Weekly Forex Forecast - May 17- 21

Start the week of May 17, 2021 with our Forex forecast focusing on major currency pairs here.

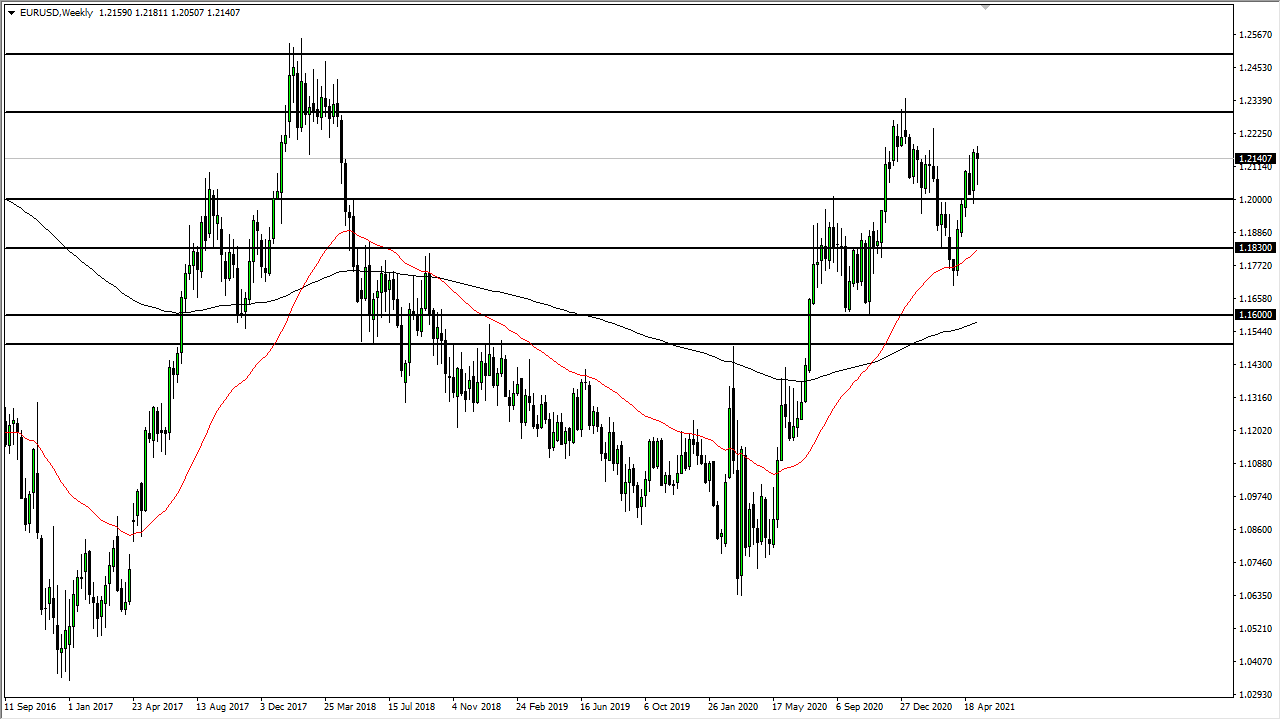

EUR/USD

The euro fell during part of the week to show signs of exhaustion of the upside and, more importantly, we saw the fear of inflation cause the Federal Reserve to change its tune and perhaps tighten monetary policy. However, people came back to their senses, especially as the retail sales numbers on Friday came out very poorly. With this, if we can break above the top of this candlestick then it is likely we will go looking towards the 1.23 handle. I believe that short-term pullbacks continue to be buying opportunities in this market (FXE, UDN).

