Healthcare Industries Diverge

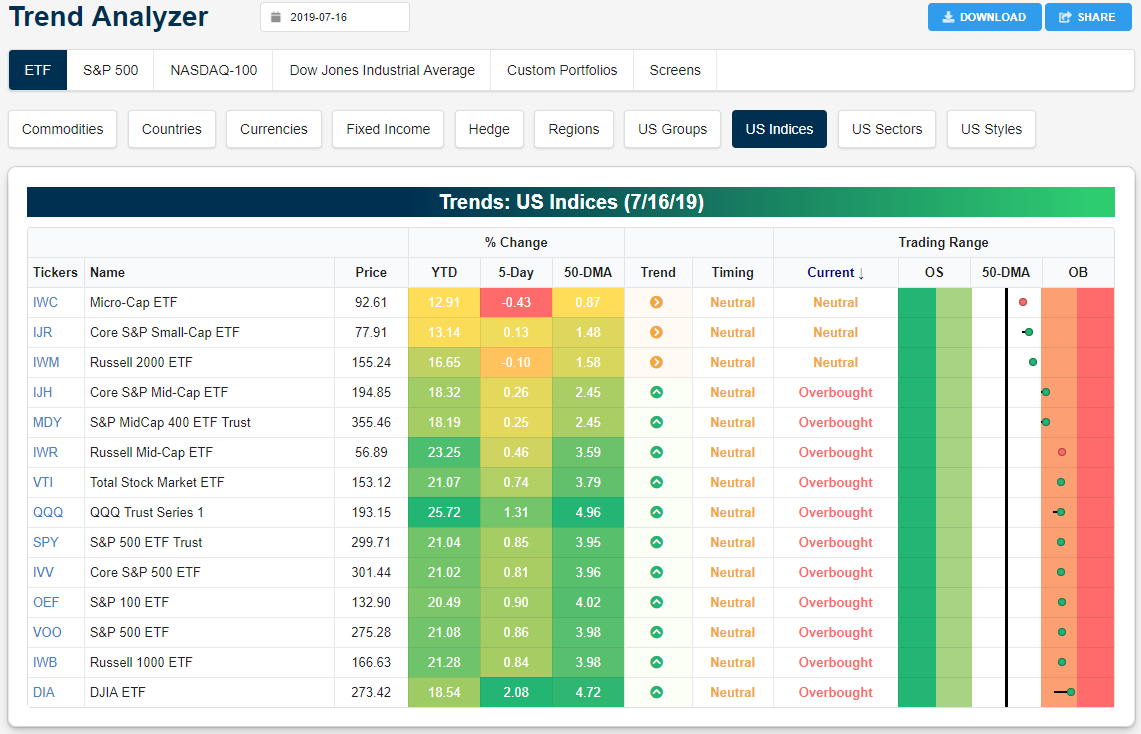

Yesterday’s session did little to create any major changes in the overbought and oversold levels of the major US index ETFs. As shown below, most of the major index ETFs have very small or no tails indicating little movement in respect to each ETF’s trading range over the past week. Large-cap indices continue to outperform small-caps with the Dow (DIA) having risen the most over the past five days.DIA has risen 2.08% while the Nasdaq (QQQ) has been the second-best performer rising 1.31%. With these changes, DIA and QQQ have both moved the most within their respective trading ranges in the past week.DIA, while still the most overbought, is actually in better shape than it was earlier in the week when it was sitting at extremely overbought levels. Meanwhile, the Micro-Cap ETF (IWC) and Russell 2000 (IWM) are both lower over the past few days. Alongside the Core S&P Small-Cap ETF (IJR), these ETFs are also the only ones to be neutral and in sideways trends.

