Gold: Don't Look For Higher Interest Rates Anytime Soon

Fundamentals

Equity Management Academy CEO, Patrick MontesDeOca, said, “One of the key issues we are dealing with right now is inflation, as the economy is showing tremendous resilience and much more demand than was expected.”

We continue to face supply shortages across the board, although some supplies are beginning to flow somewhat better.

Government stimulus continues to be extremely high, and there continue to be demands for stimulus with the debt ceiling close to $30 trillion.

“The bubble appears to be getting bigger”, MontesDeOca said.

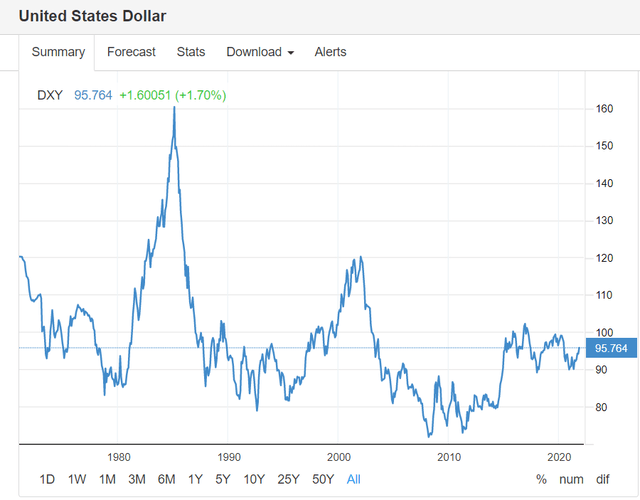

The dollar is down about 30% as a result of all the stimulus, while real estate and other hard assets are way up--albeit in dollars that are now worth much less. The dollar is artificially high at the moment because it is based on the perception that interest rates will go up.

“I do not believe that higher interest rates are coming anytime soon”, MontesDeOca said. Any increase in interest rates would devastate the economy, by sending defaults rippling throughout the national and global economy. “Interest rates cannot go up in the face of this tremendous debt.”

We appear to be heading into a stronger economy and an adjustment in prices. It all appears to be bullish for gold, silver and Bitcoin. We have strong metals markets. If you came into today long in gold futures, we recommend taking profits off the table short term. If you are long in gold derivatives, then hold onto them. Gold mining shares are up 1.78% on GDX.

“We are positioned in long in gold, silver and Bitcoin in anticipation of much, much higher prices,” MontesDeOca said.

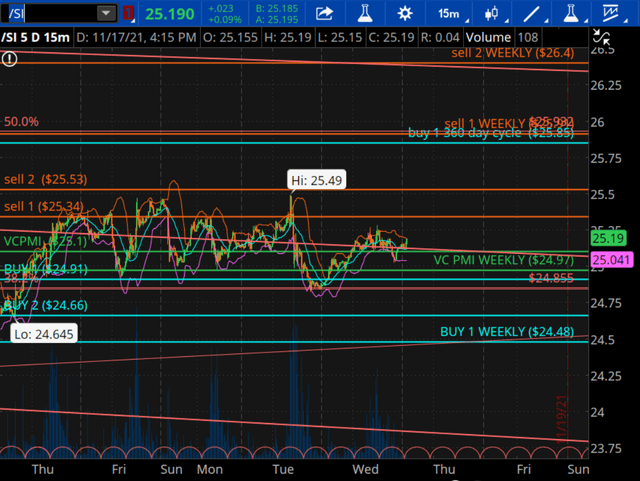

Silver

Source: ema2trade.com

In precious metals futures, we are changing from a bearish price momentum as silver moves up through $24.95--the average price. The target now is $27.87. We are seeing confirmation that you want to be long derivatives of the metals markets.

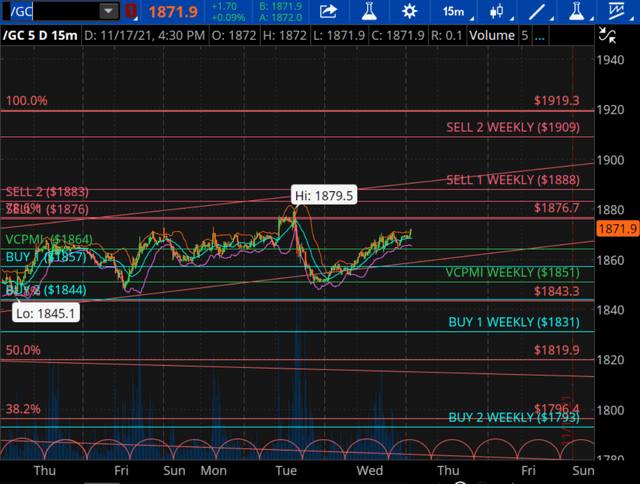

Gold

Source: ema2trade.com

If you are long gold, a close below $1852 should be your protective level, which would activate a monthly short trigger, according to the Variable Changing Price Momentum Indicator (VC PMI). It appears that we are close to a breakout with the target of $2003.

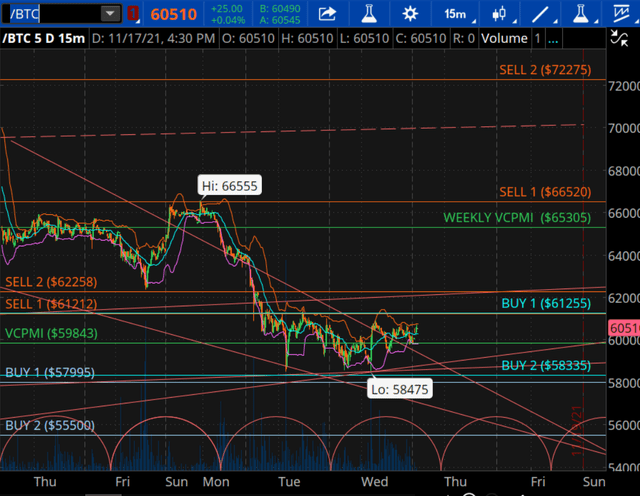

Bitcoin

Source: ema2trade.com

Bitcoin is at $59,645 and has activated weekly and daily buy triggers. The Buy 2 weekly level is $58,335. The daily Buy 1 level is $57,995. So we reverted from those levels, where buyers came into the market and the price rallied. We have a bit of a bearish daily signal, but we are within a weekly level of support between $61,255 and the weekly average of $58,335. If Bitcoin goes through $61,255, we will have daily and weekly bullish signals--a very strong signal with $65,305 as weekly target. At that point, we will add to our position in Bitcoin.

Disclosure: I/we have a beneficial long position in the shares of GDX either through stock ownership, options, or other derivatives.

To learn more about how the VC PMI works and receive ...

more