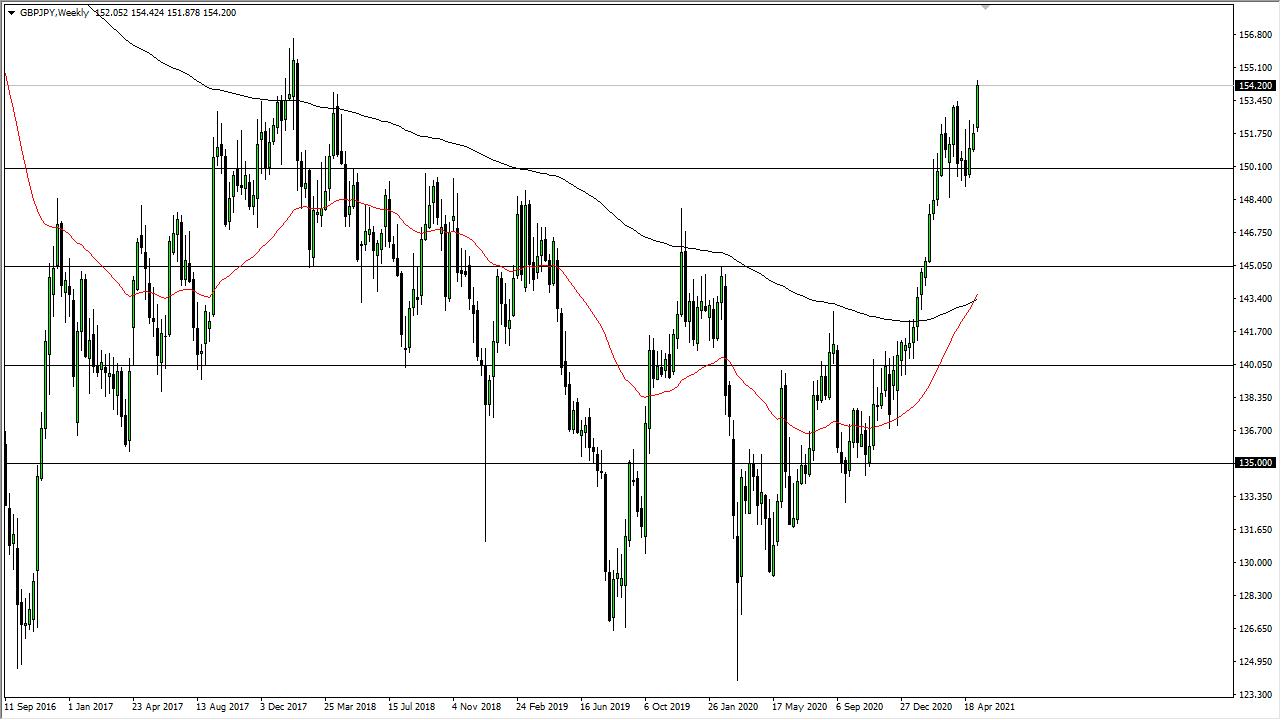

GBP/JPY

The British pound rallied again during the course of the week, as we have seen quite a bit of bullish pressure in the British pound, and perhaps more importantly, the Japanese yen has been giving up a lot of strength. Ultimately, it looks as if we have broken out above a bullish flag, so now it appears that this pair has much further to go. I do believe that as we continue to pull back on the occasional move, that should be a nice buying opportunity. The ¥150 level should end up being a bit of a “floor in the market” going forward, and it should also be noted that this pair is highly correlated to risk appetite (FXB).

