USD/CNH: Can Price Action Extend Farther To The Upside?

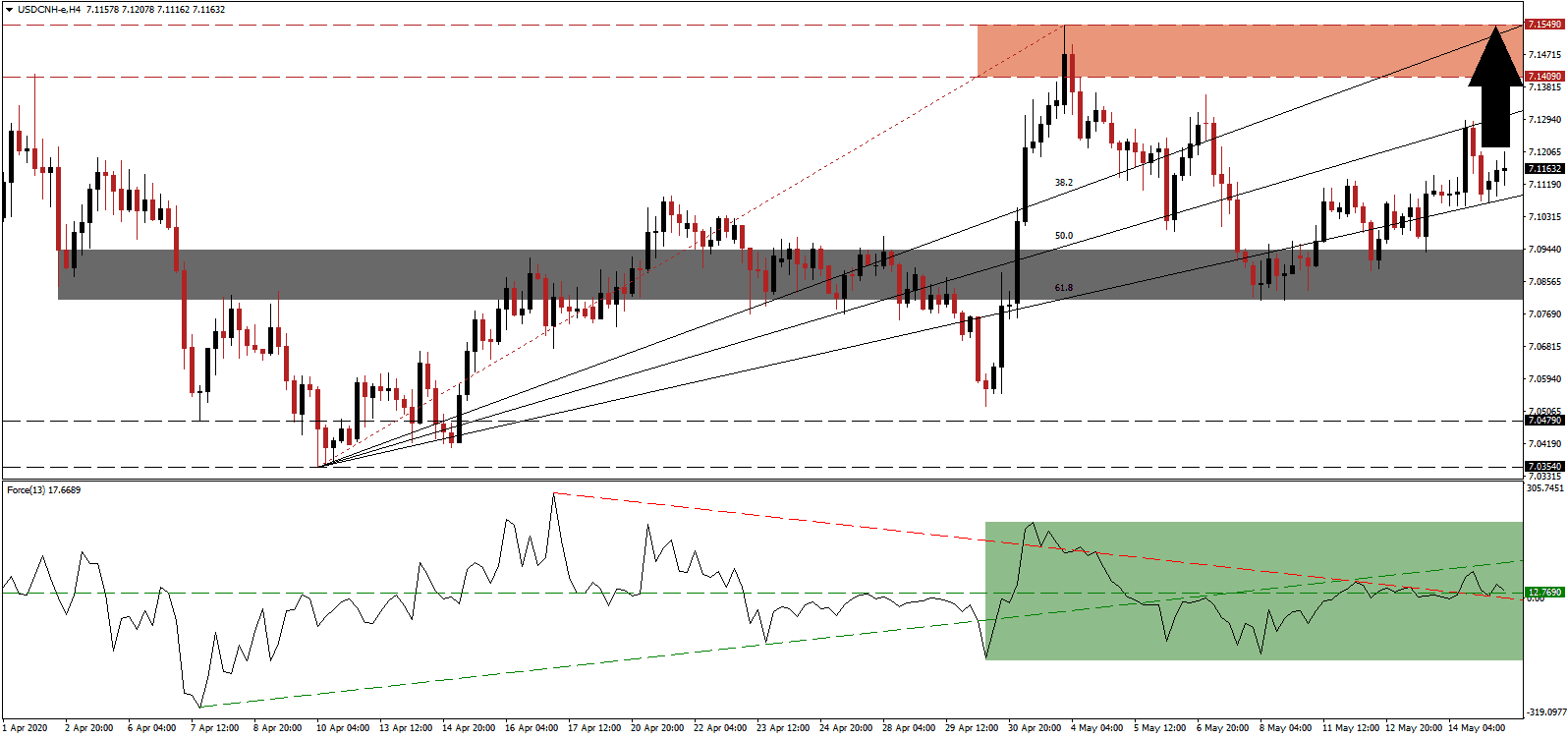

China reported a better than expected rebound in April industrial production, but retail sales remained depressed. Wuhan province is where the Covid-19 virus was initially recorded, and China has been challenged by the West for not containing the outbreak. US President Trump has been notably vocal and is risking a more protracted trade war, rendering the phase one trade truce ineffective. With US policies weakening its currency, the USD/CNH is on course to extend its gains. China has every incentive to allow its currency to depreciate in the open-market, signaling it is walking away from the trade truce, as President Trump has increases his verbal attacks. It resulted in a breakout in this currency pair above its short-term support zone, and more gains are anticipated.

The Force Index, a next-generation technical indicator, converted its horizontal resistance level into support, as marked by the green rectangle. It is now located above its descending resistance level and below its ascending support level, both taking on reversed roles. Bulls took control of the USD/CNH after this technical indicator crossed above the 0 center-line. A more extensive advance into positive territory is favored to lead to a breakout extension in this currency pair.

With China being exposed to the virus first, it is also ahead of the recovery. The pandemic, which resulted in a complete shutdown of the country for several weeks and an estimated 90 million job losses, also accelerated essential trends within the economy. Digitization, already at the core of social life, manifested its importance, as more people embrace it. A focus on the domestic economy, technology, and capital, away from reliance on being the world’s manufacturer, is poised to accelerate this decade, while the private sector is growing, on the back of rising local demand. It added to circumstances for the Chinese government to allow depreciation in its currency, making imports more expensive. The USD/CNH accelerated out of its short-term support zone located between 7.0805 and 7.0941, as marked by the grey rectangle.

Volatility is likely to increase, but the ascending Fibonacci Retracement Fan sequence is positioned to guide this currency pair farther to the upside. The 38.2 Fibonacci Retracement Fan Resistance Level is on the verge of crossing above the top range of its resistance zone located between 7.1409 and 7.1549, as identified by the red rectangle. Despite a bearish outlook for the US Dollar, the USD/CNH carries a bullish bias. It is backed by Chinese government incentives to ensure proper steps are implemented to capitalize on developing structural shifts in the global economy. A weaker currency appears central to its medium-term strategy.

USD/CNH Technical Trading Set-Up - Breakout Extension Scenario

- Long Entry @ 7.1160

- Take Profit @ 7.1550

- Stop Loss @ 7.1050

- Upside Potential: 3,900 pips

- Downside Risk: 1,100 pips

- Risk/Reward Ratio: 3.55

A breakdown in the Force Index below is descending resistance level, acting as support, could pressure the USD/CHN into a minor correction. With deteriorating developments between the US and China, the downside potential remains restricted to its short-term resistance zone unless a fundamental change in conditions materializes. Forex traders are advised to take advantage of any sell-off with new net buy positions.

USD/CNH Technical Trading Set-Up - Confined Breakdown Scenario

- Short Entry @ 7.0950

- Take Profit @ 7.0825

- Stop Loss @ 7.1010

- Downside Potential: 1,250 pips

- Upside Risk: 600 pips

- Risk/Reward Ratio: 2.08

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals and ...

more