US Dollar Index Speculators Lifted Bets For 6th Week To Over 2-YR High. NZD Bets Slide To Record Low

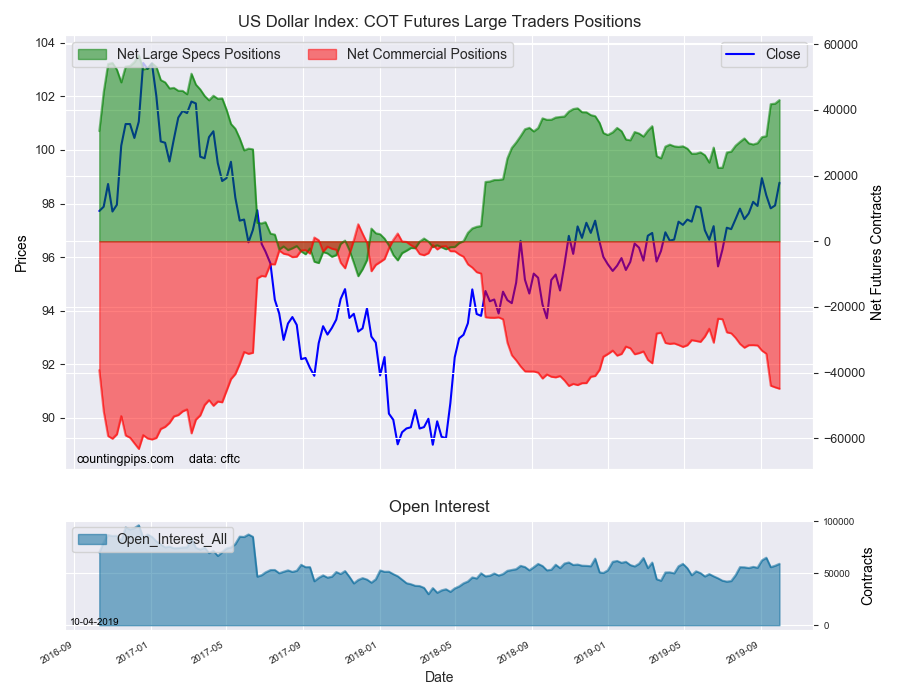

US Dollar Index Speculator Positions

Large currency speculators once again lifted their bullish net positions in the US Dollar Index futures markets this week while also dropping New Zealand dollar bets to a new record low, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 43,028 contracts in the data reported through Tuesday, October 1. This was a weekly increase of 1,089 contracts from the previous week which had a total of 41,939 net contracts.

This week’s net position was the result of the gross bullish position (longs) advancing by 2,255 contracts (to a weekly total of 52,568 contracts) compared to the gross bearish position (shorts) which saw a lesser gain by 1,166 contracts on the week (to a total of 9,540 contracts).

US Dollar Index speculators raised their bets for a sixth consecutive week and their bullish sentiment has now risen by a total of +13,529 contracts over that period. These recent gains have pushed the speculative bullish position to above the +40,000 net contract level for a third straight week and to the highest level of the past 127 weeks, dating back to April 25th of 2017.

Individual Currencies Data this week: New Zealand dollar continues to hit records

In the other major currency contracts data, we saw only one substantial change (+ or – 10,000 contracts) but also one record position in the speculators category this week.

