USD/JPY Weekly Forecast: Sellers Dominate After NFP, Aiming At 108.50

Image Source: Pixabay

- The USD/JPY pair dropped to the 100-DMA as the week closed.

- US ADP and NFP figures reported a dismal scenario for the US dollar, which helped the USD/JPY bears.

- The Delta variant is increasing in the United States, and that may keep the greenback under pressure.

The weekly forecast for the USD/JPY pair is bearish and may aim to run to mid-108.00. However, a technical upside retracement can be seen, too. The USD/JPY pair remains broadly in a bearish trend ranging at the lower end as the week closes. The general weakness of the US dollar is weighing on the pair. Meanwhile, the surge in the Delta variant in the country and the Fed’s unclear timeline on tapering may exacerbate the bears.

The USD/JPY pair started the week at 109.80 and hit the highs just below the mid-110.00 level. However, the pair maintains the offered tone and is looking to post further losses.

US ADP and NFP Reports

The most important event of the week was the employment report of the United Stated. On Wednesday, the ADP employment report that was released widely missed the expectations of 640 thousand jobs against the current reading of 374 thousand.

On Friday, the US nonfarm employment number also came worse than expected. Only 235 thousand jobs were added in August, while the expected figure was 750 thousand. However, the unemployment rate reduced to 5.2%, and average hourly wages increased by 0.6%.

The US dollar had already been under pressure throughout the week, but the dismal US NFP report weighed further and helped the major currencies sharply rise against the US dollar.

The Delta Variant in the US

There was an average of 163,600 coronavirus cases per day in the United States over the past week, increasing 12% from two weeks ago. A total of 40 million cases is likely to be reported within days.

More coronavirus cases were reported in Oregon, Kentucky, and Guam in the past week than in any other seven-day period. In addition, the past week has been the deadliest for the coronavirus in Florida.

A total of 101,500 patients have been hospitalized with coronavirus, with more than 15,500 admitted to Florida hospitals, where hospital admissions are much higher than anywhere else in the country. On Monday, Kentucky’s unemployment rate was at its highest level in a year.

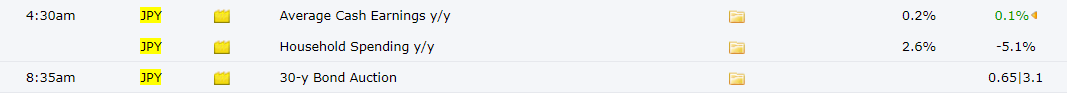

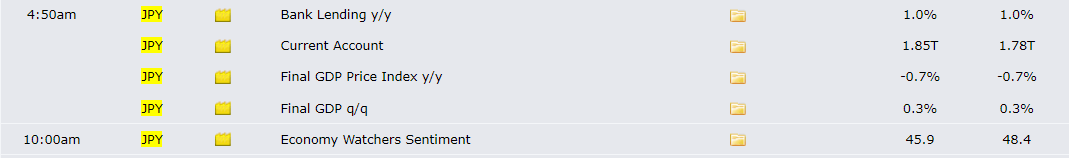

Key Events from Japan during the Week of Sept. 6 – 10

![]()

![]()

![]()

The economic calendar is light for the week ahead. However, the average household spending data is expected on Tuesday, and the figures are important to analyze the economic activity in the country. Moreover, the final GDP index year-over-year data and final GDP quarter-over-quarter data are expected to release on Wednesday with no major change in the data against previous readings.

Key Events from the US during the Week of Sept. 6 – 10

![]()

![]()

![]()

The important events include the JOLTS jobs opening report due on Wednesday ahead of Fed William’s speech in the US. Moreover, weekly unemployment claims are also important to note. Other than that, US PPI month-over-month data may also trigger volatility on Friday. The figure is expected to slide to 0.6% against the previous month's reading at 1.0%.

