USD/JPY Weekly Forecast: Bearish Pressure Under 113.00 Amid Omicron

Image Source: Pexels

- The Omicron panic set this week in motion on Friday, Nov. 26.

- The currency and Treasury markets are awaiting confirmation that the variant is dangerous.

- As payrolls miss forecasts, the US NFP weakens Treasury yields and the dollar.

The USD/JPY weekly forecast remains bearish as the Omicron variant spreads and creates a risk-off sentiment in the market. Hence, the Japanese yen appears to firm up. A panicked reaction to the appearance of Omicron last week rocked the USD/JPY pair and markets in general. In terms of health risks, the distribution of the burden, and how governments will react, objective reflections are doubtful.

The government can impose restrictions and closings that may hamper global recovery if the new virus is less complex but more transmissible. Moreover, commodity markets appear to view new blockades as opportunities as oil prices collapse and profitability is limited.

After closing at 113.13 last Friday following a panic-stricken close, the USD/JPY pair has remained largely unchanged this week. In light of the weak USD/JPY support below 113,000 and the possibility of new economic restrictions in many nations, the USD/JPY bias has shifted to the downside. The USD/JPY will quickly regain the initiative if Omicron is widely believed to be no large threat.

Despite the US nonfarm payroll report not reaching its baseline forecast of 550,000 new jobs, instead creating 210,000 jobs, the report illustrates how far the job market has come this year.

The unemployment rate fell to 4.5%, and the underemployment rate moved to 7.8%, significantly better than forecast numbers. In addition, the activity rate rose to 61.8%, the highest level since March 2020.

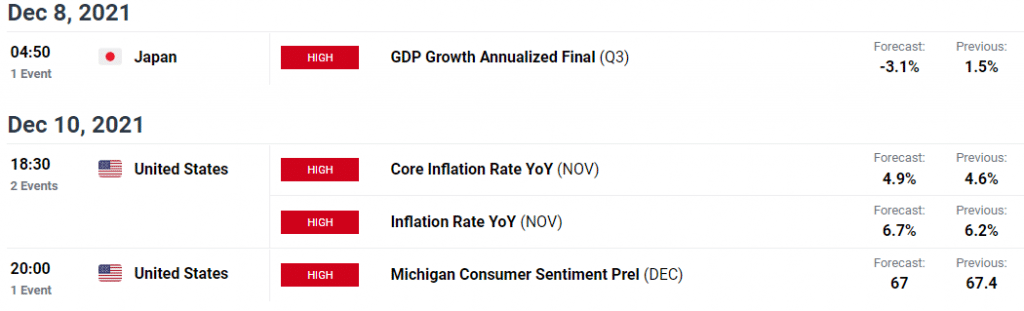

Key Dates/Events for the USD/JPY Pair

This week, the Omicron saga will be set in motion by Japan and the US economic data.

In Japan, consumer data for the fourth quarter will be released regarding labor income and total household spending in October. This will be the third consecutive month of decreasing costs. However, the Eco Watchers’ study, which tracks regional economic trends, predicts that the short-term outlook will deteriorate. As a result, PPI is forecast to rise 0.5% to 8.5% in November.

The consumer price index for November will be the main event on Friday in the US. General interest rates are believed to rise from 6.2% to 6.8% and base rates from 4.6% to 4.9%. This will increase the odds of Fed cuts, regardless of what happens with the Omicron variant.

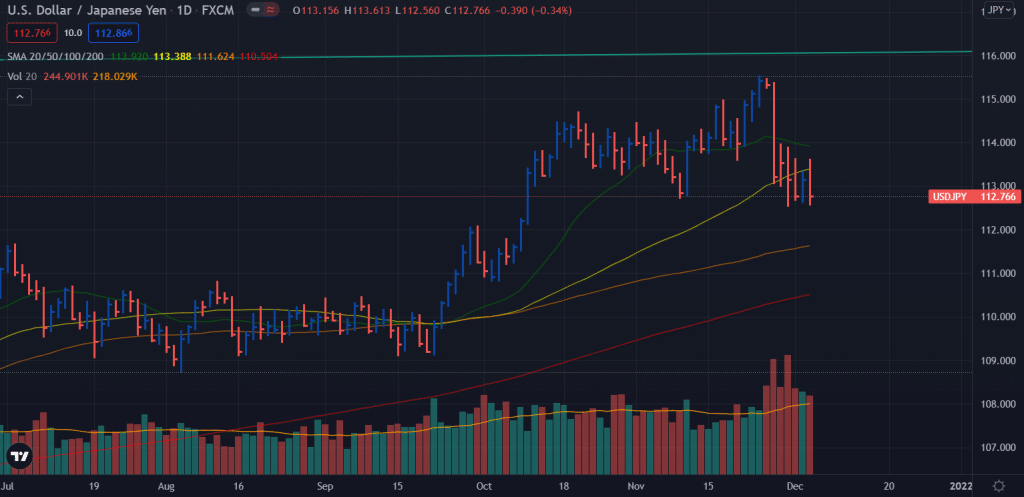

USD/JPY Weekly Technical Forecast: Bears Dominating the Market

The USD/JPY pair plunged below the 20-day and 50-day SMAs while the price closed near the weekly lows, below the 113.00 mark. The next target for the bears lies at the 100-day SMA, around 111.65, and ahead of the 200-day SMA, around 110.50.

On the upside, the pair may find strong resistance around the 20-day SMA, near 113.30 and ahead of 114.00.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more