Why Canada Is A Monetary Policy Outlier

“It is with this context in mind that Governing Council considered whether the downside risks to the Canadian economy were sufficient at this time to warrant a more accommodative monetary policy as a form of insurance against those risks, and we concluded that they were not. In this setting, we discussed whether such insurance may come at a cost, in the form of higher financial vulnerabilities and possible consequences for the economy and inflation in the future. We agreed that the new mortgage rules in place limit this cost, but the situation will require continuous monitoring. Moreover, the fact that inflation has been on target and is projected to remain near target means that we can weigh the upside and downside risks to inflation more symmetrically.” (Opening Statement by Stephen Poloz, Governor of the Bank of Canada, October 30, 2019)

In this very risky global economic environment, Canada’s central bank is a bit of an outlier and is not yet following the monetary easing playbook of its country peers.

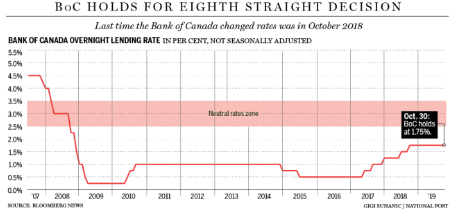

Thus far Governor Poloz has refused to follow the US Fed, which this year alone has cut its policy rate 75 basis points, albeit from a much higher level than Canadian interest rates.

In other words, the Fed has been easing America’s monetary policy this year while the Bank of Canada has maintained a relatively status quo policy position.

Bear in mind, that the US raised its policy rates far more than Canada in recent years, and at this time, the central bank policy rates in both countries are an identical 1.75%.

Ironically, when Canada’s monetary policy is compared to other peers, the BoC has by far the highest policy rate and appears to be very much an outlier. For example, the Bank of England’s policy rate is 0.75%, the ECB’s is zero, and the Bank of Japan and the Swiss National Bank each have policy rates below zero.

What is providing Poloz with the confidence to hold back on rate reductions at this time, when other trading nations are clearly more worried?

In plain words, Canada’s inflation rate is roughly on target at 2% as compared to other countries struggling to increase their rate of inflation.

Secondly, the unemployment rate in Canada is still close to a half-century low of about 5.5%. Moreover, even though the Canadian economy is only growing slowly, in the last couple of months the economy created a huge number of jobs, 54,000 in September alone.

Finally, by resisting the earlier calls to cut interest rates, Poloz still has an opportunity to do so when and should the need arrive. However, there is not all that much room to cut from 1.75%.

The US Target Federal Funds Rate