Globant Stock Is Positioned For Attractive Returns

Globant (GLOB) is an IT services company with a broad global reach across different countries and verticals. The stock can be volatile in the short term, but the business fundamentals are clearly evolving well, and the stock is reasonably valued at current prices. Overall, the risk and reward equation in Globant stock looks quite compelling over the long term.

Growing At Full Speed

Globant is focused on providing digital transformation services, an area with plenty of opportunities for growth over the long term. According to estimates from IDC, direct digital transformation investment spending will be $5.5 trillion over the years 2018 to 2021.

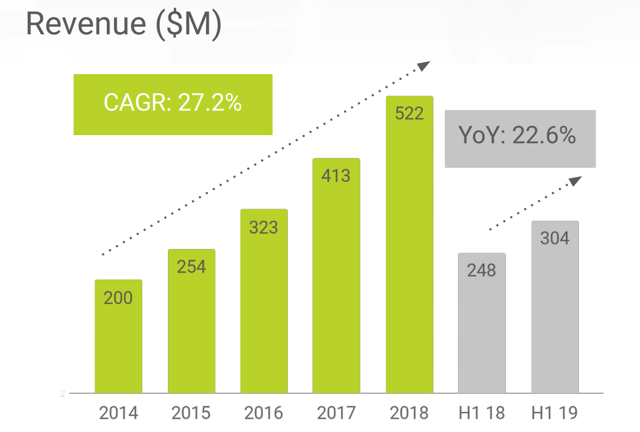

The company has delivered revenue growth above 27% per year from 2014 to 2018. Even as the business matures over time, revenue growth remains comfortably above 20% in recent quarters.

(Click on image to enlarge)

Source: Globant

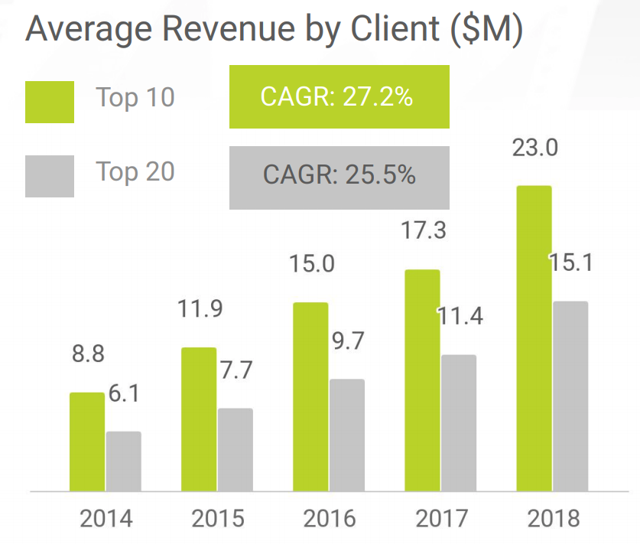

The company is not only gaining new clients but also increasing revenue per client, which reflects well on Globant's customer proposition and its ability to consistently create value for those customers.

(Click on image to enlarge)

Source: Globant.

In the past twelve months, the company reached 12 accounts above $10 million in annual revenues compared to nine for the same period last year. Globant, currently, has 97 accounts with more than $1 million in annual revenues versus 92 one year ago.

The company has a strong presence across different industry verticals, its top three industry verticals for the most recent quarter were media and entertainment with 23.1% of revenues, banks, financial services, and insurance with 21.6% of revenues, and travel and hospitality with 15.2% of revenues.

Globant is also growing rapidly in other verticals, such as consumer retail and manufacturing, and professional services, with increases of more than 60% and 30% year-over-year respectively, compared to the second quarter of 2018. This is indicating that the company understands how to successfully adapt its approach and technologies to different industries in order to fit customer needs.

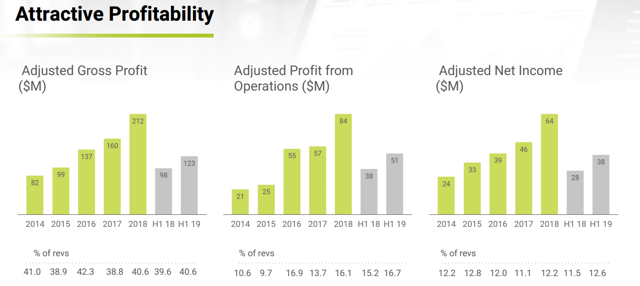

Globant is in rapid growth mode, so profit margins can be volatile and hard to predict from quarter to quarter. However, management is doing a sound job in terms of financial discipline and profitability is moving in the right direction over time.

(Click on image to enlarge)

Source: Globant

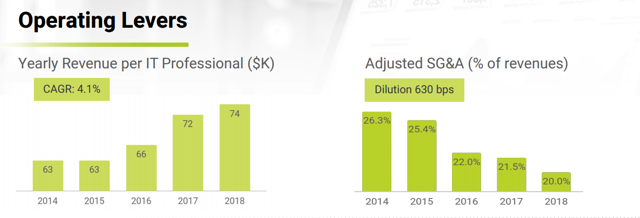

The company is consistently making more money per employee while also spreading SG&A costs on a growing revenue base. This trend should allow profit margins to continue expanding over time.

