We Were Wrong On RBI Policy, But For The Right Reasons

The shift in Indian central bank policy stance from ‘neutral’ to ‘accommodative’ doesn’t’ mean there will be more rate cuts. Hopefully, the central bank recognizes pipeline inflation pressures and stays put in the meetings ahead.

Reserve Bank of India's new Governor Shaktikanta Das Source: Shutterstock

Another RBI rate cut - not quite what we expected

As expected by an overwhelming majority in the Bloomberg survey, the Reserve Bank of India slashed the key policy rate by 25 basis point for the third time this year, taking the repurchase rate to 5.75% and reverse repo rate to 5.50%. The central bank also changed its monetary policy stance from 'neutral' to ‘accommodative’ but there was no change to the 4.00% cash reserve requirement ratio for commercial banks.

We thought the RBI would see through the latest GDP slowdown recognising pipeline inflation pressures from food and fuel prices, a weaker currency and an excessively loose fiscal policy

We were a consensus outlier in our forecast of an 'on-hold' policy, partly based on our conviction that this is what we think the central bank should be doing rather than what it would necessarily do, given that the economy has had enough stimulus - two rate cuts earlier this year, plus significant fiscal boost from government's re-election bid.

We believed the RBI would see through the latest GDP slowdown recognizing pipeline inflation pressures from food and fuel prices, a weaker currency and an excessively loose fiscal policy.

Does change of policy stance matter?

We think the RBI's easing cycle is now finally over, especially after today's rate cut and despite shifting the policy stance from neutral to accommodative. Also, the previous two rate cuts in February and April were despite the 'neutral' stance, which was changed from ‘calibrated tightening’ stance in the February meeting (the same meeting they in fact cut rates). Another rate cut with neutral stance might not have gone down too well, which is why we view today’s shift in stance as nothing more than justifying today's rate cut decision.

If risks are 'broadly/evenly balanced'in India, why has the central bank changed the policy stance from neutral to accomodative?

However, we are reading today’s RBI statement as recognizing some inflation risk from ‘a broad-based pick-up in prices in several food items’, even as the statement points to weak domestic and external demand weighing down non-food items while muted passthrough of global crude price volatility keeps domestic fuel price in check.

The RBI has nudged its inflation forecast for the first half of FY19-20 higher to 3.0 - 3.1% from 2.9 - 3.0% but cut that for the second-half to 3.4 - 3.7% from 3.5 - 3.8% with risks broadly balanced. They've also lowered the growth forecast for the current fiscal year to 7.0% from 7.2%, again with risks evenly balanced, which begs the question - why change the policy when risks are 'broadly/evenly balanced'?

In our view, the RBI easing cycle is finally over

By the time, all these rate cuts and the fiscal stimulus come through the real economy over the next two quarters, the inflation genie is most likely to be out of the bottle.

We maintain our forecast for a rate hike in the second quarter of 2020

A weak currency and increasing tariff barriers are likely to encourage imported inflation, amid risks of supply shocks from food and fuel prices. Negative growth in agriculture GDP in the last quarter of FY18-19 doesn't bode too well for food prices, for which prospects also hinge on the monsoon season.

We continue to see inflation reaching the 4% mid-point of the RBI’s target zone over the next two quarters. Hopefully, the RBI will eventually see this as coming and leave policy on hold in the forthcoming meetings. Barring a prolonged slowdown in the economy and muted inflation in 2020, we believe the next move in the RBI policy rates would be higher.

We maintain our forecast for a rate hike in the second quarter of 2020.

What’s in it for the markets?

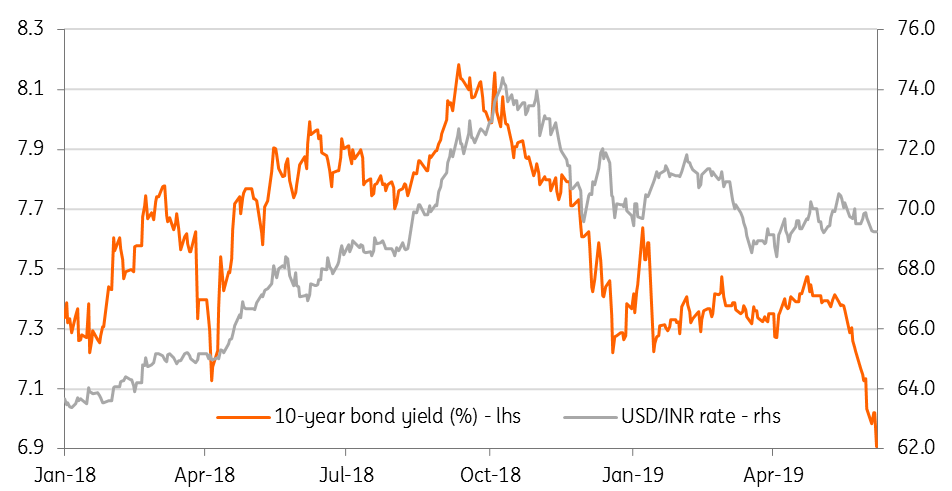

Ideally, a widely expected policy decision should have no impact on markets, but we still think the recent strength of the government bond and the rupee is transitory. Besides potential inflation risk, the wide fiscal deficit and supply overhang from that on the bond market should make the yields sticky downward going forward.

A short-living rally in government bonds and INR

Source: Bloomberg, ING

As for the rupee, we think the market overbought the currency amid the euphoria of prime minister Narendra Modi returning to power for the second term. As for most emerging market currencies with a backdrop of twin deficits (fiscal and current account deficit), the external environment currently hasn’t been friendly and it’s unlikely to be so in the near-term as long as the trade war continues.

Moreover, with President Trump now shifting focus towards India, there will be more tailwind for INR depreciation going forward. We wouldn't be surprised if the currency re-asserts its recent status as an Asian underperformer in the days ahead.

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more