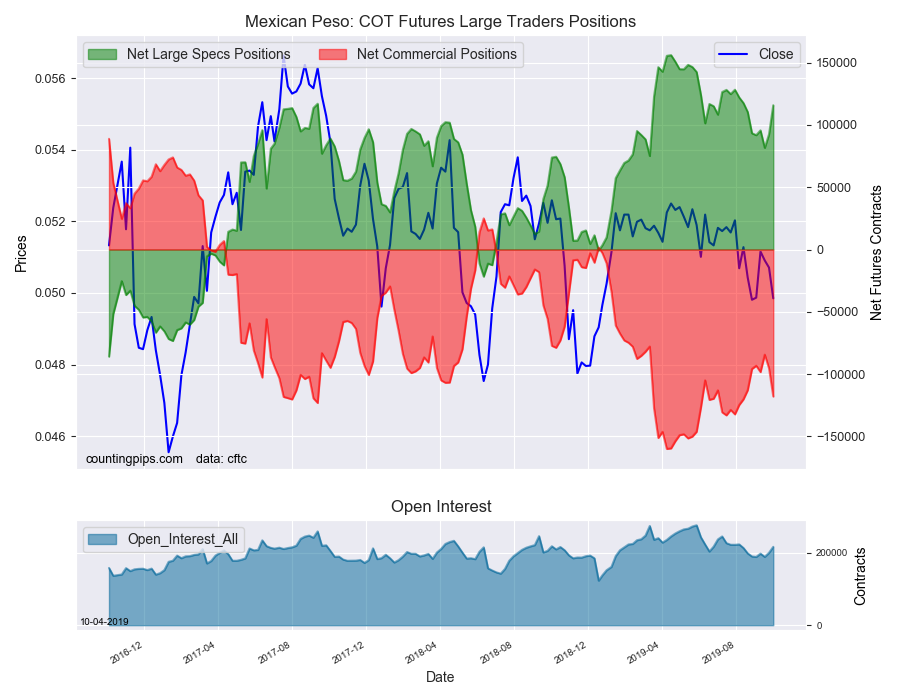

Mexican peso bullish bets jumped by over +20,000 contracts this week and rose sharply for a second consecutive week. The peso positions had also risen by over +10,000 contracts last week. These recent gains pushed the net position back over the +100,000 contract level for the first time in six weeks, dating back to August 27th. Previously, peso positions had been above the +100,000 contract level for twenty-three straight weeks through August 20th.

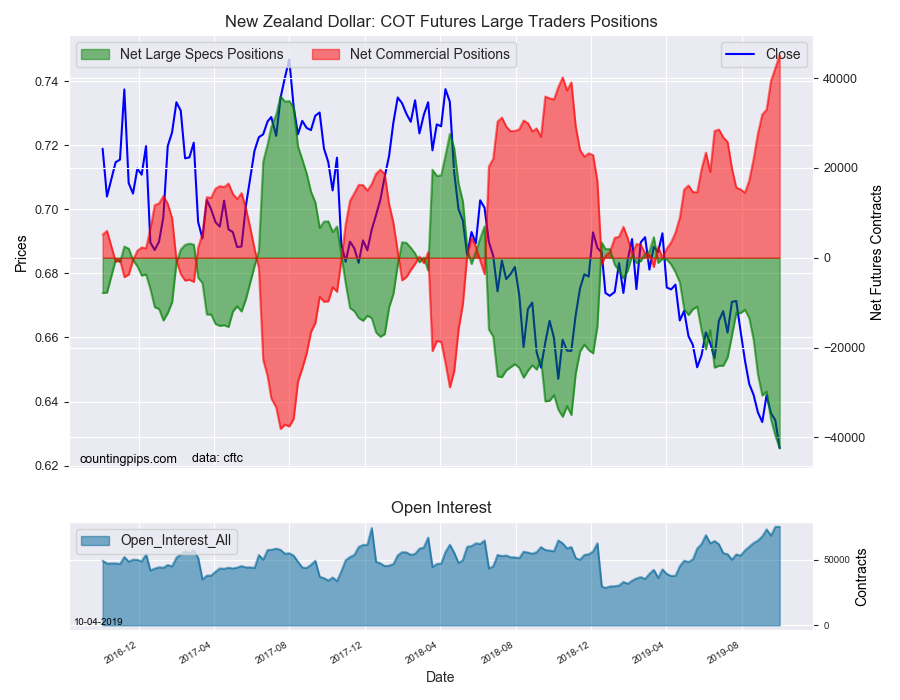

New Zealand dollar bets hit another new record bearish level this week after reaching records in each of the past two weeks as well. This week’s decline pushed bearish bets above the -40,000 net contract level and results from the NZD bets falling in eight out of the past ten weeks. Speculative bets have now been in bearish territory for a total of twenty-nine consecutive weeks, dating back to March 19th.