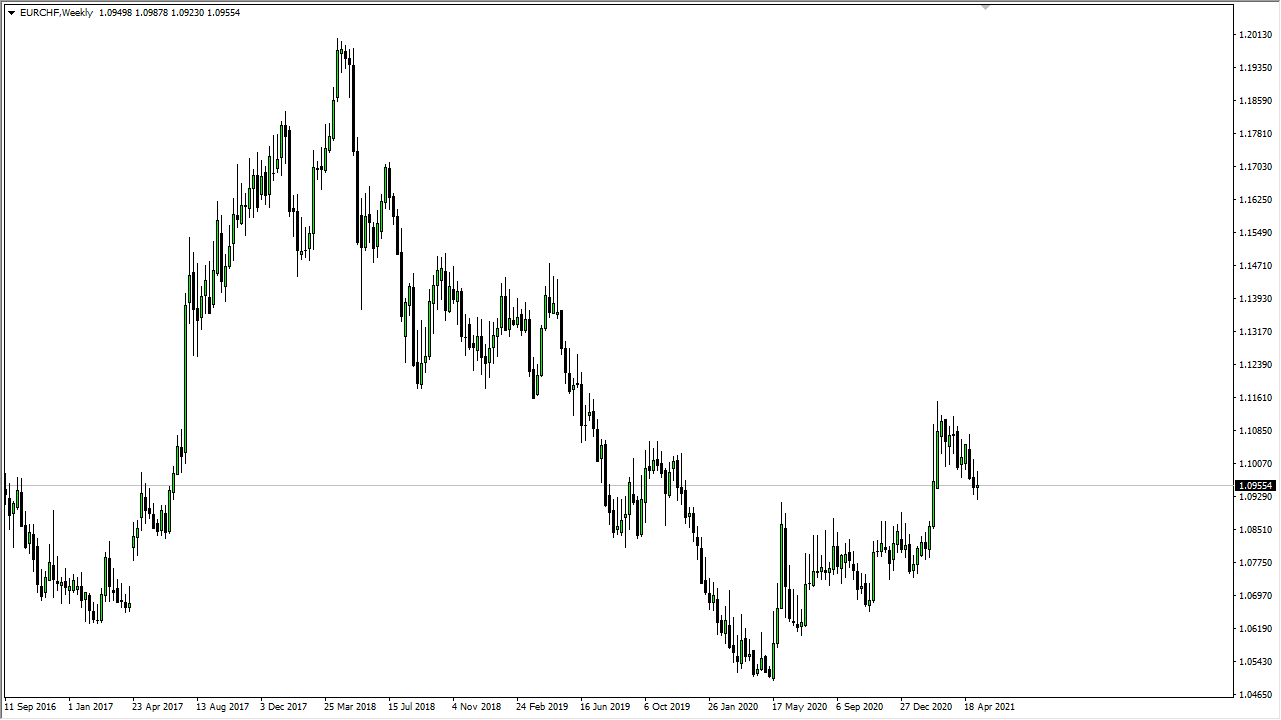

EUR/CHF

The euro fluctuated during the week against the Swiss franc, as we continue to see the 1.08 level offer a bit of support. We have also seen a significant pullback from the highs, but now we are at roughly 50% of the original breakout, so I think at this point, we will probably see this market recover. If we can break above the highs of the week, then it is likely that we could go looking towards 1.11 handle. On the other hand, if we break down below the weekly low, then it is possible that we could go looking towards the 1.0850 level given enough time (FXF).

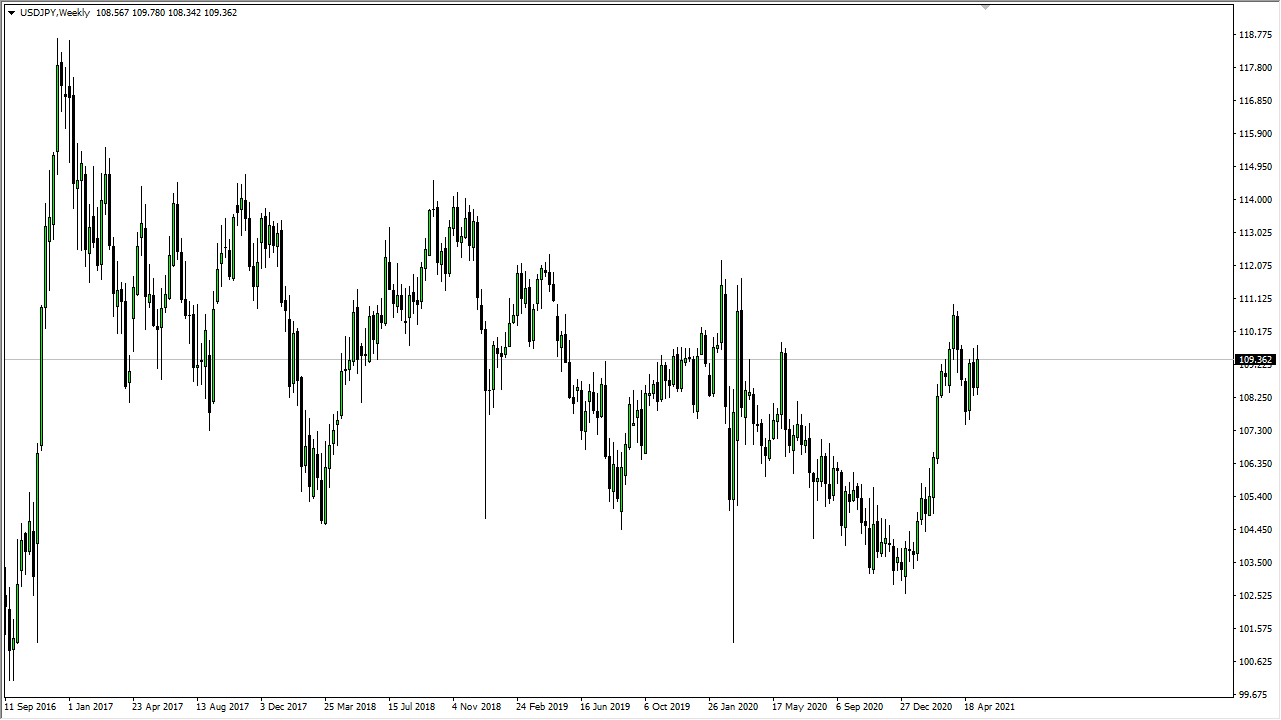

USD/JPY

The US dollar has rallied against the Japanese yen yet again, and as a result it looks like we are trying to break to the upside, perhaps aiming for the ¥111 level. That is an area that continues to offer a target, as we had pulled back significantly from there. However, if we were to turn around and break down below the ¥108 level, then the market could fall apart and go looking towards the ¥105 level (FXY).

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more