Weekly Forex Forecast - Sunday, May 22

Start the week of Monday, May 23, 2022 with our Forex forecast which focuses on the major currency pairs.

Image Source: Unsplash

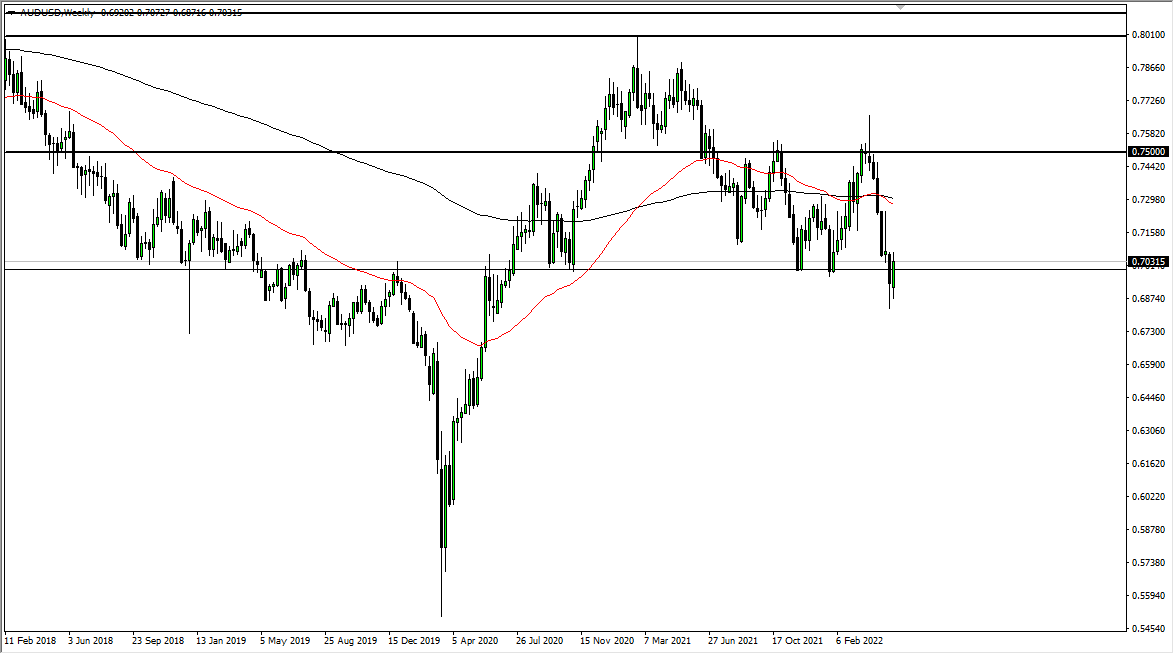

AUD/USD

The Australian dollar had a positive week, but it is still very much in a downtrend. The market is seeing it just above the 0.70 level. I think at this point you have to look at any short-term rally as a potential selling opportunity.

The US dollar is by far the strongest currency out of all of the major ones, so I do think that eventually we will see it drop again. The 0.68 level looks to be supported, and if we were to break down below there, the market would likely continue going much lower.

Pay close attention to risk appetite around the world. At this point, I think it is only a matter of time before sellers come back in. It is not until we break above the 0.72 level that I would be interested in trying to buy this market, which would take quite a bit of change in attitude.

