USD/JPY Weekly Outlook: Better Risk Sentiment Could Target 111.00

Image Source: Unsplash

USD/JPY Forecast Highlights

- USD/JPY could lead the rally beyond the 111.00 mark.

- Fed’s hawkish stance may lend support to the pair.

- Risk sentiment will weigh more on yen than the dollar.

The USD/JPY pair maintains a weekly bullish outlook. Though the pair saw a bit of a dip during the week, risk sentiment later soared and helped the pair gain some traction. The forex market has observed the effects of COVID-19, followed by the spread of the delta variant beyond India. While many developed countries are mostly vaccinated, this strain is highly transmissible.

The infection rate is rising quickly in the US, primarily in under-vaccinated areas. The prospects from the Fed’s tighter policy are immense. In addition, the fear of increasing inflation and constant tampering with bonds was observed to flop off temporarily.

Cases are higher in Japan, where the Olympic games have begun again. However, reports about athletes and officials testing positive have not discouraged the organizers.

Will the Fed Continue to Support the Dollar?

In America, the delta variant is set to continue spreading and can increase hospitalization and deaths. While the dollar can rise against most currencies, it would probably fail to battle with the yen. Falling US yields are strongly correlated with the USD/JPY pair.

Somehow, the most influential central banker seemed in no hurry to print dollars. Then, COVID-19 cases began to rise and alarm the markets. The disappointing consumer and business survey may sway the Fed to postpone the early withdrawal of support.

Key Events in Japan to Watch

Despite rising cases, the Japanese government has pushed through with the delayed 2020 Olympics, but these events remain at very high risk. Especially if the additional participants are infected with COVID-19. Even if there are only limited cancellations of games and conclude with a prompt ceremony, the view of empty stadiums could weigh on sentiments.

The success or failure of these events may have a tremendous political impact, and Prime Minister Yoshihide Suga faces internal reelection in September in his LDP party. Therefore, any concerns related to political instability could weigh on sentiments. It is essential to the point out that global risk sentiment influences the yen more than Japanese indicators.

What to Watch Next Week for USD/JPY?

The next week comes with two major events. CB consumer confidence data is expected on Tuesday. The figures are not expected to surprise the market.

![]()

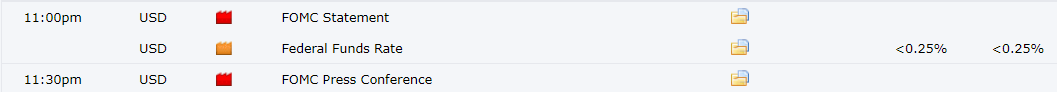

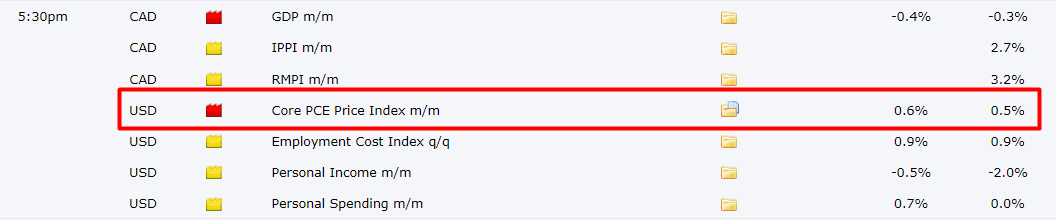

Second is the US federal funds rate and FOMC statement due on Wednesday. We have to look for the tone of the FOMC in their statement. On Friday, we have personal spending and income data, which includes PCE inflation.

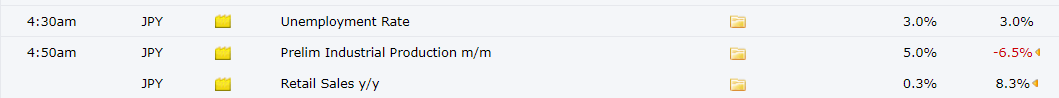

Data from Japan is not as significant next week. Some low tier data include BOJ Kuroda’s speech on Monday followed by the unemployment rate, industrial production, and retail sales data on Friday. However, the market doesn’t expect much from these events.

