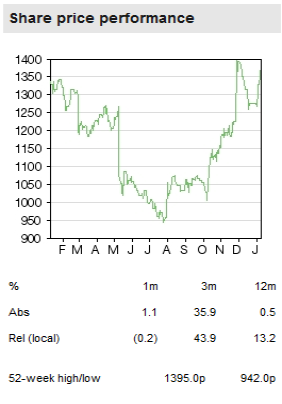

Greggs plc. (GRG.L), the leading food-on-the-go retailer, has continued an impressive upwards trend in like-for-like (lfl) owned-store sales growth across Q4, and in the final five weeks of FY18e. The company is successfully drawing new customers into its stores with strategic product launches and efforts to reduce queues and improve product availability. We upgrade both our FY18 and FY19 PBT forecasts for the second time in six weeks, by 3%.

Lfl sales continued to strengthen across Q4

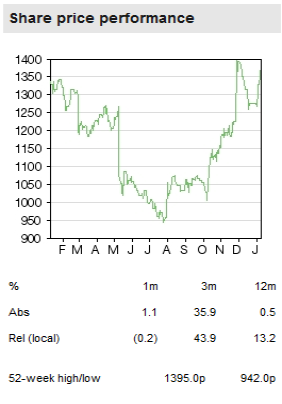

Q418 company-managed store lfl sales rose by 5.2%, implying growth of approximately 6.3% over the final five weeks compared with a reported increase of 4.5% over the first eight weeks of the quarter. This follows a solid Q318 increase of 3.2% and marks the 21st consecutive quarter of lfl sales growth for the company; an enviable record in the current climate. Although travel and work-related locations generally delivered the highest lfl sales growth, the strong performance was broad based, a testament to the ongoing transformation of the brand.

Leveraging the brand

Although Greggs does not invest in above-the-line advertising, it does use social media marketing and is very successful in generating waves of positive publicity around innovative new products to draw new customers into the stores – the recently launched vegan sausage roll to complement ‘Veganuary’ being an example. New IT systems, implemented in 2017, are starting to deliver marked improvements in replenishment and the speed at which customers are served.

