Xpeng Inc: The Tesla Challenger From China

Dealing with new companies on the stock market is a particularly thrilling endeavor. Next to the non-existent stock information, there is often also little information on the company's financials, as disclosure requirements are often not requested from private companies, depending on the respective legislative environment. Of course, that impairs our ability to make sound assessments on the company's stock development, but it can also bear massive winning potential. One of those newbies on the stock market is Xpeng Inc. (XPEV), or Xiaopeng Motors. The Chinese electric vehicle manufacturer, founded in 2014, went public in August 2020, raising about $1.5 billion through its IPO. After a stable stock price development in its first two months, the stock price literally skyrocketed in November, increasing over 270% in 3 weeks. Since then, the price has halved again, raising questions about the true value of the company.

Photo by Erik Witsoe on Unsplash

Since the electric vehicle market is a very forward-looking sector, which almost everyone ascribes a bright future too, it is worth having a closer look at Xpeng. Some already argue that Xpeng is somewhat "the next Tesla" because of its recent stock price surge and because its cars are very futuristic. Currently, the Chinese carmaker offers two models: the G3 and P7. The G3 is Xpeng's so-called "smart SUV" and retails just above $30.000 after subsidies for its most exclusive version with a total range of 520km. Its basic model is available already for around $22.000. This price tag alone is a competitive advantage to other electric SUVs and does not fall short on the technical side, either. However, Xpeng's ace is its P7 sedan, a highly advanced autonomous driving software. Within the first 25 days of implementing its newest version in January 2021, P7s have driven over accumulated 1 million kilometers autonomously across China – without accident! That alone speaks for the innovative power of this company. After hearing about that number, the advanced voice control system, battery safety standard (surviving 17 tests), and driving range of over 700km do not come by surprise. Between $35.000 - $54.000 retail price (after subsidies) depending on the model, the luxury sedan does not only compete at the top of the technical field but also in the pricing field.

Although there are currently only two models, it becomes clear that the products adhere to the highest standards of car manufacturing. Additionally, the company shows clear signs of healthy growth. In January 2021, Xpeng once again broke its car delivery record for the third time in three consecutive months, delivering over 6.000, which is an approximately 470% increase on a year-over-year basis. For the third quarter of 2020, the company's revenues were about an impressive $290 million, which is an increase of over 340% compared to Q3 2019. It is predicted that the company's earnings are to grow by an average of 54.5% over the next couple of years.

Further, the company has begun shipping to Norway in December 2020, which accelerated its plan to expand to Europe – a growing EV market. It remains to be seen what the Q4 results, which are going to be released on 8 March 2021, are going to show. Still, it strongly appears as if the company is very well positioned to become a significant player in this market, which is currently wholly dominated by Tesla. Although other carmakers also expand their EV product portfolios, Xpeng is one of the few car manufacturers that exclusively produce electric cars. With a 40% increase in research and development personnel since June 2020, the company is also eager to lead the field in technological advancement, which adds to the company's value.

However, after all these great outlooks, there are also some challenges for Xpeng in the coming years. Luckily, these challenges do not come from inside of the company but are preferably external threats. As there is strict government control in China, Chinese firms are always subject to potentially harmful measures, probes, and investigations. We have recently witnessed the crackdown on Alibaba and its subsidiary Ant Group, after its founder, Jack Ma, openly criticized the Chinese government. The conglomerate was immediately subject to an antitrust probe, which caused the stock price to deteriorate. Accordingly, Chinese firms are highly dependent on their government's benevolence. Suppose the company is supported and the government takes more considerable stakes in the firm, which is likely, due to Xpeng's strategic importance. In that case, it can also turn out to be great security for investors.

Moreover, because Xpeng's shares are listed on the New York Stock Exchange, the company can also potentially be a victim of political differences between the USA and China. In the past, the American government hinted that some Chinese companies might be delisted from the American stock markets. These kinds of measures can be used to exert pressure on China while harming the investors.

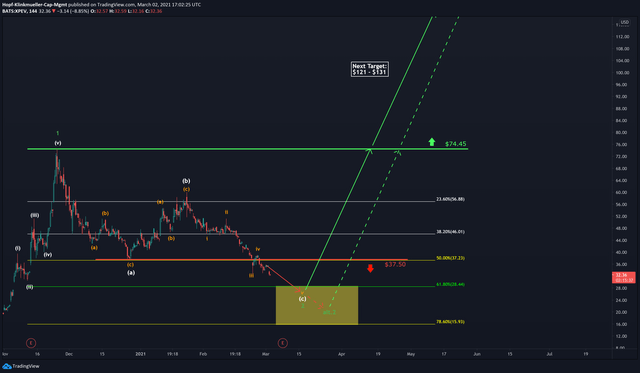

Despite the political risks the company might face, we strongly believe that the company is a great growth candidate. Next to the excellent position based on the fundamental data outlined above, there are also first significant signals from a wave-analytical perspective. During the surge in November, we were able to identify a 5-step impulse that drove the stock price to its peak at $74.45. After that, the curve sloped downward, and we expect the price to turn around just before it hits its support line at $19.22. So far, the curve follows a very clear pattern that would support such a turnaround. Moreover, the earnings release is approaching, and we believe that this might trigger the price to surge again and start to build new all-time highs in the course of wave 3 in green.

XPeng 144min Chart

Though being in a fragile political environment, the Xpeng stock looks pretty good from our perspective. Its innovative approach, which makes it already one of the leading companies in autonomous driving, its generally high-quality vehicles, corporate strategy, and futuristic alone are good indicators for future growth. Supported with our chart analysis, we can also support its growth outlook from the technical side. Overall, we might face a super-bullish stock here, which could genuinely resemble Tesla – and not only on the road!