World Markets: Eyeing Corrective Pullbacks In DAX, FTSE & Others

EUROPE/AMERICAS

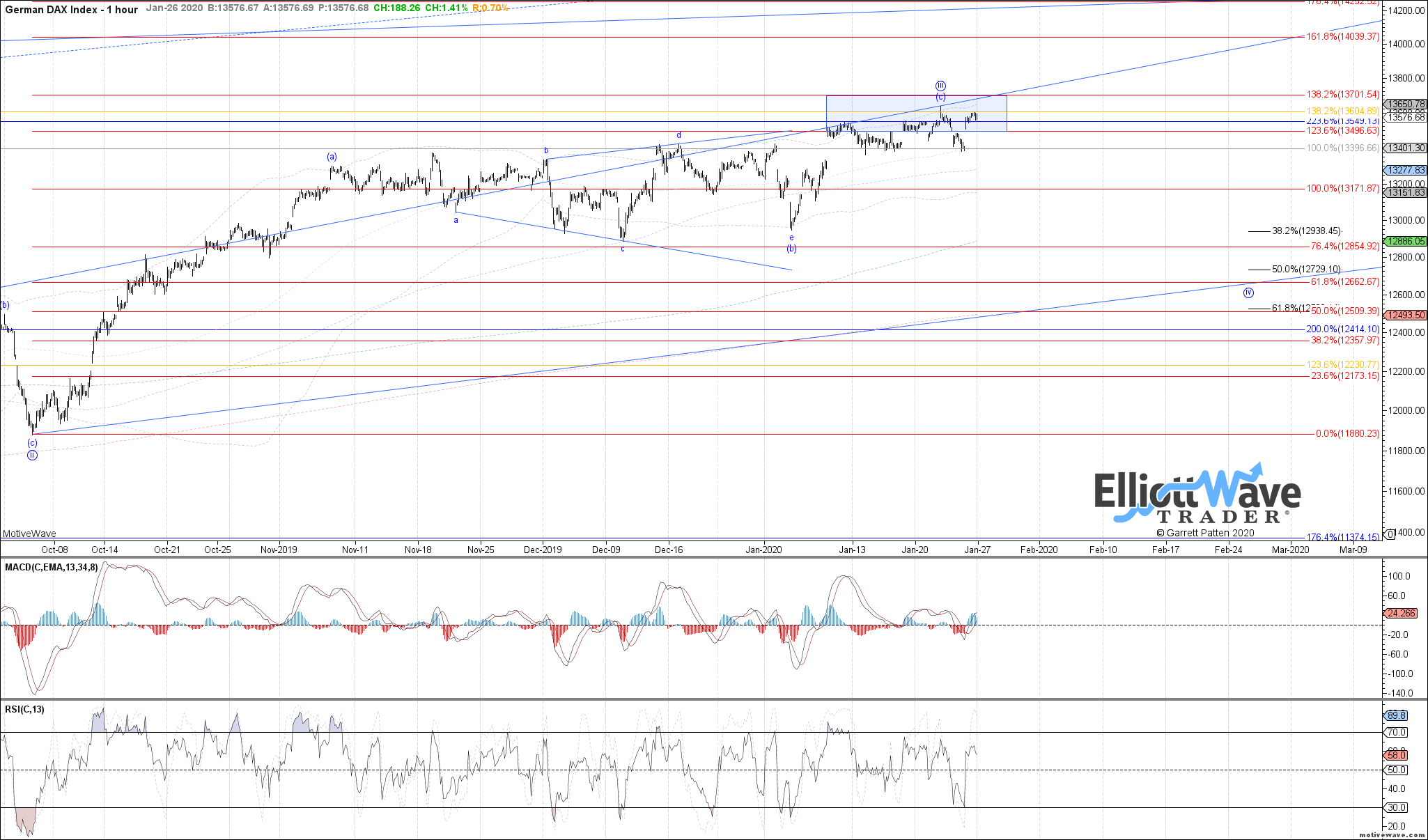

DAX: The DAX traded initially higher last week, pushing further into the target region for wave (c) of iii but still shy of reaching the next fib resistance at 13700. With last week’s high, it looks like a more complete 5 waves up as wave (c) of iii, but we still need to see price break below the 13360 signal support to suggest that a local top has been struck and price is beginning a corrective pullback as wave iv of C with 12660 as the ideal target below.