A further upgrade to earnings forecasts

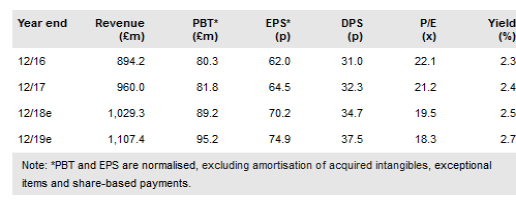

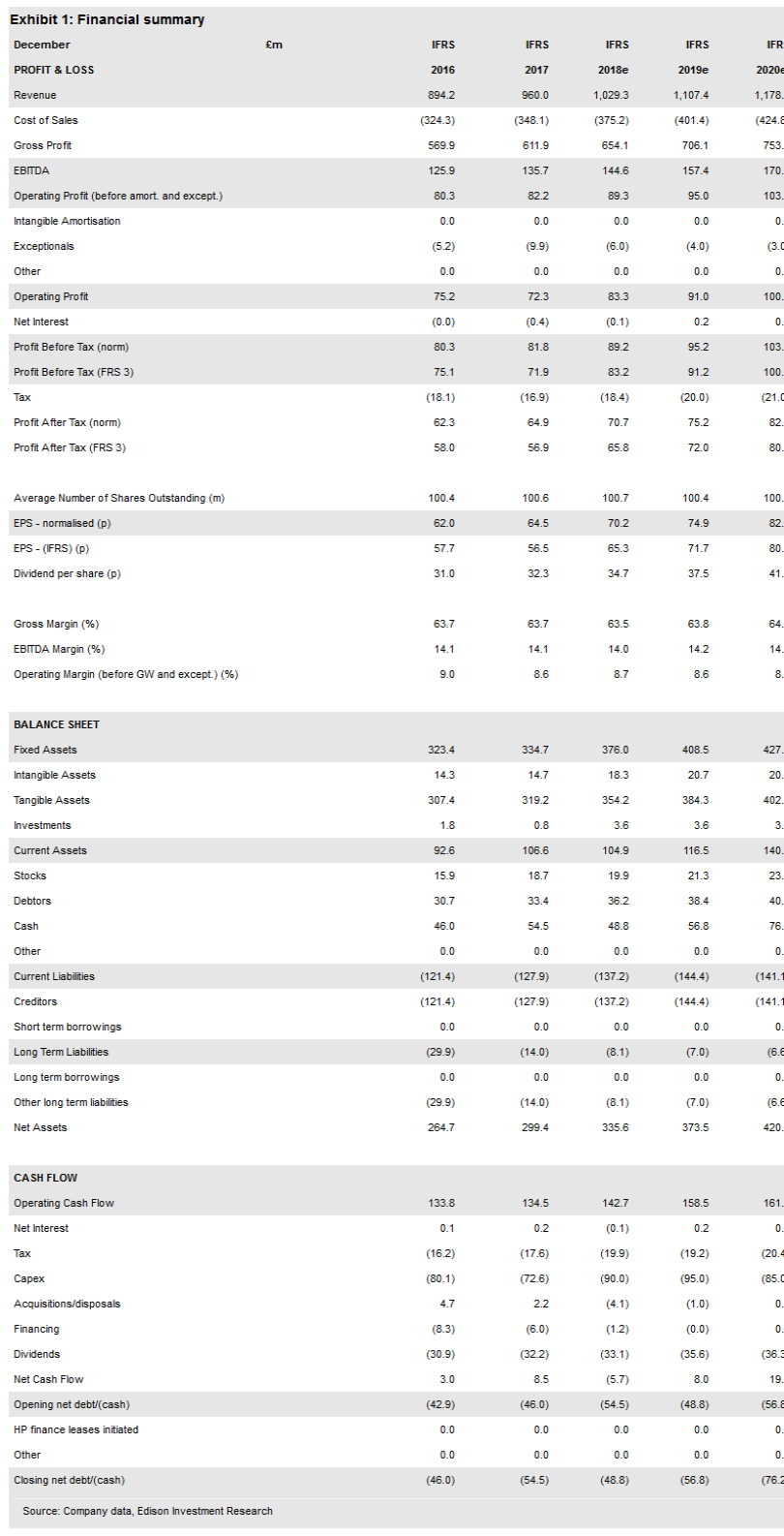

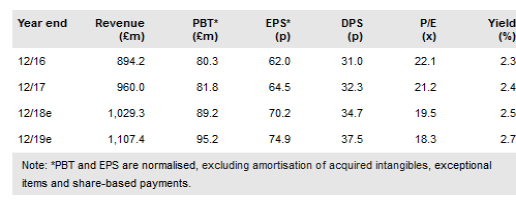

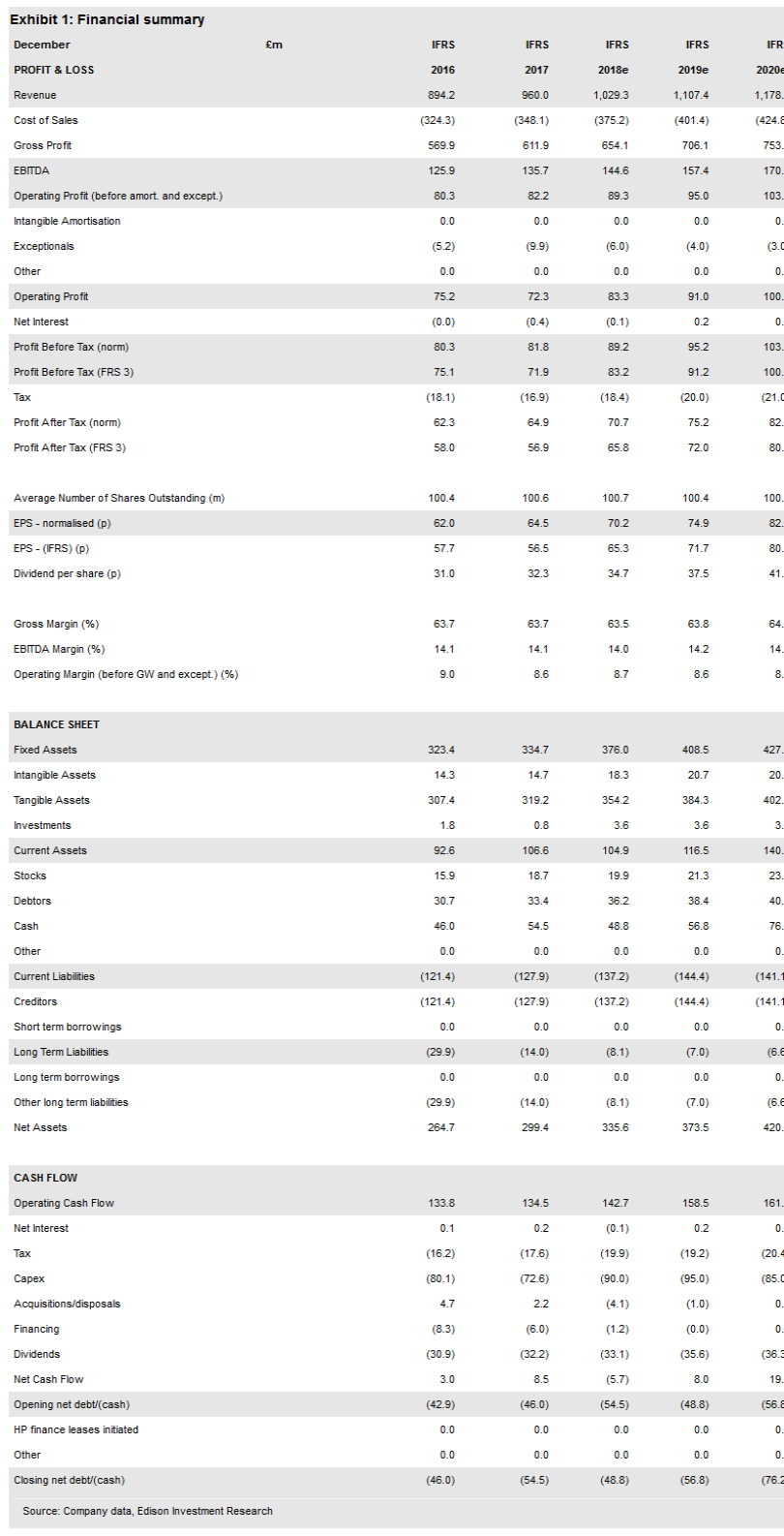

We upgrade both our FY18 and FY19 PBT by 3% to £89.2m and £95.2m, respectively. In FY19 we conservatively forecast 2% lfl sales growth, with a stronger H1 vs H2 against softer comparatives (assuming no repeat of the extreme weather patterns that dominated the first half of 2018), and 5.6% growth from new stores.

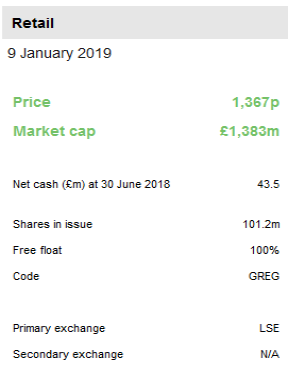

Valuation: Supported by quality of earnings and yield

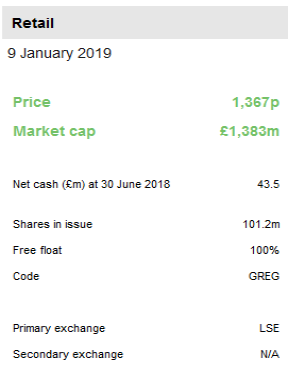

As a result of the sector de-rating, our blended DCF and peer-group valuation remains broadly unchanged at 1,517p. This implies an FY19e P/E multiple of 20.3x, which does not appear stretched given the quality of earnings and dividend yield.

(Click on image to enlarge)

Disclosure: This report has been commissioned by Greggs and prepared and issued by Edison, in consideration of a fee payable by Greggs. Edison Investment Research standard fees are £49,500 pa ...

more

Disclosure: This report has been commissioned by Greggs and prepared and issued by Edison, in consideration of a fee payable by Greggs. Edison Investment Research standard fees are £49,500 pa for the production and broad dissemination of a detailed note (Outlook) following by regular (typically quarterly) update notes. Fees are paid upfront in cash without recourse. Edison may seek additional fees for the provision of roadshows and related IR services for the client but does not get remunerated for any investment banking services. We never take payment in stock, options or warrants for any of our services.

Accuracy of content: All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Opinions contained in this report represent those of the Edison analyst at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations.

Exclusion of Liability: To the fullest extent allowed by law, Edison shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.

No personalised advice: The information that we provide should not be construed in any manner whatsoever as, personalised advice. Also, the information provided by us should not be construed by any subscriber or prospective subscriber as Edison’s solicitation to effect, or attempt to effect, any transaction in a security. The securities described in the report may not be eligible for sale in all jurisdictions or to certain categories of investors.