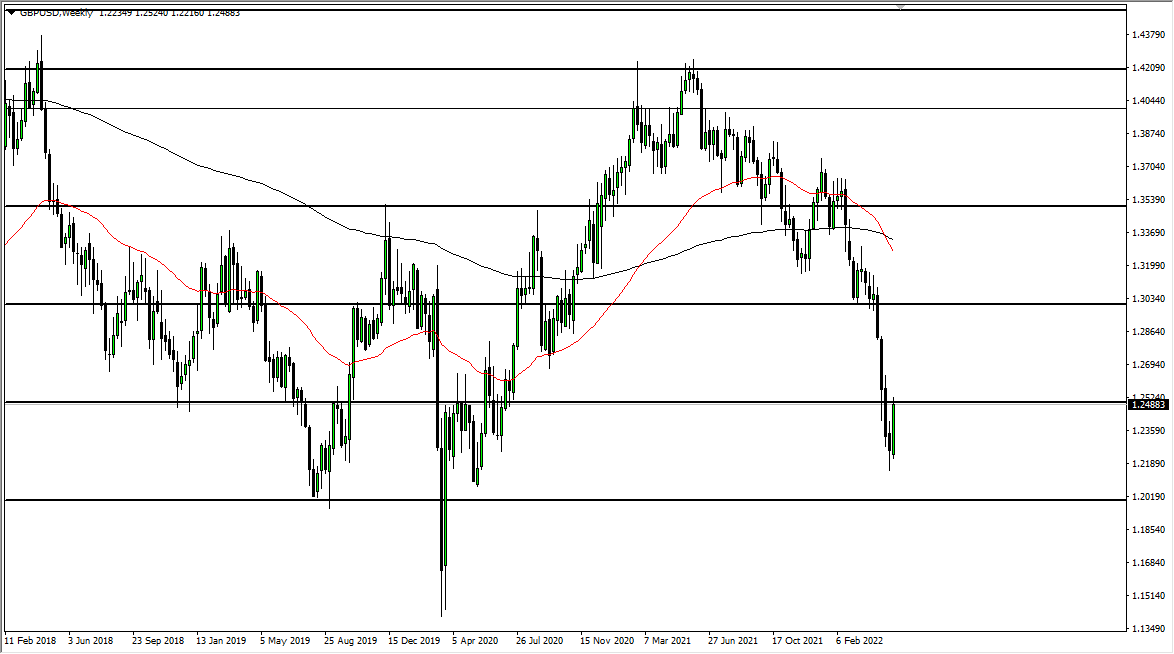

GBP/USD

The British pound rallied quite significantly last week to test the crucial 1.25 level, but it has struggled a bit there. Nonetheless, this is a market that will continue to see a lot of pressure to the downside, but we are so oversold that you may get to see a short-term rally first.

I think, given enough time, you may see signs of exhaustion that you could short, as the Bank of England has to deal with extraordinarily negative economic numbers while the Federal Reserve is hell-bent on tightening.