Overall, the major currencies that saw improving speculator positions this week were the US dollar index (1,089 weekly change in contracts), British pound sterling (3,703 contracts), Japanese yen (1,134 contracts), Canadian dollar (1,735 contracts) and the Mexican peso (23,398 contracts).

The currencies whose speculative bets declined this week were the euro (-5,256 weekly change in contracts), Swiss franc (-983 contracts), Australian dollar (-5,147 contracts) and the New Zealand dollar (-2,876 contracts).

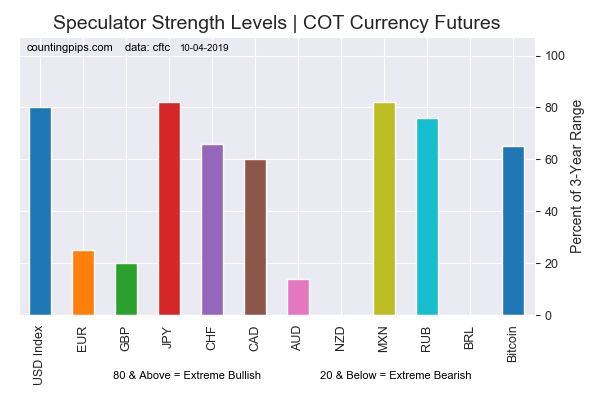

Chart: Current Strength of Each Currency compared to their 3-Year Range

See the table and individual currency charts below.

Table of Large Speculator Levels & Weekly Changes:

| Currency | Net Speculator Position | Specs Weekly Change |

| USD Index | 43,028 | 1,089 |

| EuroFx | -65,978 | -5,256 |

| GBP | -77,092 | 3,703 |

| JPY | 13,917 | 1,134 |

| CHF | -11,535 | -983 |

| CAD | 6,327 | 1,735 |

| AUD | -52,302 | -5,147 |

| NZD | -42,474 | -2,876 |

| MXN | 115,812 | 23,398 |

This latest COT data is through Tuesday and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Weekly Charts: Large Trader Weekly Positions vs Price

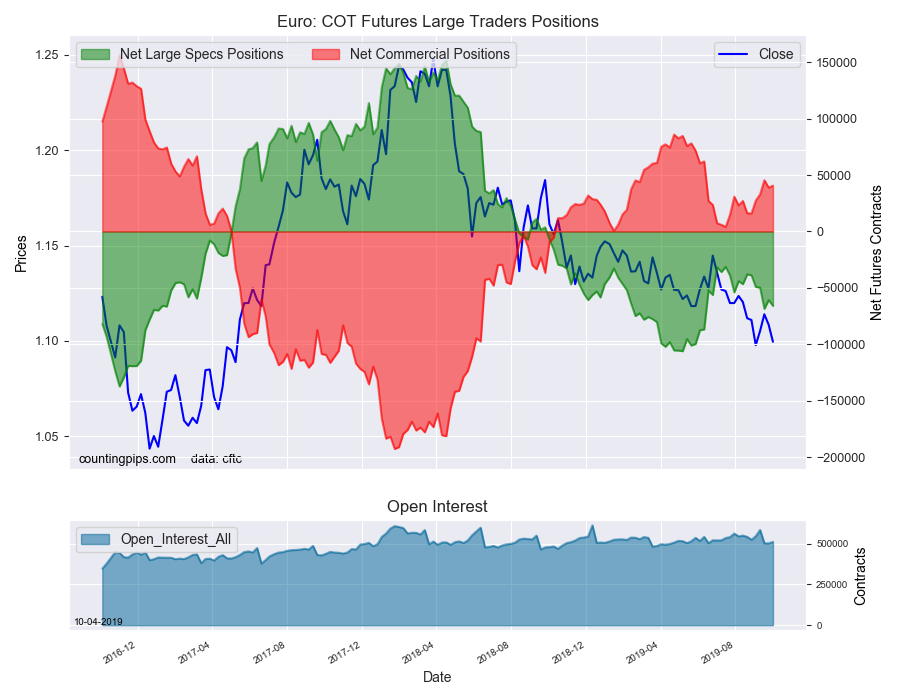

EuroFX:

The Euro large speculator standing this week reached a net position of -65,978 contracts in the data reported through Tuesday. This was a weekly decline of -5,256 contracts from the previous week which had a total of -60,722 net contracts.