![]()

USD/JPY Technical Analysis: Bulls to Dominate the Market

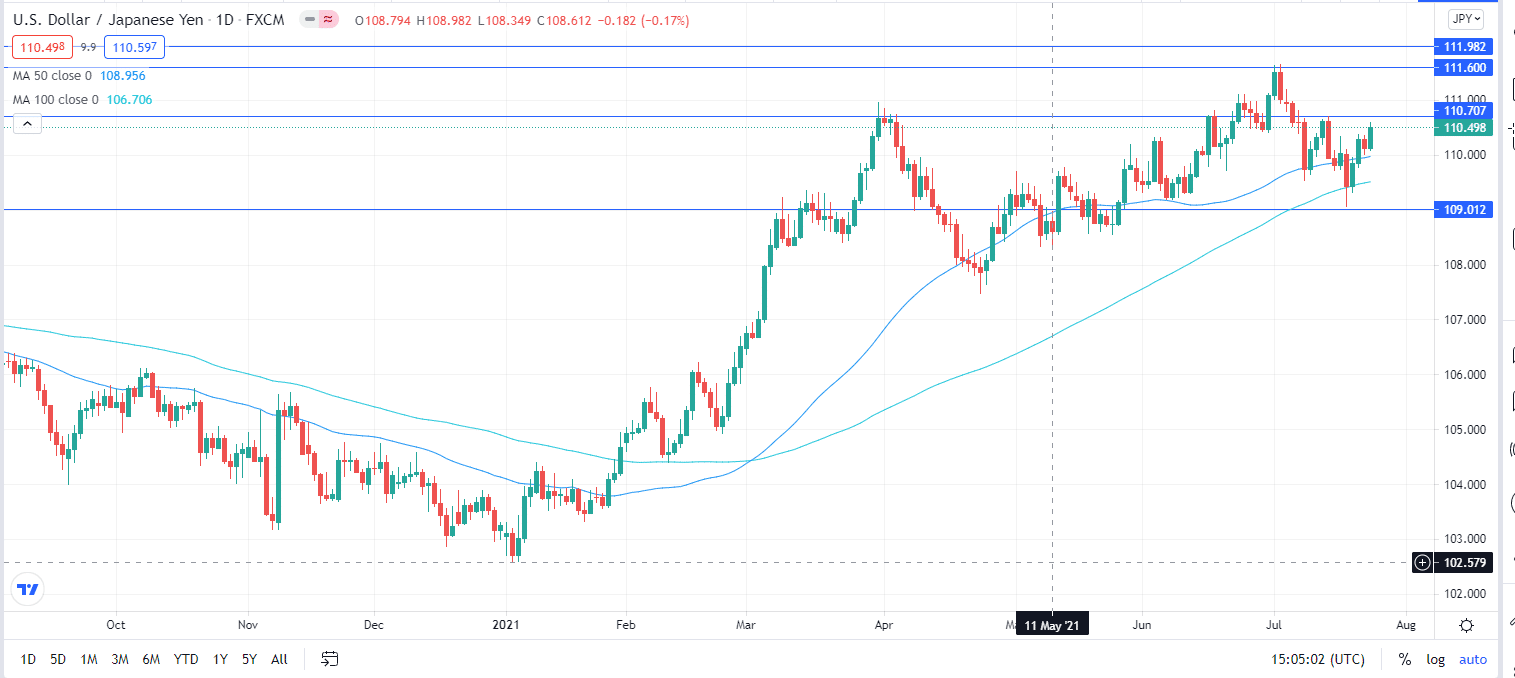

The USD/JPY pair's move off from the 109.00 level has proved technically significant. The currency pair brought back 50-day and 100-day SMAs. While momentum remains marginally down, the pair set lower lows, yet the USD/JPY bulls have benefited. Some resistance waits at the 110.70 level, which was a peak point in mid-July. The peak of 111.60 is a crucial cap for now.

USD/JPY Outlook on the Daily Chart

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more