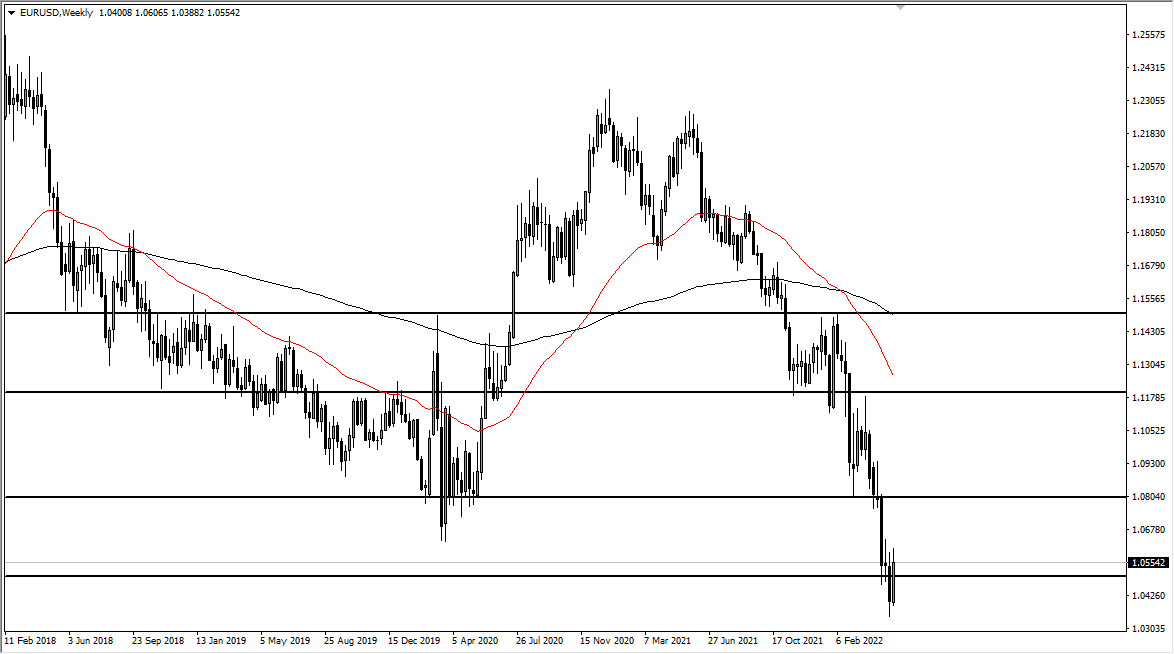

EUR/USD

The euro rallied significantly last week to break above the crucial 1.05 level. However, as we approached the 1.06 level, there was enough resistance to turn the market back around.

Keep in mind that the European Central Bank is nowhere near tightening monetary policy while the Federal Reserve is planning to be aggressive. At this point, it looks like the euro is going to go looking towards the parity level. Rallies are to be sold into, as the US dollar continues to strengthen.

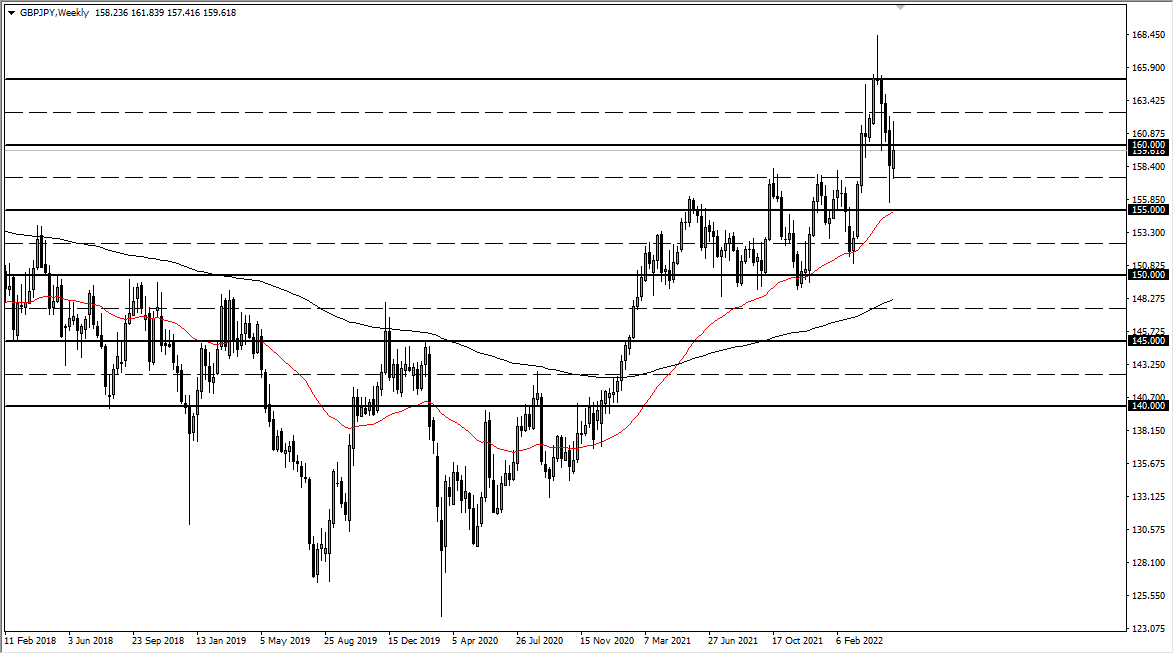

GBP/JPY

The British pound has spent most of the week trying to rally, and it did a pretty good job about doing so against the yen for some time. However, we have seen a lot of resistance above the JPY160 level, and now it looks like we are ready to fade short-term rallies. Keep in mind that this pair is very sensitive to risk appetite, and risk appetite is shot at the moment.

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more