When It Comes To Financial Crises In The Emerging Markets, History Repeats Itself All Too Often

The collapsing Turkish lira provides yet another example of how financial crisis are a regular feature amongst emerging economies. Readers may recall the situation in 1998 when the collapse of Thai currency set off a wave of currency collapses, rising interest rates, defaulting debt and severe balance of payments stresses in many Asian nations. Today, a similar pattern is developing, only this time Turkey is front and center. It is not always easy to separate out the exact sequence of how these economies actually become unstable. Often it is a case that there is a huge importation of foreign capital, principally debt, that finances domestic investment both private and public. At the same time, their current account balances go deep into the red as imports rise without offsetting exports. Whether the sequence starts initially with a current account balance turning negative or, whether an excessive inflow of foreign investment drives up the value of the currency, the end result is the same---- a balance of payments crisis.

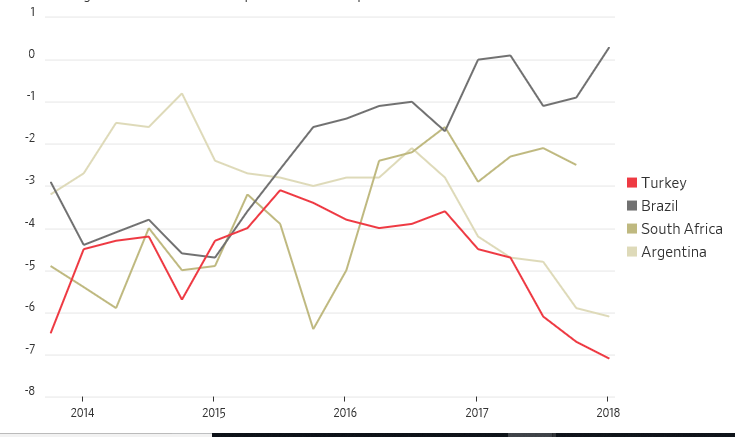

Right now, Turkey is the poster child, but we must not lose sight of the fact that other emerging economies face the same set of conditions. For the period 2014-2017, Turkey, South Africa, Brazil, and Argentina ran consistently large negative current account balances as a percent of GDP.( Figure 1).

Figure 1 Current Account Balances for Selected EM Economies

Source: OECD

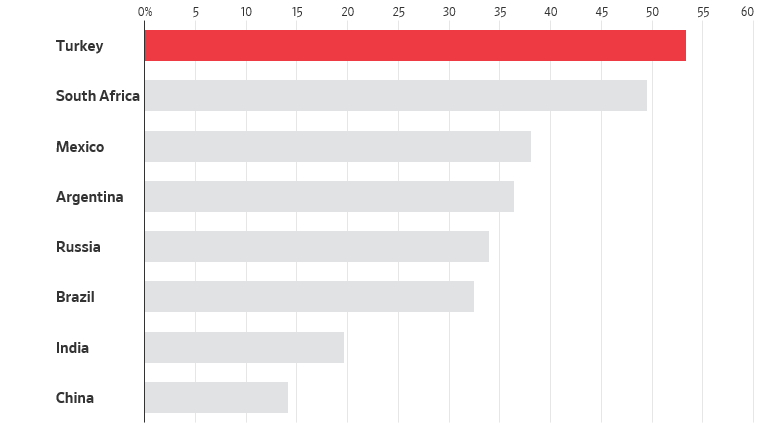

Turkey’s reliances on external funds for corporate and household use now stands at 50% of the GDP, the highest among major emerging markets. (Figure 2). Furthermore, the external debt becomes more expensive to repay as the lira weakens, stressing companies and households who have borrowed in foreign currencies.

Figure 2 External Debt as a % of GDP for EM countries

Source: IMF and World Bank

What we are now witnessing is ways in which the market adjusts to these imbalances. The dynamics are very painful to endure for the local economy. On the trade side, the currency, in this case, the Turkish lira, is down 45% this year. The fall in the currency has made imports more expensive, fuelling domestic inflation. As a net importer of oil, Turkey was forced to draw down its foreign exchange reserves to pay for the rising oil imports.

On the capital side, the Turkish 10 -year bond yields hit 20 %, up from 12% in May, as investors seek to protect themselves from higher inflation. Also, bondholders are nervous regarding the prospects for loan defaults and require more protection in the form of credit swaps. Higher interest rates, however, stunt economic growth and a falling currency heightens the risks associated with foreign investment. As investors try to flee emerging market debt, yields on U.S. Treasuries and Germany Bunds fell dramatically. Ultimately, the adjustments will play themselves out, however, at great expense to Turkish households and domestic and foreign investors.