Investment in securities mentioned: Edison has a restrictive policy relating to personal dealing and conflicts of interest. Edison Group does not conduct any investment business and, accordingly, does not itself hold any positions in the securities mentioned in this report. However, the respective directors, officers, employees and contractors of Edison may have a position in any or related securities mentioned in this report, subject to Edison's policies on personal dealing and conflicts of interest.

Copyright: Copyright 2019 Edison Investment Research Limited (Edison). All rights reserved FTSE International Limited (“FTSE”) © FTSE 2019. “FTSE®” is a trade mark of the London Stock Exchange Group companies and is used by FTSE International Limited under license. All rights in the FTSE indices and/or FTSE ratings vest in FTSE and/or its licensors. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE indices and/or FTSE ratings or underlying data. No further distribution of FTSE Data is permitted without FTSE’s express written consent.

Disclaimer: Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. This document may contain materials from third parties, which are supplied by companies that are not affiliated with Edison Investment Research. Edison Investment Research has not been involved in the preparation, adoption or editing of such third-party materials and does not explicitly or implicitly endorse or approve such content. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of publication and is subject to change without notice. While based on sources believed reliable, we do not represent this material as accurate or complete. Any views or opinions expressed may not reflect those of the firm as a whole. Edison Investment Research does not engage in investment banking, market making or asset management activities of any securities. The material has not been prepared in accordance with the legal requirements designed to promote the independence or objectivity of investment research.

less

How did you like this article? Let us know so we can better customize your reading experience.