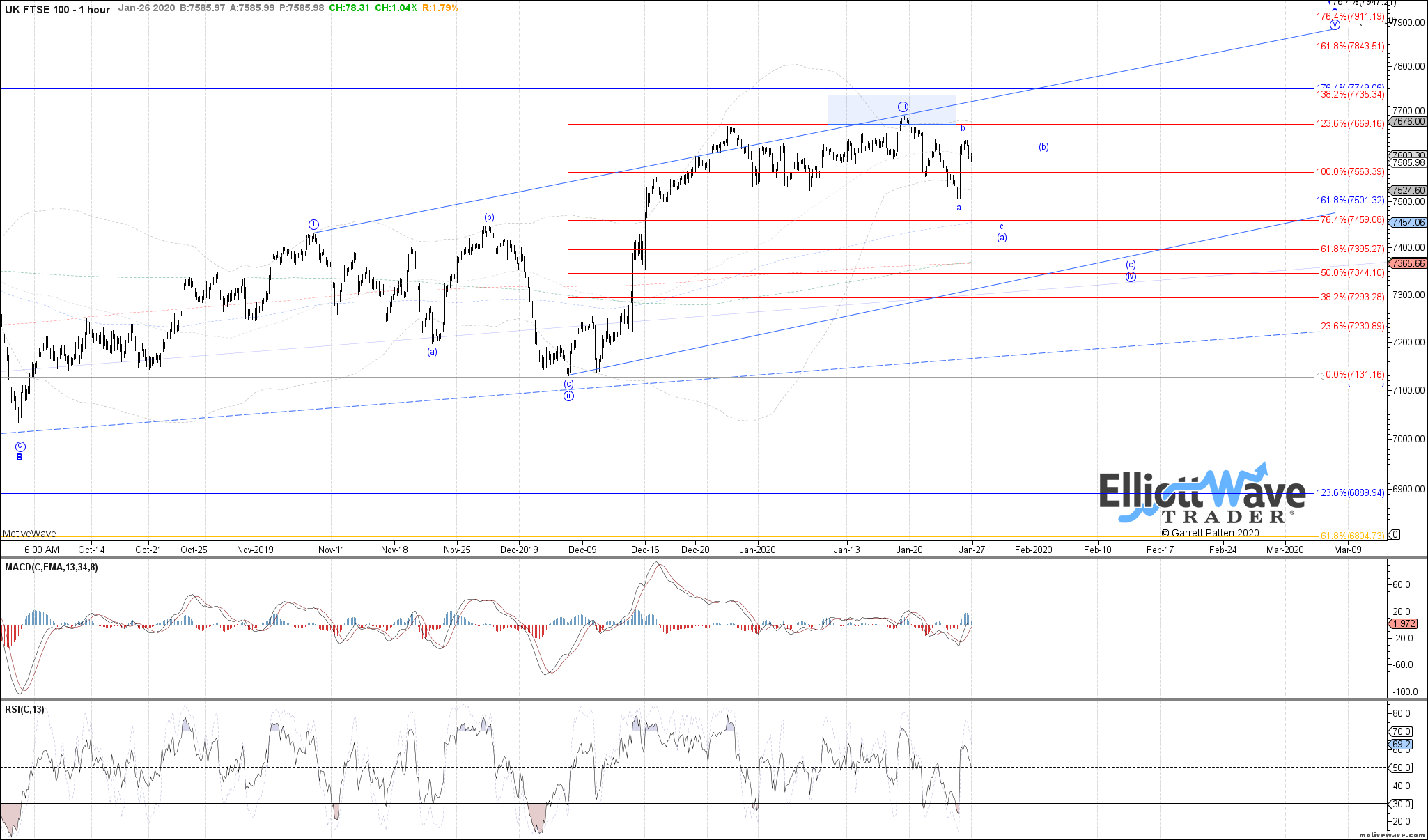

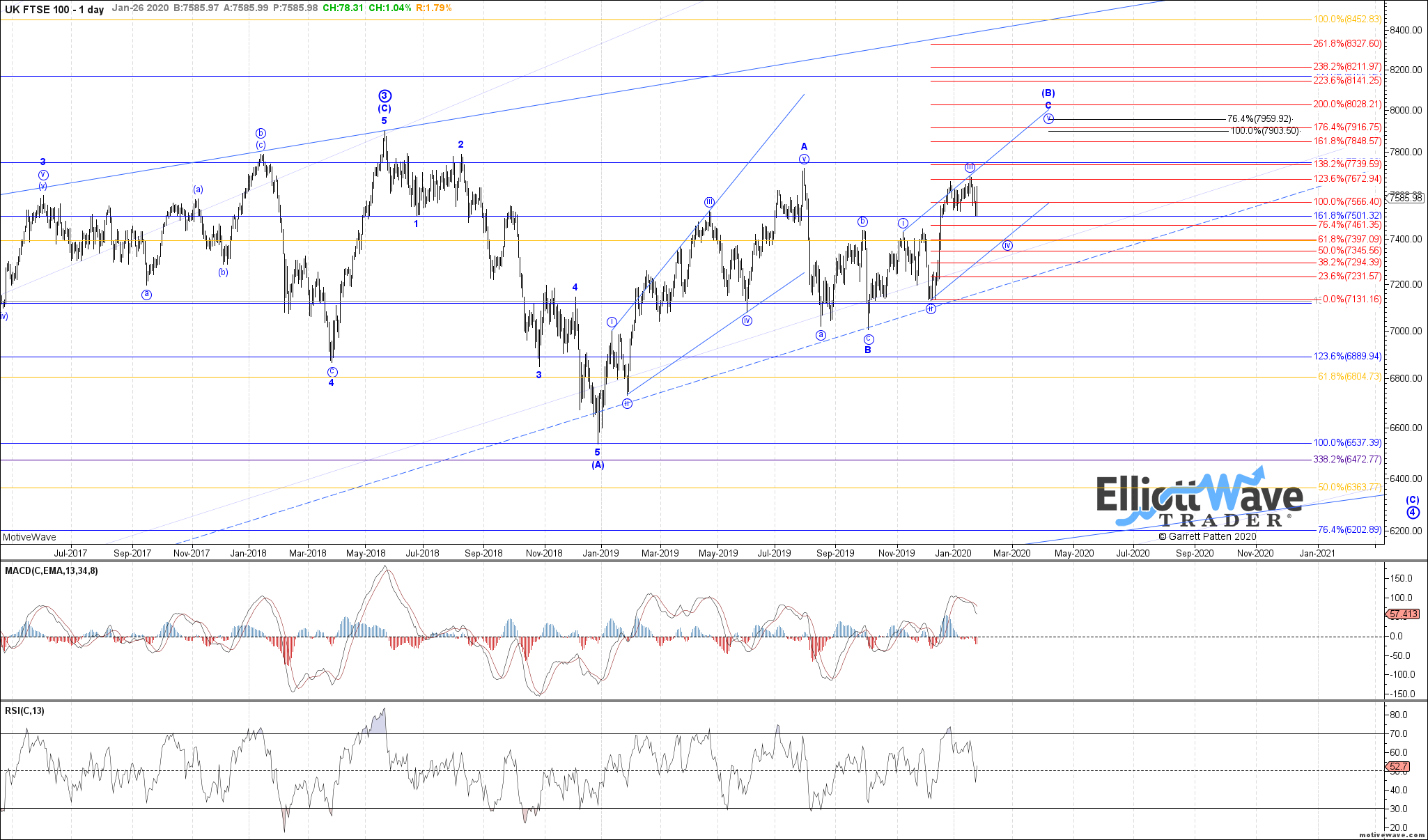

FTSE: The FTSE rolled over last week, poking below the 7525 signal support to suggest that a top may be in place as wave iii of the ending diagonal C-wave off the Oct low. If so, then last week’s low should have completed wave a of (a), with Friday’s bounce filling out wave b of (a). Therefore, continuing initially lower this week as wave c of (a) would be the ideal outcome as price fills out a corrective wave iv pullback.

STOXX: The STOXX also rolled over last week, poking below the 3745 to suggest a possible top struck as wave (iii) of the ending diagonal c-wave off the August low here as well. If that is the case, then last week’s low should have completed wave A of a, with Friday’s bounce filling out a corrective bounce as wave B of a. Therefore, continuing initially lower this week as wave C of a is the preferred outcome, as price begins to fill out a corrective wave (iv) pullback.