(Click on image to enlarge)

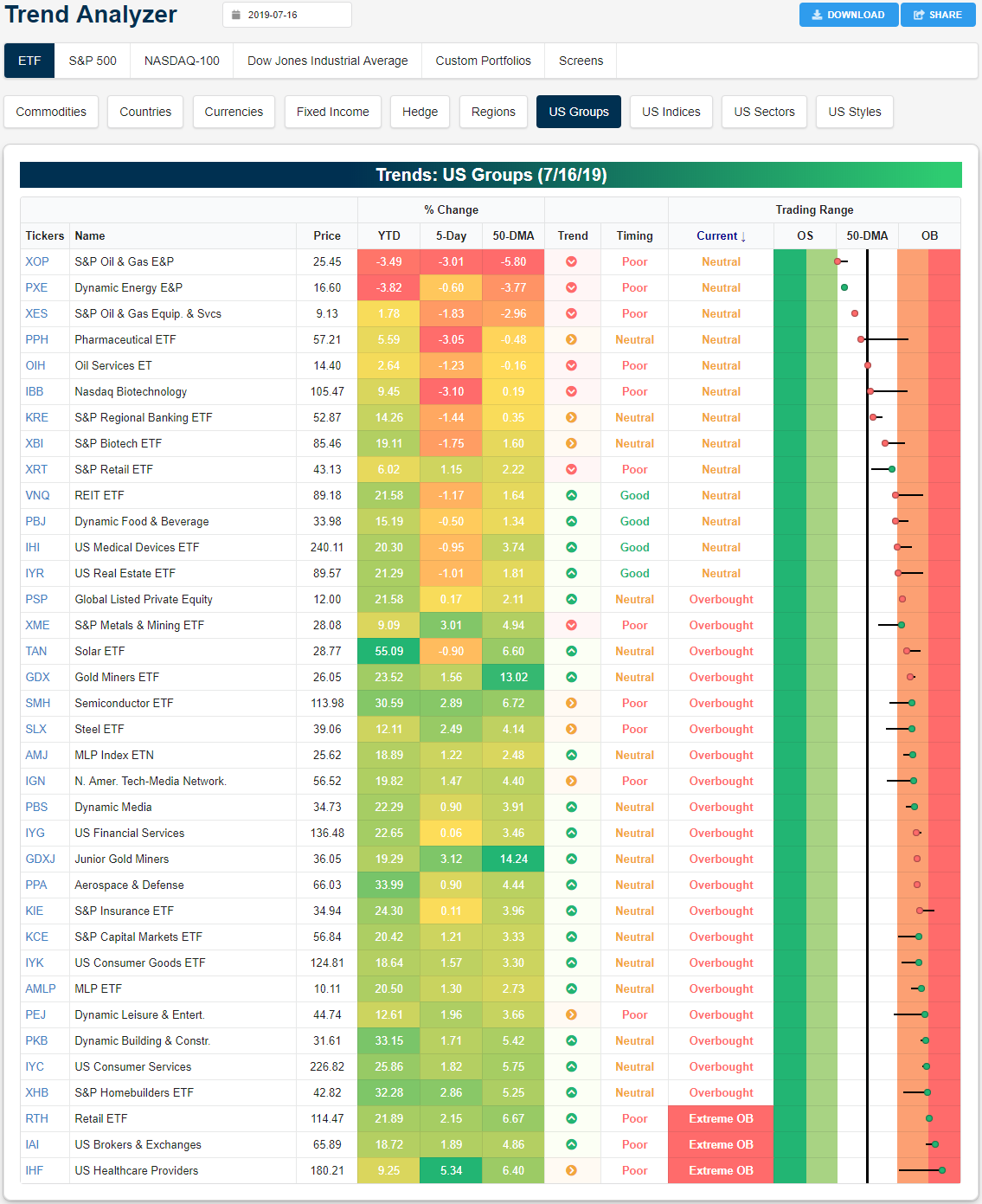

Looking at the various industry groups, there has been an interesting divergence between Healthcare industries over the past few weeks following headlines reporting the Trump administration’s proposal of reforms including an executive order pushing for more transparent pricing in late June. Pharmaceuticals (PPH) and Biotech (IBB) have been taking a beating so far in July after a jump to extremely overbought levels at the start of the month. In the past week, PPH and IBB have fallen 3.05% and 3.1%, respectively. These have been the two worst-performing industry ETFs in the past week and have rapidly pulled back to their 50-DMAs. Meanwhile, US Healthcare Providers (IHF) has been the best-performing industry ETF with a 5.34% gain, thanks to a large gap up last week on more headlines from the White House regarding a rebate plan. This has sent the ETF surging into extremely overbought territory. IHF is not alone at extreme levels though as the Retail ETF (RTH) and Brokers and Exchanges (IAI) also both sit at elevated levels.

(Click on image to enlarge)

Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much ...

more