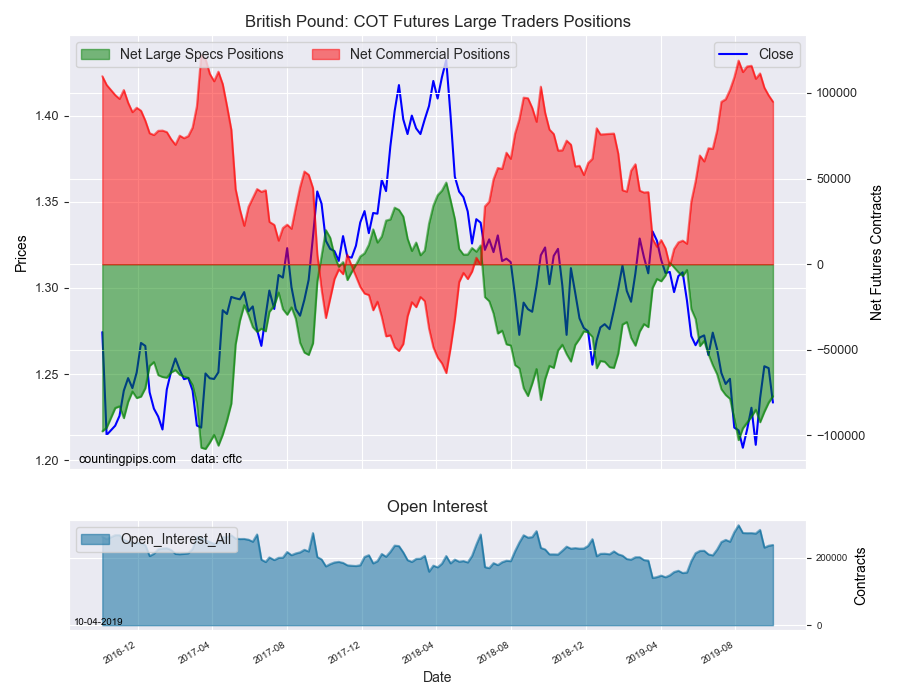

British Pound Sterling:

The large British pound sterling speculator level totaled a net position of -77,092 contracts in the data reported this week. This was a weekly increase of 3,703 contracts from the previous week which had a total of -80,795 net contracts.

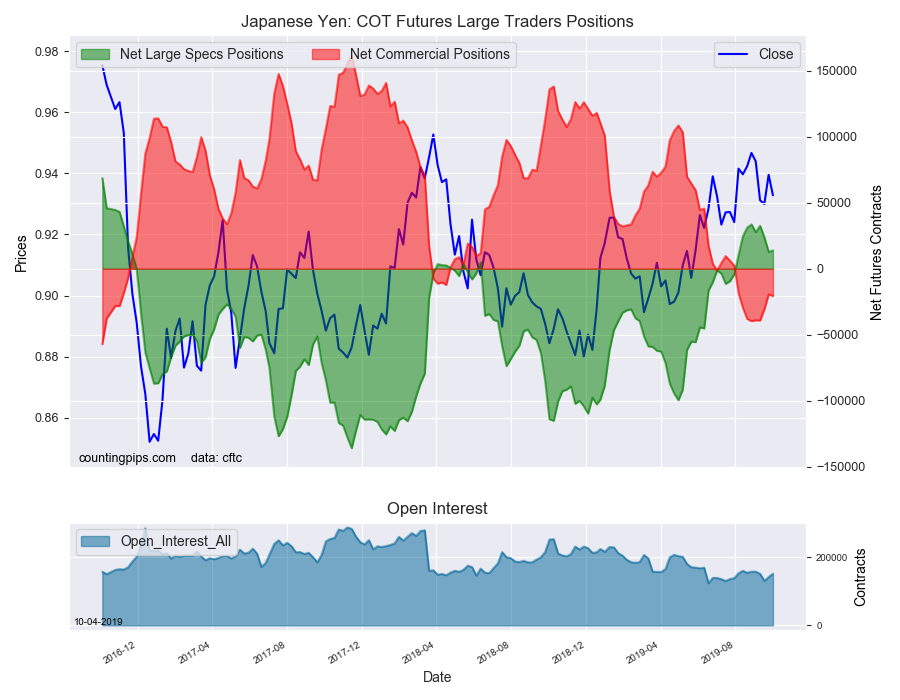

Japanese Yen:

