USD/TRY Stays Bid Around 8.1500

The Turkish lira sheds part of Monday’s advance and pushes USD/TRY to the 8.15/16 area, where it met some resistance on turnaround Tuesday.

Photo by Omid Armin on Unsplash

USD/TRY now looks to the CBRT

USD/TRY reverses the marked pullback recorded on Monday, although it so far manages well to keep the trade within the weekly range.

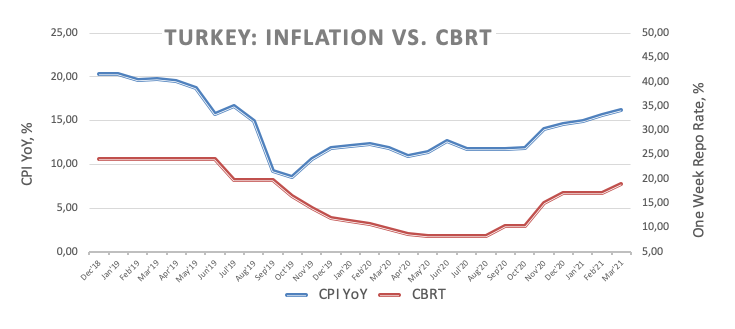

The lira regained some interest at the beginning of the week after inflation figures in Turkey showed the CPI rose for the sixth consecutive month in March, this time by 16.19% from a year earlier. On a monthly view, consumer prices gained 1.08%.

In the very near-term, the lira is expected to keep the rangebound trade unchanged at least until the Turkish central bank (CBRT) meets on April 15th. On the latter, and against the backdrop of rising nervousness amongst investors, CBRT Governor S.Kavcioglu said he will not reverse N.Agbal’s policies immediately (?), adding that he plans to meet the central bank’s inflation target at 5.0%.

So far, the Turkish currency depreciated around 13% since President Erdogan’s decision to replace the CBRT Governor in late March.

What to look for around TRY

The near-term outlook for the lira remains fragile to say the least. Despite stating the opposite, the new CBRT Governor S.Kavcioglu is gradually expected to reverse (wipe out) the shift to a market friendly approach of the monetary policy that was successfully implemented by former Governor N.Agbal back in November 2020. President Erdogan’s appointment of Kavcioglu demonstrated once again whose hand is rocking the monetary cradle in Turkey and will most likely be the prelude of the return to unorthodox/looser measures of monetary policy in combination with rapidly rising bets of a balance of payments crisis and a drain of FX reserves. Against this backdrop, it will surprise nobody to see spot trading around 10.00 in the months to come.

Key events in Turkey this week: End Year CPI Forecast (Friday).

Eminent issues on the back boiler: Potential US/EU sanctions against Ankara. Government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic.

USD/TRY key levels

At the moment the pair is advancing 0.45% at 8.1350 and faces the next up barrier at 8.4526 (2021 high Mar.30) seconded by 8.5777 (all-time high Nov.6 2020) and finally 9.0000 (round level). On the other hand, a drop below 7.7772 (high Mar.9) would aim for 7.4974 (200-day SMA) and then 7.1856 (monthly low Mar.19).

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more