Global Payments Inc.: 17% Growth At A Reasonable Price

Global Payments Inc (GPN)

Renowned investor Peter Lynch gave us a formula that when a stock’s P/E ratio was equal to its earnings growth rate it was fairly priced. However, it is important to recognize that Peter Lynch was a growth investor and that he was looking for significantly above-average growth. In the same context, I consider the P/E ratio equal to earnings growth rate a very relevant formula for valuing stocks to grow at 15% a year or better. When you can identify a fast-growing company selling at a P/E ratio below its growth rate, you’ve identified what is often referred to as a GARP or growth at a reasonable price opportunity.

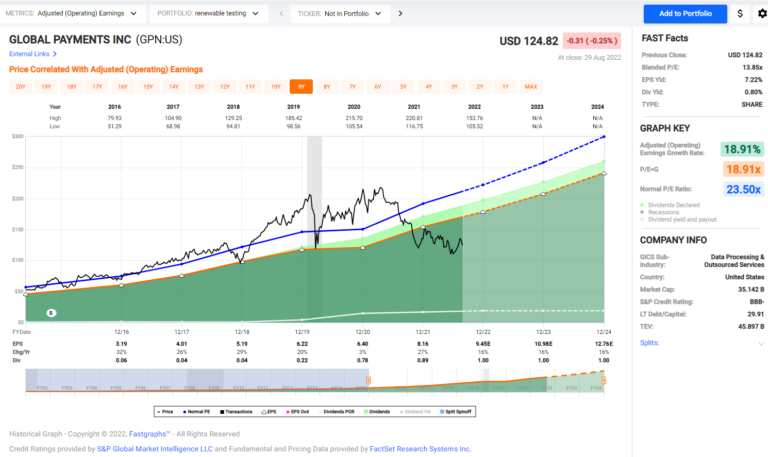

Global Payments Inc. is a leading payment processing company in the data processing and outsourced services sub-industry sector. The company’s historical earnings growth rate has averaged just under 18% and the company can be bought at a blended P/E ratio of 13.85. Thus, by definition, defines Global Payments Inc. as a growth stock at a reasonable price. In this analyze-out-loud video, Mr. Valuation will go through the important metrics on this fast-growing payment processor by the numbers.

(Click on image to enlarge)

Global Payments FAST Graph

Video Length: 00:17:16

More By This Author:

These Stocks Are Set To Double In?

Magna International Inc. Stock Analysis By The Numbers

Comcast Is A High-Quality Dividend Growth Stock On Sale

Disclosure: Long GPN at the time of writing.

Disclaimer: The opinions in this article are for informational and educational purposes only and should not be construed as a recommendation to buy or ...

more