Large Japanese yen speculators reached a net position of 13,917 contracts in this week’s data. This was a weekly gain of 1,134 contracts from the previous week which had a total of 12,783 net contracts.

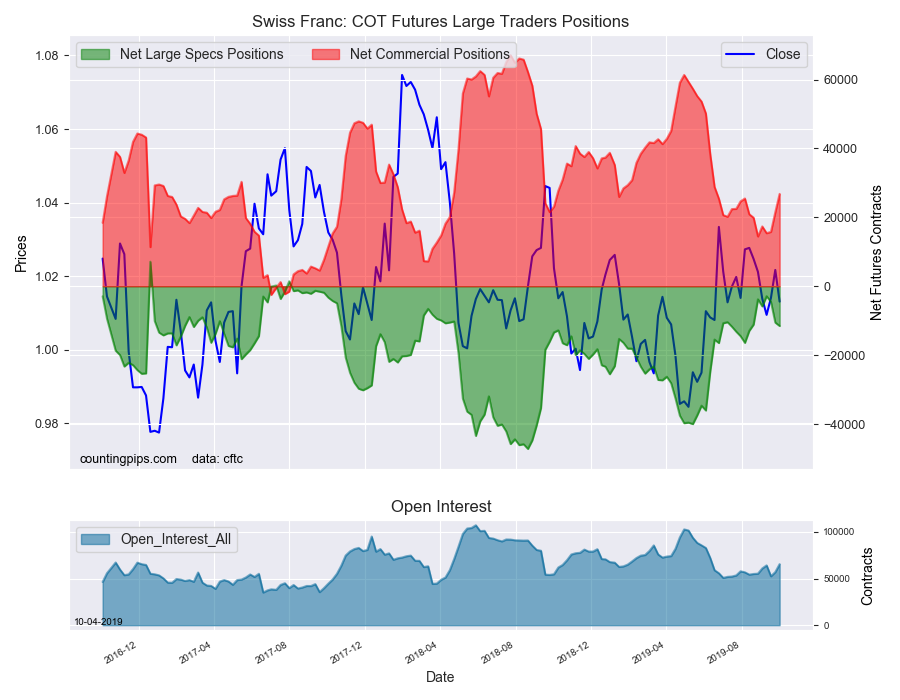

Swiss Franc:

The Swiss franc speculator standing this week reached a net position of -11,535 contracts in the data through Tuesday. This was a weekly decrease of -983 contracts from the previous week which had a total of -10,552 net contracts.