(Click on image to enlarge)

Source: Globant

Reasonable Valuation

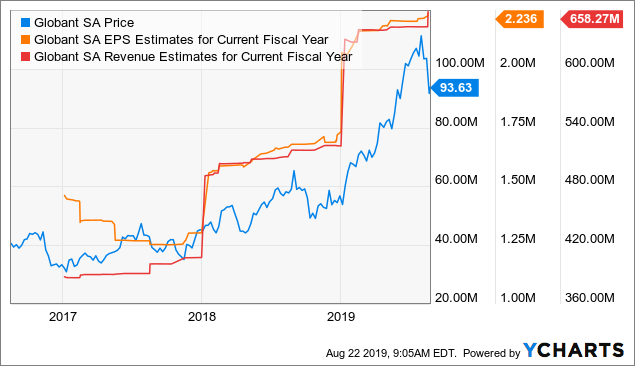

Wall Street analysts are on average expecting Globant to make $658.3 million in revenue during 2019 and $806.5 million in 2020. Under these assumptions, the stock is trading at price to sales ratios of 5.2 and 4.2 for the current year and next year respectively. This is a very reasonable valuation for a business that can sustain revenue growth rates well above 20% year over year.

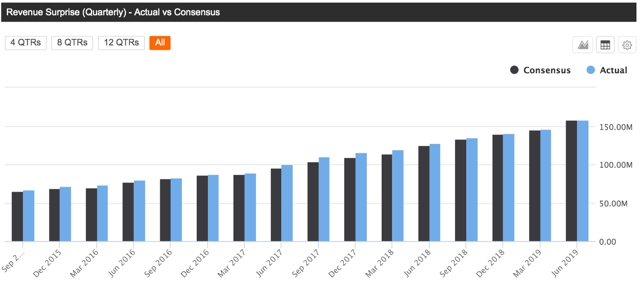

It is important to keep in mind that forward-looking valuation is a dynamic as opposed to a static concept. Globant has a healthy habit of consistently delivering revenue numbers above expectations, the chart below shows how the company has consistently exceeded revenue forecasts in each and every quarter since the third quarter of 2015.

(Click on image to enlarge)

Source: Seeking Alpha Essential

The chart below shows how earnings and sales estimates for Global in the current year have significantly increased over time. If the valuation is going to remain constant, rising sales and earnings expectations should push the stock price higher too.

(Click on image to enlarge)

Data by YCharts

Past performance is no guarantee of future returns. However, winners tend to keep on winning, and companies that consistently deliver earnings numbers above expectations tend to continue doing so in the future more often than not.

This is an important consideration when analyzing valuation. A company with strong financial performance and accelerating momentum obviously deserves a higher valuation than a business producing mediocre financial performance and weakening momentum.

But sometimes it can be challenging to incorporate the multiple factors into the analysis in order to see the complete picture from a quantitative perspective. In that spirit, the PowerFactors system is a quantitative algorithm that ranks companies in a particular universe according to a combination of factors, including financial quality, valuation, fundamental momentum, and relative strength.

In simple terms, the PowerFactors system is looking to buy good businesses (quality) for a reasonable price (valuation) when the company is doing well (fundamental momentum) and the stock is outperforming (relative strength).

(Click on image to enlarge)

Data from S&P Global via Portfolio123

The backtested performance numbers show that companies with high PowerFactors rankings tend to deliver superior returns over the long term, and this has bullish implications for Globant stock.

Globant has a PowerFactors ranking of 95 as of the time of this writing, meaning that the stock is in the top 5% of companies in the US stock market based on financial quality, valuation, fundamental momentum, and relative strength combined. In other words, valuation levels are compelling when analyzed in the context of other quantitative return drivers.

Moving Forward

Since Global was founded in Argentina, the economic crisis in such a country could create some volatility around the stock price. This uncertainty can probably explain to some degree why the stock has pulled back by 18% from its highs of the year over recent days.

(Click on image to enlarge)

Source: Think or Swim

However, the impact on business fundamentals is not much of a reason for concern. Nearly 75.2% of the company's revenues come from North America, with the US as its top country. During the second quarter of 2019, 88.7% of Globant's revenues were denominated in US dollars, protecting the company's revenue from currency fluctuations in Argentina.

Interestingly, nearly 30% of Globant's headcount is currently located in Argentina, so a currency devaluation could actually have positive implications for the business, as profit margins could be benefited by cheaper labor costs when expressed in US dollars.

From that perspective, the stock remains in a strong uptrend over the long term, and the recent pullback could provide an attractive entry point for investors.

Globant operates in a very dynamic industry, and the company faces tough competition from big players with plenty of resources. But management has proven its ability to consistently deliver solid performance while fending off the competition over the years.

At current prices, the stock is reasonably valued for such a high growth business that is consistently surpassing expectations. If management keeps executing well and leading the company in the right direction, Globant stock could deliver attractive returns for investors.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in GLOB over the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my ...

more