US Corn & Bean Counts Up From 2019, But Not 2018. Derecho Too

Market Analysis

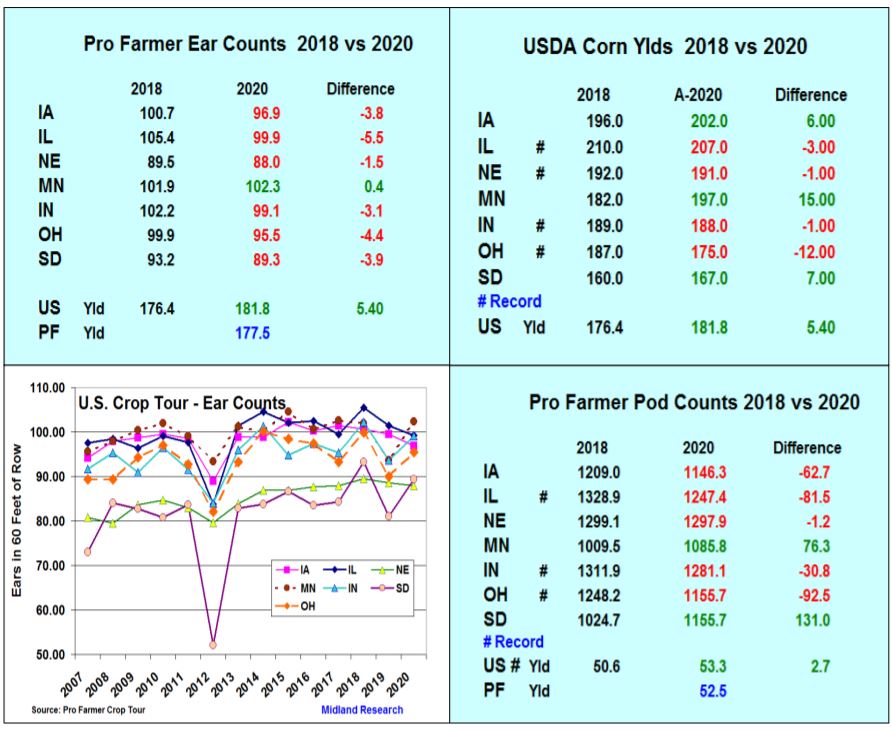

This year’s Pro Farmer Midwest Crop Tour data showed a recovery from 2019’s difficult season across the seven major states that the tour samples each year. However, with the USDA’s August yield projections being substantially higher than their previous yearly records, the 2018 crop year appears to be better period for comparisons. After my crop tour of C. IL earlier this month revealed a 3,000 lower average ear count per acre (27,900) verse last year, this yield factor was on my watch list. Overall, ear numbers per acre and soybean pod numbers are the two most important crop factors in measuring the potential yield. After an erratic ECB spring planting season, August’s expanding Midwest dryness and Iowa’s Derecho damaging numerous fields, these additional factors will also impact the USDA’s upcoming September 11 crop update.

Looking at corn’s (CORN) main yield component across the PF tour, 2020’s ear counts were down in 6 of the 7 states vs. 2018. This was lead by 5.5 ear drop in IL’s number. Interestingly, 4 states (IA, IN< OH, SD) had 3-4 less ears while MN eked out a 0.4 higher ear average than 2018. Two states SD and MN had higher projected average yields on the 2020 PF tour with ear length & rows numbers helping their yields. However, IL, IN, OH & NE had lower PF average yields than 2018. With IA experiencing expanding dryness & heavy winds along with 3.8 less ears, the tour’s IA corn yield estimate was 10.4 bu. less than 2018. Overall, this suggests the USDA’s 2020 US corn yield of 181.8 bu (+5.4 bu vs 2018’s near record) looks very optimistic. Because of their data, state sampling adjustments and lower harvested area of 525,000 acres (300,000 in Iowa), Pro Farmer forecast a 14.82 billion bu. crop with 177.5 yield.

Soybean’s (SOYB) potential looks strong, but this year’s tour pod counts are down in 5 of 7 states (MN & SD were up). With dryness impacting seed size and pod numbers, Pro Farmer projected 52.5 US yield and 4.36 billion bu soybean crop.

What’s Ahead

The Pro Farmer crop data and the hottest Midwest temperatures of the growing season have added production uncertainty to the US corn & soybean crop. However, significantly larger Chinese purchases will be needed to tighten US corn and soybean supplies ahead of harvest.

Use new-crop strength in the $3.57-$3.63 and $9.35-$9.42 range to have 30-33% of your 2020/21 crops hedged ahead of harvest.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more