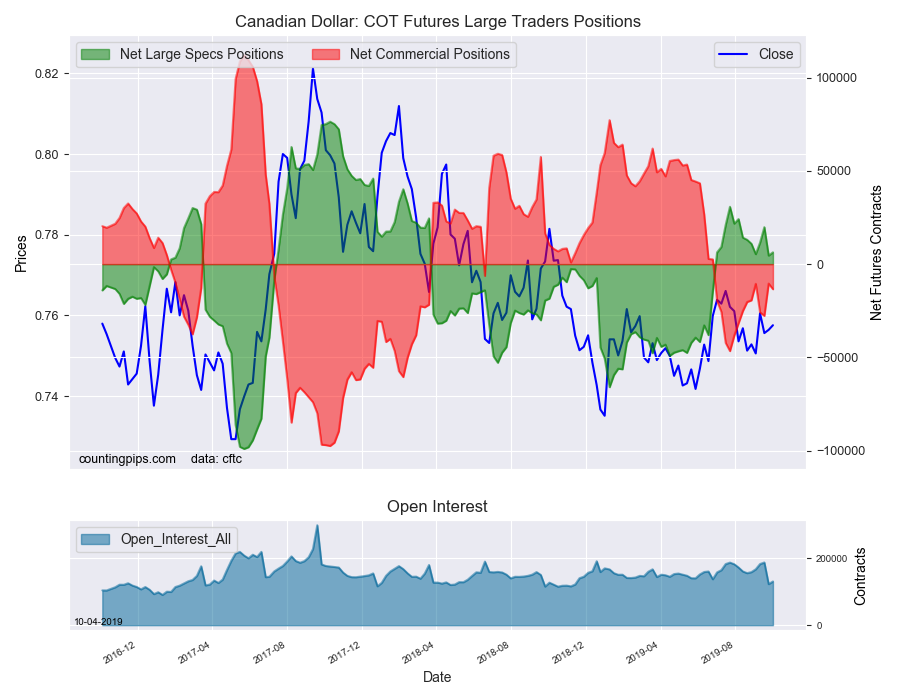

Canadian Dollar:

Canadian dollar speculators came in at a net position of 6,327 contracts this week. This was a increase of 1,735 contracts from the previous week which had a total of 4,592 net contracts.

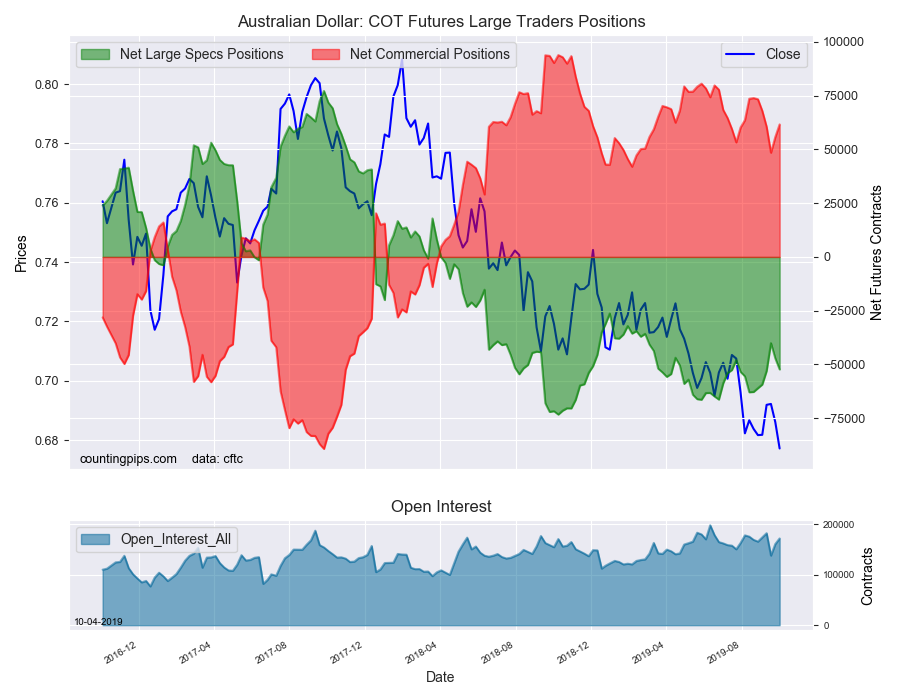

Australian Dollar:

The large speculator positions in Australian dollar futures came in at a net position of -52,302 contracts this week in the data ending Tuesday. This was a weekly decline of -5,147 contracts from the previous week which had a total of -47,155 net contracts.

New Zealand Dollar:

The New Zealand dollar speculative standing totaled a net position of -42,474 contracts this week in the latest COT data. This was a weekly lowering of -2,876 contracts from the previous week which had a total of -39,598 net contracts.

Mexican Peso:

Mexican peso speculators reached a net position of 115,812 contracts this week. This was a weekly boost of 23,398 contracts from the previous week which had a total of 92,414 net contracts.

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here.

Disclosure: Foreign Currency trading and trading on margin carries a high level of risk and can result in loss of part or all of your investment.Due to the level of risk and market volatility, ...

more