Green Thumb's Q3 Financials Show Why It Is Up 108% YTD And Up 29% So Far In November

Green Thumb Industries Inc. (GTBIF), a constituent in the Pure-Play Pot Stock Index, is a leading national cannabis consumer packaged goods company and owner of Rise™ retail stores. It reported its financial results for the third quarter ended September 30, 2020, yesterday as follows:

Q3 Financial Highlights (All results are presented in USD and compared to the previous quarter.)

- Revenue: +31.3% to $157.1M

- Gross Margin: increased to 55.4% from 53.2%

- Net Profit (Loss): improved to $9.6M from $(12.9)M

- Net Profit (Loss)/Share: improved to $0.04 from $(0.06)

- Adj. EBITDA: increased 50.2% to $53.2M

- As a % of Revenue: increased to 33.9% from 29.6%

- SG&A: increased marginally to $49.7

- As a % of Revenue: declined to 31.7% from 41.5%

- Cash on hand: $78.1M

Q3 Operational Highlights

- Grew gross branded product sales 32.6% with its family of consumer brands now produced, distributed, and available in 48 retail locations in 11 states with quarter-over-quarter comparable sales up 17.9% based on the 42 stores that were open for at least 12 months.

- Increased retail revenue sequentially by 27.9% quarter-over-quarter, primarily driven by increased foot traffic in established stores.

- Completed the initial phase of construction of its manufacturing facility in Oglesby, Illinois, and began producing and distributing its brand portfolio from that facility during the third quarter.

- Added branded-product production and distribution capabilities to two new markets, New Jersey and Ohio.

- Announced the launched a cannabis business incubator intended to help promote opportunity and success for new social equity entrepreneurs in Illinois.

- Partnered with the Last Prisoner Project (a coalition of cannabis industry leaders, executives, and artists dedicated to bringing restorative justice to the cannabis industry) on an integrated marketing campaign, including a short documentary (“Waiting to Breathe”) to raise awareness and funds for the project.

Management Commentary

Ben Kovler, founder and CEO said:

- “This was an excellent quarter as we:

- delivered substantial revenue growth,

- expanded gross margins,

- expanded EBITDA margins quarter-over-quarter and

- delivered positive net income for the first time.

- We remain:

- focused on distributing our consumer brands at scale and delivering superior consumer experiences while giving back to our communities,

- bullish on our strategic position and the long-term prospects of our business,

- focused on providing the flexibility to capitalize on the growth opportunities ahead, and

- laser-focused on delivering shareholder value in everything we do.”

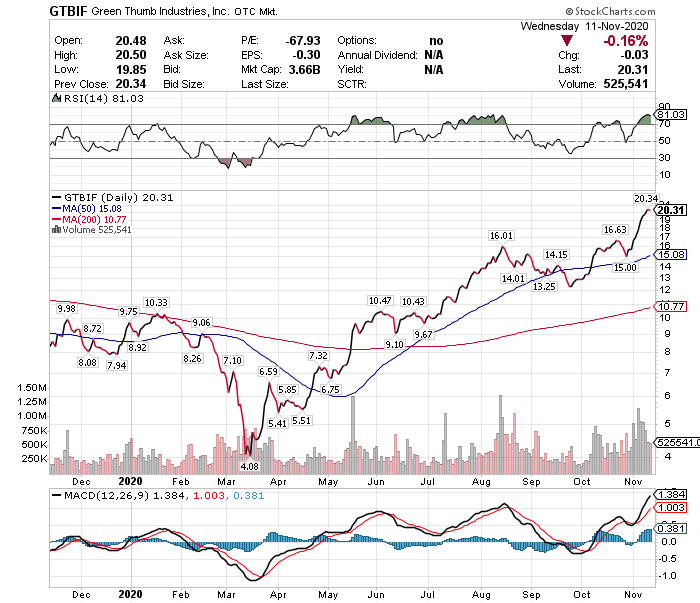

Stock Performance

Green Thumb is one of the 13 pot stocks in the munKNEE Pot Stock Index of 25 pure-play constituents that is UP in price YTD (+108.3%). The positive trend continues with an increase in its stock price of 56.7% since the end of September and 29.0% so far in the month of November.

If you found the above analysis of interest check out the other recent analyses of Canopy, Tilray, Aurora, Cronos, and Aphria.

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more