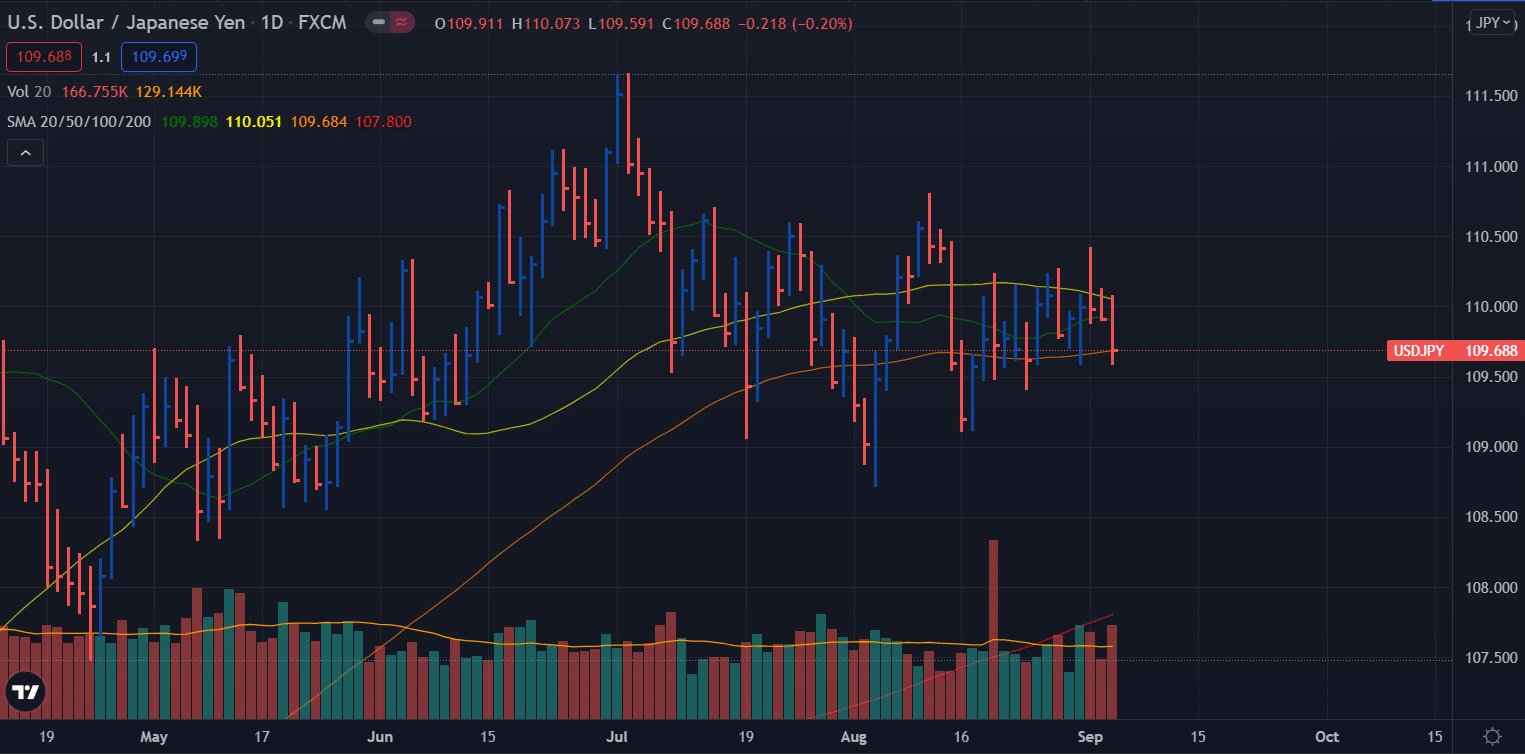

USD/JPY Weekly Forecast – Daily Chart

USD/JPY Weekly Technical Forecast: 100-DMA Pausing the Bears

The USD/JPY pair came back below the 20-day and 50-day moving averages. However, the downside is paused at the 100-day moving average. The volume supports bearish price action. We may see further losses to horizontal levels of 109.10 ahead of 108.75 and then 108.50. However, we may also see a relief rally in the first half of the week, and the pair may pull back to 110.00 ahead of 110.40.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more