Weekly Forex Forecast - Sunday, June 12

Start the week of June 13, 2022 off right with our Forex forecast which focuses on the major currency pairs.

Image Source: Pexels

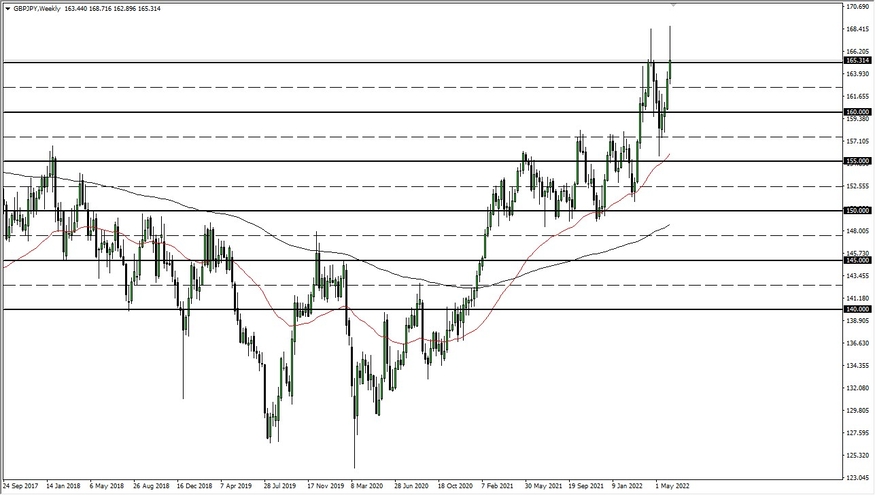

GBP/JPY

The British pound rallied during most of the week, but it gave back quite a bit of the gains as more of a “risk-off” environment came into the markets. Inflation numbers on Friday were horrible in the United States, so that only exacerbated the problem. Because of this, the market is likely going to continue to pull back a bit, but I don’t think this is necessarily the end of the uptrend.

We have formed a little bit of a “double top,” but I do think that the games that the Bank of Japan is playing with its interest rate market will eventually continue to put downward pressure on the yen.

EUR/USD

The euro was pummeled over the past week, with most of the losses coming on Thursday and Friday. The ECB suggested that there were interest rates coming down the road, but they appear to be small and incremental. It is not like the Federal Reserve, which is starting to show that it is going to have to get extraordinarily tight.

This is especially true after the inflation numbers came out much hotter than anticipated on Friday. It’s only a matter of time before we will see a breakdown below the 1.05 level and we will start to look to the 1.04 level.

USD/JPY

The US dollar skyrocketed against the Japanese yen yet again during the last trading week, and even though we had pulled back both Thursday and Friday, buyers came back in to pick up this market.

With the Federal Reserve having to tighten monetary policy as aggressively as they will, and the Bank of Japan looking to keep interest rates down, this is a perfect storm for the pair to continue blasting off to the upside. I think dips at this point in time will continue to be bought, and it’s likely that we will break through the JPY135 level sometime this week.

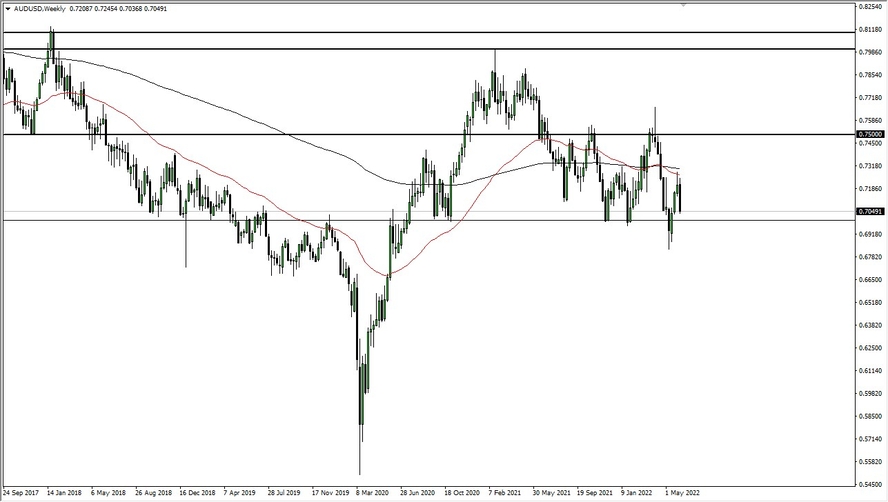

AUD/USD

The Australian dollar tried to rally last week, but it gave back the gains as we approached the 0.70 level. This is an area that should be significant support, but if we break through there again, it’s likely that we will continue to go lower. We had already attempted to approach this level about a month ago, so a lot of the damage has already been done ahead of the next attempt.

I personally have no interest in buying this market at the moment. Short-term rallies may continue to offer selling opportunities.

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more