced for growth, but the stock is not overpriced at all if the company can deliver in accordance with expectations. Since earnings are rapidly growing, current earnings and cash flows don't reflect the company's true earnings power over the long term.

The price to earnings growth ratio is currently 0.13 when based on earnings growth expectations for the next five years, which looks quite attractive. As a reference, the average price to earnings growth ratio for companies in the Biotech industry is currently 1.2. Genomic Health is clearly more unpredictable than the average industry player, so a valuation discount can be partially justified on that basis. However, the valuation gap is still quite large.

In terms of price to sales, Genomic Health trades at 6.1 times revenue, while other successful players in genomics such as Illumina (ILMN), Editas (EDIT), and CRISPR (CRSP) trade at price to sales ratios of 13.8, 33, and 36, respectively.

data by YCharts

Since the company has considerable outperformed expectations in the recent past, Wall Street analysts have substantially increased their earnings expectations for Genomic Health in both the current year and next year.

data by YCharts

Price movements in the stock market don't depend on the fundamentals alone. The current price is reflecting a particular set of expectations about the business. If the company can beat those expectations and drive increased expectations about the future, this generally drives the stock price higher too. In other words, fundamental momentum can be a powerful driver for stock prices.

Looking at valuation levels, Genomic Health is certainly priced for growth, but the stock is not overpriced at all if the company can deliver in accordance with expectations. Since earnings are rapidly growing, current earnings and cash flows don't reflect the company's true earnings power over the long term.

The price to earnings growth ratio is currently 0.13 when based on earnings growth expectations for the next five years, which looks quite attractive. As a reference, the average price to earnings growth ratio for companies in the Biotech industry is currently 1.2. Genomic Health is clearly more unpredictable than the average industry player, so a valuation discount can be partially justified on that basis. However, the valuation gap is still quite large.

In terms of price to sales, Genomic Health trades at 6.1 times revenue, while other successful players in genomics such as Illumina (ILMN), Editas (EDIT), and CRISPR (CRSP) trade at price to sales ratios of 13.8, 33, and 36, respectively.

data by YCharts

These companies are quite unique, so comparisons are admittedly not very straightforward. But the point remains that the market is willing to pay aggressive valuations for successful players in such a promising market, and Genomic Health still has a lot of upside in terms of valuation from current levels.

