USD/JPY Technical Analysis: During An American Holiday - Monday, May 25

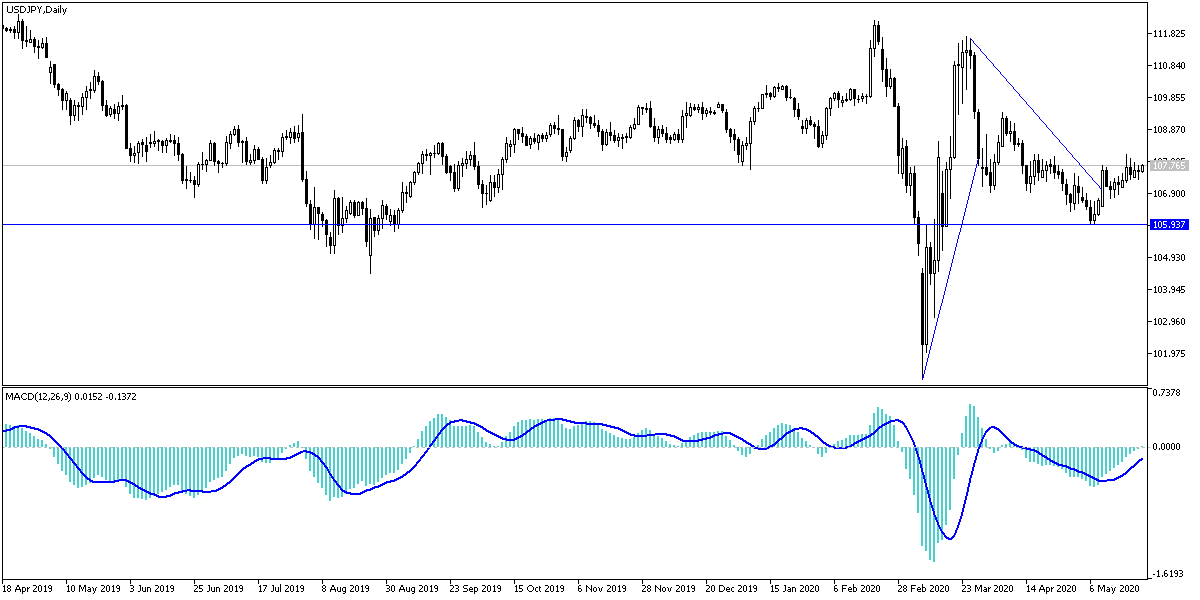

On the short term, it appears that the pair USD/JPY is gradually rising from a falling wedge.

Throughout last week’s trading, the USD/JPY pair was moving inside the bullish channel, but it often lacked the momentum to strengthen this trend. Gains did not exceed the 108.08 resistance, and quickly returned to drop towards 107.32 support, before settling around 107.66 at the beginning of this week's trading.

Renewed geopolitical and trade tensions between the two largest economies in the world arose after a period of calm. Everything changed after the spread of the coronavirus and the exchange of accusations between them about the cause of the outbreak, which contributed to the complete paralysis of global economic activity.

On the economic side. In Japan, the first quarter GDP recorded a change (quarterly) of -0.9%, which was better than the expected change of -1.2%. Annual gross domestic product came at -3.4%, against expectations for a -4.6% growth. The industrial production rate was in line with the (annual) forecast for March at -5.2%, while April's imports and exports missed expectations. However, the April CPI came in below -0.1% with a change of -0.2%.

In the United States, the initial jobless claims for the week ending May 15 came higher than expected at 2.438 million claims, compared to expectations of 2.4 million claims. Ongoing claims were also high at 25.073 million, compared to expectations for 24.765 million.

The Philadelphia Fed Manufacturing Index for May came at -43.1, which was also worse than the expected reading of -41.5. The Markit Manufacturing and Services PMI for May exceeded forecasts of 38 and 30, respectively, with 38.6 and 36.9 readings. US existing home sales for the month of April also exceeded expectations, although they also fell.

According to technical analysis: On the short term, it appears that the pair USD/JPY is gradually rising from a falling wedge. This indicates that bulls are trying to gain control of the pair in the short term. Therefore, bulls will target short-term profits at around 108.10, or higher at 108.65. On the other hand, bears will look to achieve profits from dropping to around 106.95, or less at 106.34.

On the long run, and according to the performance on the daily chart, it appears that the USD/JPY is in decline, but with great volatility. With the performance not stable in the recent period, bears will look to extend the current drop towards the 105.58 support, or less at 103.04. On the other hand, bulls will look to target bounce profits at around 109.94, or higher at 112.25.

Monday, May 25, the pair does not expect any significant and influential economic data from the United States or Japan, and accordingly, the performance will be related to the extent of the investors' risk appetite.

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals and ...

more