Wirecard Soars As Soft Bank Crushes Shorts After Buying 5.6% Stake

As German markets regulator BaFin investigates a Financial Times reporter for allegedly conspiring with unscrupulous short-sellers to besmirch the good name of Munich-based FinTech darling Wirecard, Japanese telecoms conglomerate/VC giant Soft Bank has squeezed out any remaining shorts who managed to hold on through a Beijing-style ban on short-selling, and what some argued was a 'manipulated' vindication by an Asian law firm.

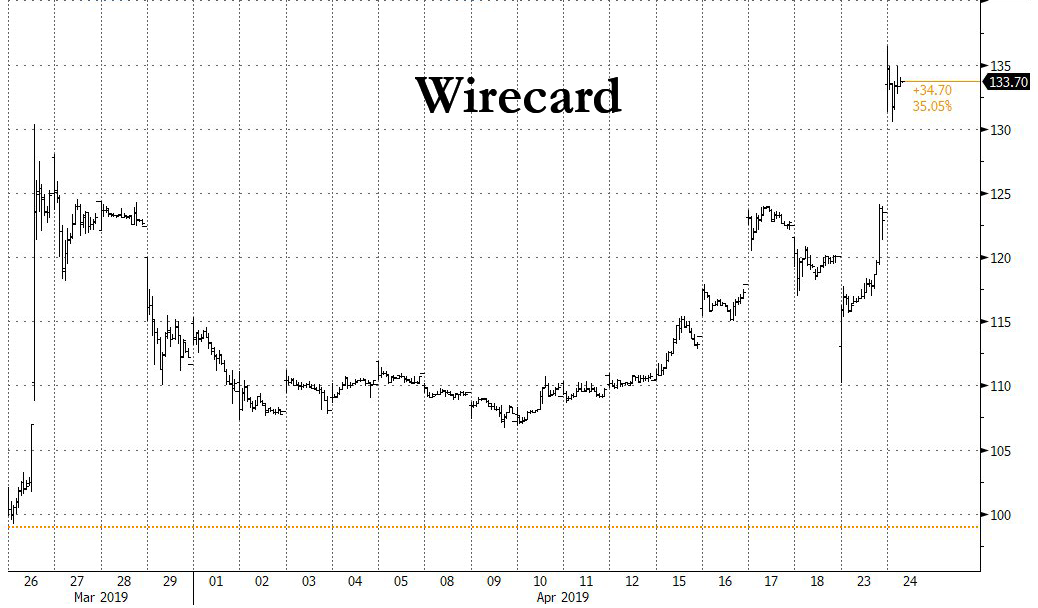

Wirecard confirmed late Tuesday that Soft Bank had agreed to invest €900 million ($1 billion) for a 5.6% stake in the company. The news triggered a torrid rally in Wirecard shares, which ripped 9% higher on Wednesday, leading the German DAX higher on a day when European stocks traded mostly lower.

According to the terms of the deal as reported by Reuters and the Financial Times, Soft Bank won't buy a direct equity stake. Rather, Wirecard will issue convertible bonds exclusively to Soft Bank that will transform into equity after five years. The conversion price of €130 per share represented a 5% premium to Wirecard's closing price on Tuesday.

For the deal to go through, Wirecard shareholders must approve the debt offering during the company's June 18 annual meeting.

Though Soft Bank and its Saudi-backed 'Vision Fund' has been criticized for its tendency to overvalue Silicon Valley startups (see its investments in Uber and WeWork), Wirecard's shares are still trading well below their September peak. A series of FT reports alleging accounting fraud at Wirecard's Asia operations, published earlier this year, sent Wirecard shares hurtling lower, though they have started to recover since Wirecard publicized a law firm's report clearing its management of wrongdoing.

Fearful that a route in Wirecard shares could drag down German indexes and European stocks more broadly, BaFin has assured the public of its confidence in Wirecard and accused short-sellers and the FT of conspiring to drive its stock lower. At one point, BaFin went so far as to ban short-selling in Wirecard shares, a move reminiscent of Beijing's response to a 2015 route in Chinese shares, when authorities started locking up short-sellers.

In addition to the investment, Soft Bank has pledged to partner with Wirecard to help it expand its operations in Japan and South Korea.

Wirecard and Softbank said they had also signed a strategic partnership to collaborate in the area of digital payments.

As part of this, Softbank will help Wirecard expand into Japan and South Korea, and provide opportunities to collaborate with other companies in its portfolio in areas such as data-analytics/AI and innovative digital financial services.

"Through this potential partnership, we will expand our reach and products to the East Asian markets, thereby further strengthening our position in Asia," Wirecard Chief Executive Markus Braun said in a statement.

Analysts at Baader Helvea said the investment was a “clear positive” that will allow Wirecard to leverage its product portfolio in Japan and South Korea, potentially even accelerating strong organic growth momentum.

Per the FT, Credit Suisse advised Soft Bank on the deal.