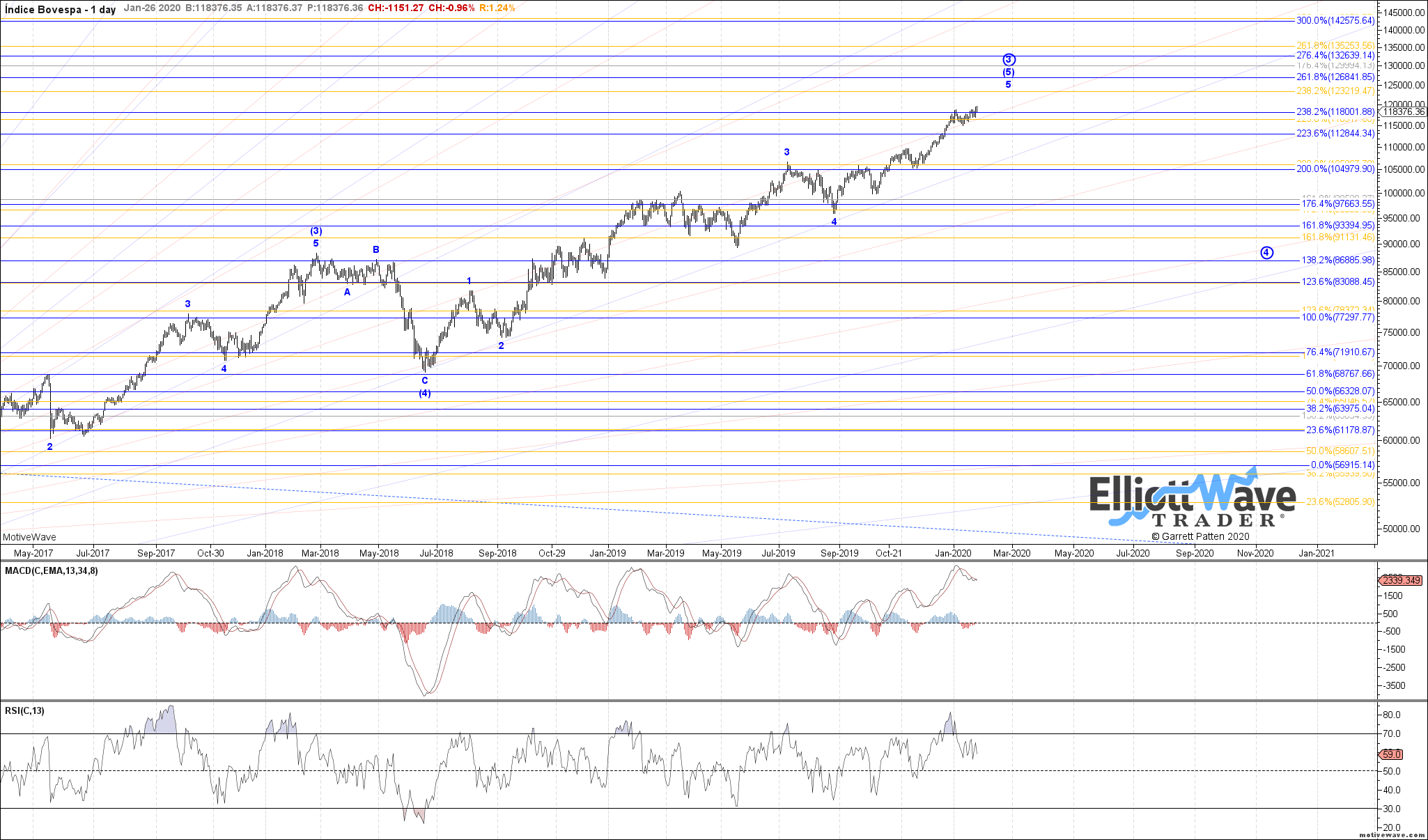

IBOV: The Bovespa continued higher overall last week, making another new high on the month and therefore still extending in wave iii of the ending diagonal 5th off the August low. There is still reason to expect that a corrective pullback as wave iv of 5 is near though, however, we continue to need a break below 115050 as the signal that wave iii of 5 has topped and a corrective pullback has begun.

IPC: The IPC rolled over last week, ending right at the 45115 support cited at Friday’s close. If a standard impulse C-wave is filling out off the Dec low, then price needs to turn back up immediately starting this week as wave v of (iii). However, based on early trading in other markets so far, that outcome seems unlikely. If 45115 does break, then 44360 would be the next support that bulls would want to defend if further overall upside is still in the cards.