Zinc: Back On Track After A Turbulent Year Of Mine Supply

After a turbulent year of zinc mine supply, the market is set to return to growth but this is unlikely to happen until after the first quarter. Macro tailwinds remain supportive to prices. However, the velocity of credit expansion and tighter borrowing criteria in the property market remain a concern for the pace of China's demand growth.

Source: Shutterstock

Concentrate market is key, and the tightness could continue into 1Q21

- Zinc increased to a two-year high amid macro tailwinds and tightness in the concentrate market. As we have discussed before, zinc mine supply has been hardest hit by Covid-19 related disruptions, particularly from Peru earlier this year.

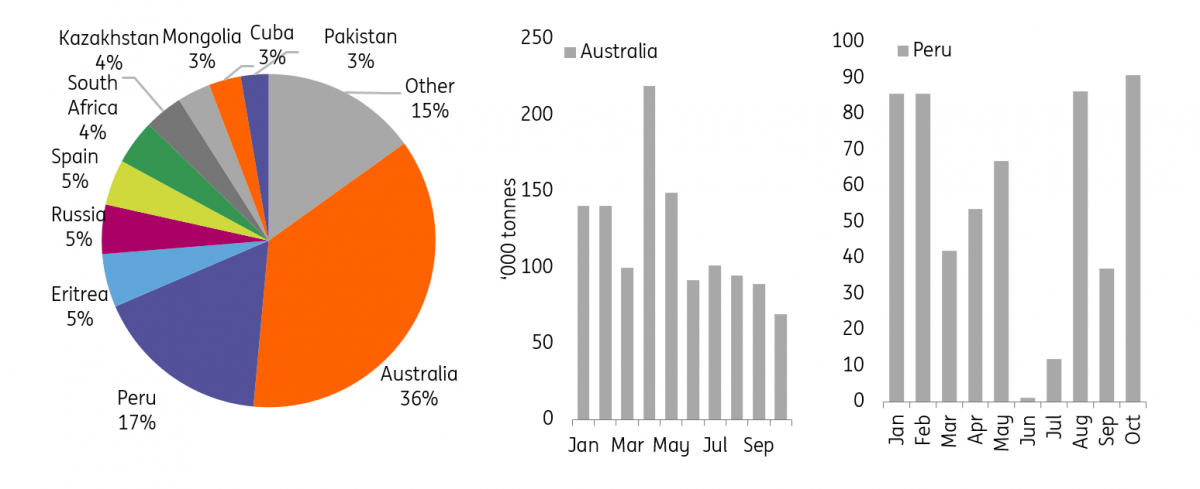

- Australia, the top supplier of zinc concentrate to China, was able to divert more concentrate to China earlier this year (Fig. 1), partially offsetting the losses caused by disruptions in Peru. Since 3Q20, Peruvian zinc mine production appeared to be back on track (Fig. 2) though shipments to China have fluctuated in recent months. Chinese zinc mine supply improved over the summer, with spot treatment charges seeing a moderate recovery.