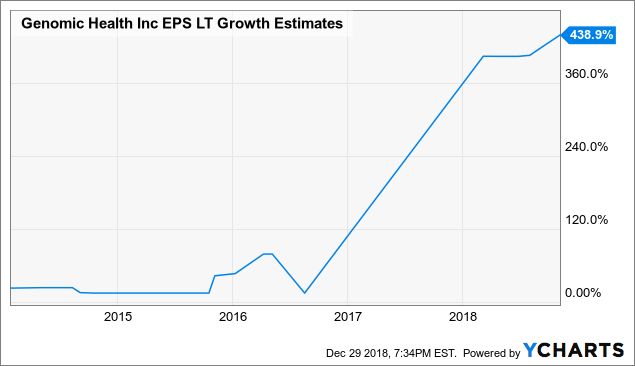

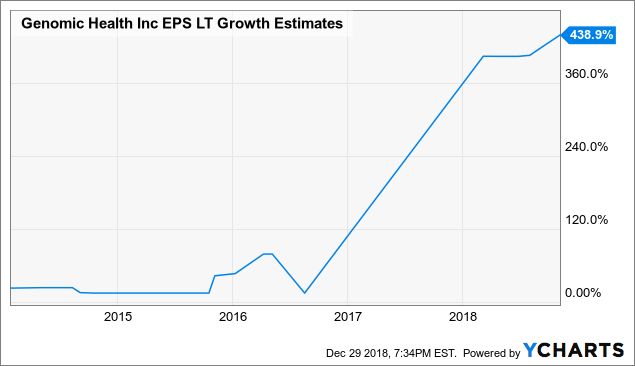

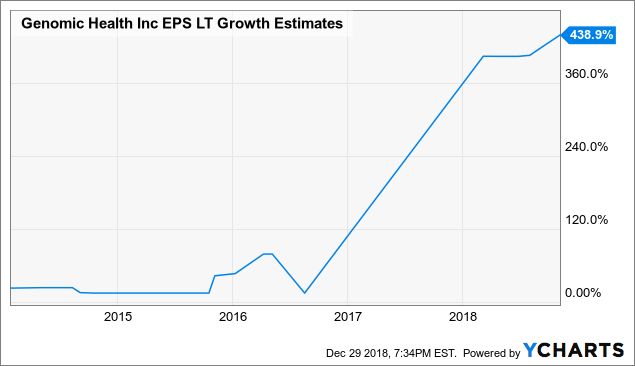

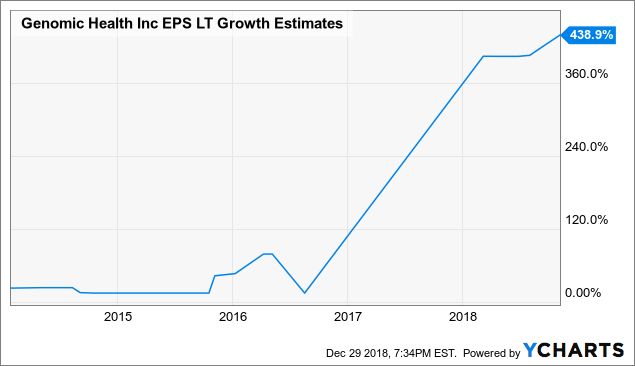

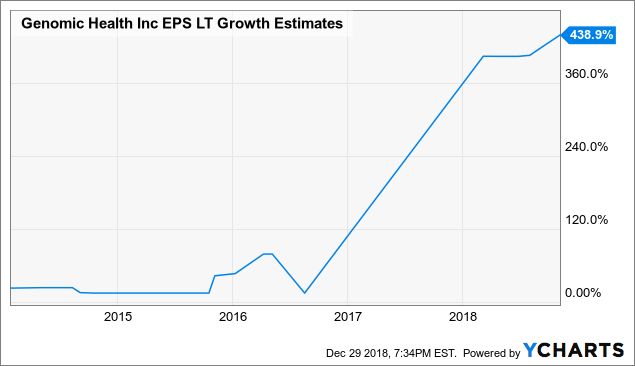

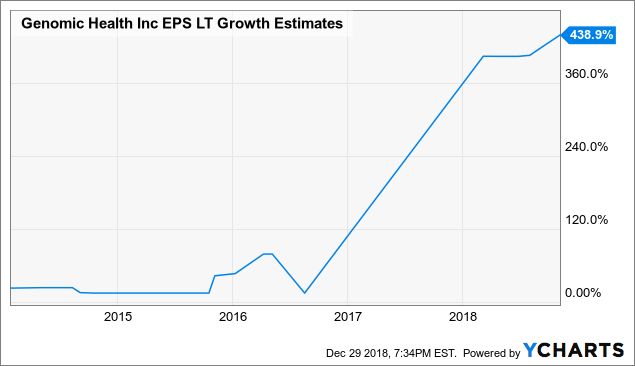

Importantly, valuation is dynamic as opposed to a static concept. Long-term growth expectations for Genomic Health have exploded higher in recent years, and higher growth expectations obviously deserve higher valuations.

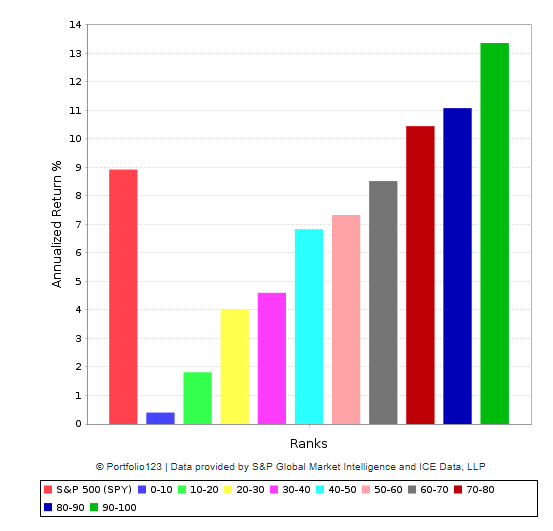

The PowerFactors system is a quantitative investing system available to members in my research service, "The Data Driven Investor." This system basically ranks companies in a particular universe according to quantitative indicators such as financial quality, valuation, fundamental momentum, and relative strength.

The PowerFactors system has produced consistent outperformance over the long term. The chart below shows the annualized returns for companies in 10 different PowerFactors ranking buckets since January of 1999 in comparison to the SPDR S&P 500.

Companies with higher rankings tend to produce superior returns and vice versa. Importantly, stocks with relatively high quantitative rankings tend to materially outperform the market over the years.

Data from S&P Global via Portfolio123

Genomic Health is one of the top companies in the U.S. market based on the PowerFactors ranking, so the statistical evidence is saying that the quantitative indicators look particularly strong in this case.

Some Risks To Consider

It's good to know that the business is thriving and that the numbers are strong. However, investing is about probabilities and possibilities as opposed to certainties.

To begin with, Genomic Health operates in a very competitive industry, and there is a lot of money flowing to all kinds of technologies in the sector. If the company fails to sustain its technological leadership going forward, this will have a negative impact on financial performance and shareholder returns.

Besides, regulatory risk and pricing pressures in different markets and countries are always important risk factors when investing in the healthcare sector.

Genomic Health is not a particularly big company, and high-growth stocks are especially sensitive to general stock market fluctuations. In a market scenario with plenty of uncertainties, investors in Genomic Health need to be willing to tolerate a high degree of volatility, both to the upside and to the downside.

Those risks being acknowledged, Genomic Health is a high-growth stock in a particularly promising market with a lot of room for expansion in the long term. As long as the company remains on the good track, it makes sense to expect attractive returns from a position in Genomic Health over the years ahead.

Capitalize on the power of data and technology to take the guesswork out of your investment decisions. Statistical research has proven that stocks and ETFs showing certain quantitative attributes tend to outperform the market over the long term. A subscription to The Data Driven Investor provides you access to profitable screeners and live portfolios based on these effective and time-proven return drivers. Forget about opinions and speculation, investing decisions based on cold-hard quantitative data can provide you superior returns with lower risk. Click here to get your free trial now.

Disclosure:

I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my ...

more