UK Housing Market: Limited Supply Holds Back Spring Bounce

Take heart, we’re not the only ones waiting for a full-fledged spring, the latest RICS survey suggests the UK housing market is also waiting for temperatures to rise.

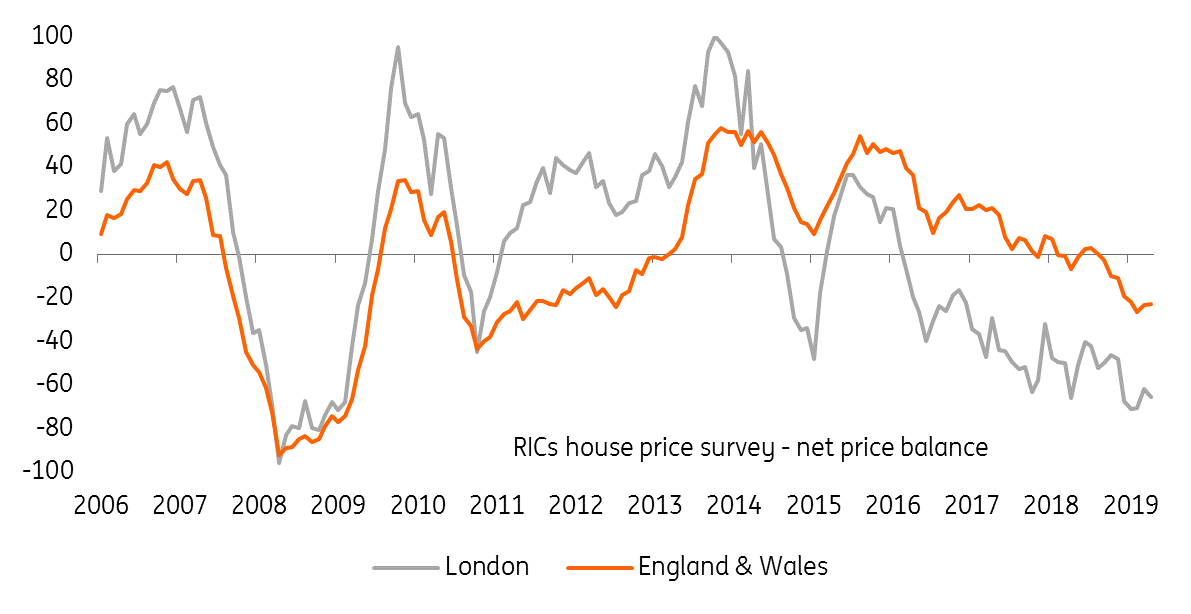

House prices in the UK have seen a noticeable slowdown over the last two years, and despite Brexit being kicked down the road to October, things haven’t perked up much for the property market. Brexit uncertainty, coupled with a lack of available stock, continue to make people feel nervous about buying and selling their homes and there seems to be little sense of a turnaround anytime soon.

According to the Royal Institute of Chartered Surveyors (RICS) sentiment survey, the balance between the proportion of surveyors seeing house prices rise to those seeing a fall in April has remained unchanged at -23%. This is in line with recently released government numbers which suggest average prices in the UK grew by a marginal 0.6% in February compared to a year earlier - the smallest rise since September 2012.

Despite all the doom and gloom, it’s worth noting that price expectations for UK houses over the next twelve months are modestly positive

London and the South East appear to be the weakest link where things appear to be particularly troubling, as prices in London alone fell by 3.8% year-on-year. Brexit uncertainty, coupled with changes to stamp duty and tax treatment of rental income, has hit the capital harder than the rest of the country. Property valuations in London are typically much higher and rental yields lower than in other UK regions.

But there is also a clear divergence in the number of properties on the market. In London, estate agents are reporting fairly average levels of properties on their books, resulting in very poor sales-to-stock ratios, and thereby putting further pressure on prices. Elsewhere in the country, the stock is much more limited and in many cases, well below average. The RICS survey suggests fewer properties are coming to the market too, as sellers continue to withhold stock thereby limiting choice for potential buyers. A net balance of 35% of surveyors has seen a fall in instructions during April - the poorest reading since June 2016.

But despite all the doom and gloom, it’s worth noting that price expectations for the next twelve months are modestly positive. Scotland and Northern Ireland have already been bucking the trend where prices continue to rise.

RICs house price survey - net price balance

Source: Macrobond

What’s going on in the lettings market?

As affordability bites, first-time buyers continue to postpone their purchases to save for a larger deposit, which increases the size of the rental sector.

The survey suggests the upcoming letting fees ban, which prevents landlords from charging tenants for credit checks and references and proposed plans to get rid of section 21, which allows them to evict tenants at short notice, could potentially make some landlords leave the market altogether. These changes come on top of the recent stamp duty changes which have seen buy-to-let investors facing an extra 3% charge, prompting another sharp fall in landlord instructions.

However, in the long-term, these changes need not necessarily be viewed negatively, as a larger rental market may offset tax distortions that currently discourage renting in the UK.

What does all of this mean for the economy?

Given how important consumer confidence is for the housing market, the temporary dip in Brexit noise, rising wage growth story and a strong jobs market should all, in theory, be positive factors, at least in the near-term. However, the latest Bank of England credit conditions survey suggests that demand for secured lending for house purchases is expected to decrease further in 2Q, suggesting the tide in the property market is not likely to change rapidly.

Still, we don’t expect the property market to feature too heavily in the Bank of England’s future decision on interest rates. Over half of mortgage holders are on a fixed-rate product, compared to around 30% back in 2012.

This means that consumers are generally less exposed to the impact of gradual rate rises and the outlook for interest rates will continue to hinge on the outlook for investment, which we expect to remain pressured by ongoing uncertainty. We currently don’t expect a rate hike this year, although having said that, recent comments from Governor Mark Carney suggest a November move shouldn’t be ruled out if Article 50 is extended again.

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more