Fig 1.China zinc concentrate imports by country

Source: China Customs, ING

Fig 2. Peruvian zinc mine production

Source: MINEM, ING

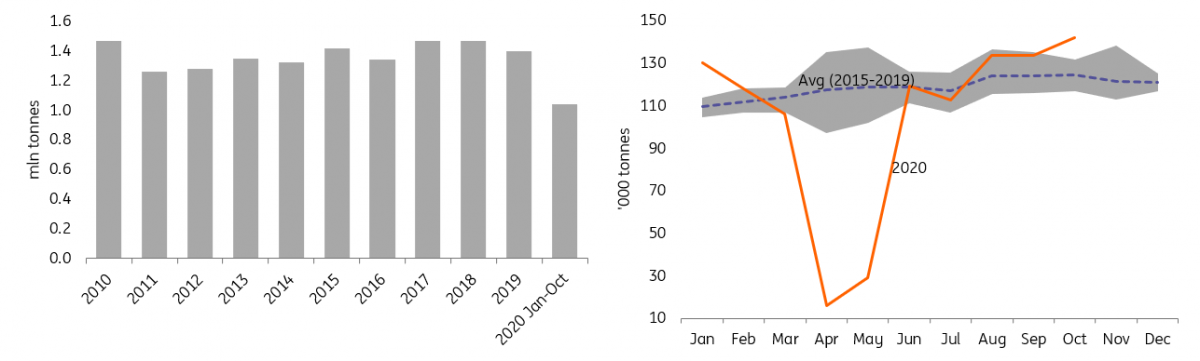

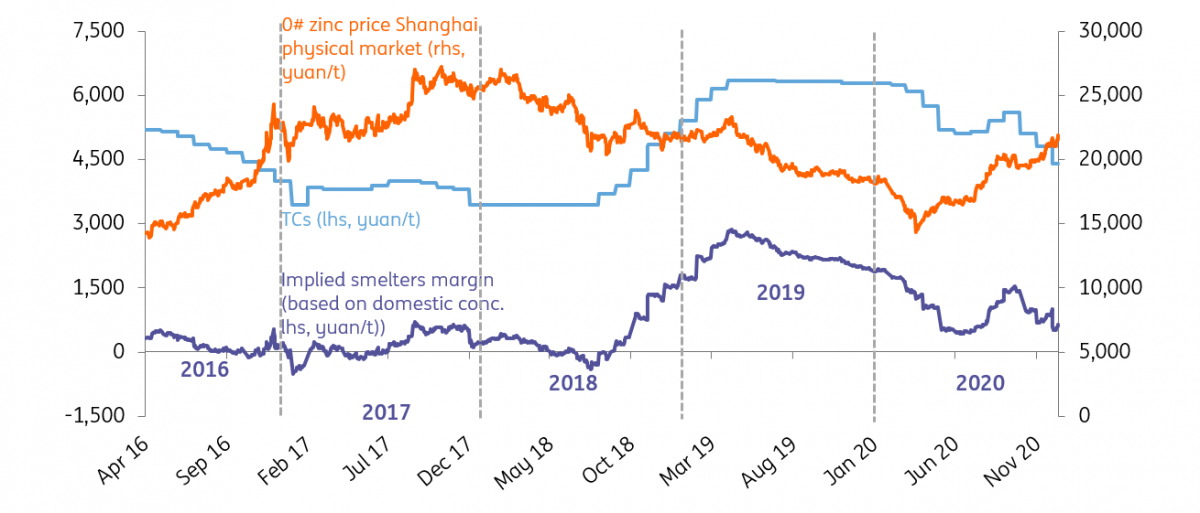

- This didn’t last into the fourth quarter as expectations over smelters' winter restocking activities further exacerbated the tightness in the concentrate market, which was also fuelled by a mine accident at Vedanta’s Gamsberg mine in South Africa on 18 November. The spot TCs (import market) have fallen to around US$80/tonne compared to US$310/t at the beginning of the year, down by 74% year-to-date. Meanwhile, following reports on seasonal suspensions at several domestic mines in Northern China, the TCs for the Chinese home-produced concentrate have also come under continued pressure. Falling TCs have been weighing on smelters’ margins (Fig. 3), though historically the current implied margins (based on domestic concentrate) are still better than we saw back in 2016/17 partly due to relatively higher by-product revenue.

- Looking ahead, we expect the concentrate market tightness to continue into the first quarter and should improve towards the second half of the year. For the full year, we currently expect a moderate surplus (90kt) in the concentrate market balance. This is based on estimates that there will be net growth of 450kt zinc mine supply next year through mining expansions/new projects. However, we also assume that Gamsberg could return to operation somewhere in 1Q21 and that mines in South America continue to recover.

Fig 3. Treatment charges vs smelter margins (indication)

Source: Antaike, ING

Refined market in surplus, strong demand recovery from China

- In 2020, world production of refined zinc and zinc alloys together will increase only mildly, by 0.7% YoY to just below 14mln tonnes as a result of more robust growth from China offsetting a moderate decline from elsewhere. Chinese zinc production, representing around half of the total world supply, is expected to grow by 2.7% YoY to 6.3mln tonnes this year, based on Antaike data.

- It's a similar picture on the demand side. We expect China's zinc demand to rise by 1.5% YoY with a sharp decline in demand of more than 6% from the ex-China market; hence the net effect will be only 0.8% YoY growth in zinc demand globally this year.

- Galvanizing demand, zinc's major primary usage, has been the key to driving zinc usage, benefiting from the nation's automotive and infrastructure projects as well as strong exports of home appliances. Comparatively speaking, the alloy sector's performance has been rather dull, with partial ingot demand displaced by imported slags (2020 first 10 months 162kt vs. 2019 total 58kt). It is not yet clear whether imports of such material (mainly dross as we suspect) will continue to grow at the current pace but should the trend hold into next year, that is a bearish sign for ingot demand going forward.

Fig 3. Market balance: zinc concentrate and refined zinc (kt)

Source: ILZSG, Antaike, ING

Macro tailwinds concentrate tightness, but short-term demand set to enter a seasonal lull…

- A strong run in recent zinc prices (+24% since the beginning of 4Q20; over 27% year-to-date) has been driven by macro tailwinds along with a strong steel market in China. Construction activity has been extended from certain regions in China during winter, which has continued to drive consumption in the galvanized sector compared to its traditional weaker seasonal pattern. Zinc (along with nickel) has also been carried along by the bullishness in the steel market mainly as these two metals are largely exposed to the steel industry (galvanized/stainless) which are used in construction.

- In zinc, concentrate tightness and the above-mentioned stronger demand, together with strong exports in zinc downstream products, have supported the market during the recent bull run. However, there are headwinds as we move into 1Q21 should refined inventory start to build. In fact, higher zinc prices are flagging risks of demand substitution from stainless steel or aluminium, for example.

- The refined zinc inventory in China's market follows a seasonal pattern, and the level is currently low. We think that the recent strong momentum in downstream demand is critical in preventing a quicker build-up of inventories, but in our view, this is unlikely to last long. The historic pattern would suggest that inventories start to rise ahead of the lunar New Year Holidays (February 12). In the medium term, zinc demand will see a moderate recovery in ex-China markets as some leading indicators, such as the US construction sector, are sending positive signals. But we don’t expect the absolute volumes to return to pre-Covid levels until 2023 at the earliest. We expect China's real demand to remain stable next year, but ‘three red lines’ in the property market (caps on debt-to-cash, debt-to-assets, and debt-to-equity ratios for developers who want to borrow more) and the velocity of credit expansion will likely weigh on sentiment. Some headwinds towards the second half of next year in conjunction with the concentrate market improvement (est. 2H21) may weigh on prices.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more