UK Adds No New Countries To Its Green Travel List

During yesterday's session, the UK announced that for the time being it will not add new countries to its so-called "green list" of countries and destinations considered safe when travelling due to the COVID-19 pandemic.

This list began to be published after the United Kingdom began allowing its citizens to travel abroad, with the UK government categorising countries into three lists, following the simple operation of a traffic light. Through the list, British citizens can see if they can travel freely or with restrictions, depending on the epidemiological situation and the vaccination process. The travel list is updated every three weeks.

The countries on the green list are those where British citizens can travel without any restrictions. Currently on the green list we can find the following countries: Australia, Brunei, Falkland Islands, Faroe Islands, Gibraltar, Iceland, Israel, New Zealand, Portugal, Singapore, George and South Sandwich Islands, Saint Helena and Ascension Island.

If we focus more closely on the list, we notice a curious trend. Indeed, many of these destinations are members of the Commonwealth or British territories, while most of the major and popular European destinations of the English, such as Spain, Italy, Greece and France are excluded. The exception to this was Portugal, but the country will now be removed from this list, instead moving to the amber list, despite hosting the final of the Champions League in Lisbon last week, which featured two English teams.

This decision has had a significant impact on the European tourism sector, as it was expected that the new update would in fact include several new destinations, rather than a decrease in green countries. As a result, there was a general decline in yesterday's session, in terms of the tourism sector in the financial markets.

Specifically, companies IAG, Lufthansa, Air France-KLM, EasyJet and Ryanair had declines of 4.82%, 3.52%, 4.64%, 5.08% and 4.52% respectively during Thursday’s session.

If we focus on IAG, the holding company formed by British Airways and the Spanish Iberia, it has been one of the companies that has weathered the pandemic storm the best during the last months. This is largely thanks to the significant volume of liquidity that it had during the past year, and partly due to its good position in the sector and the capital increase that it made during the month of September. However, in the stock market, its price is still quite punished despite to the good future prospects, thanks to the good pace of vaccination, although after yesterday's decision, the final take-off may be delayed.

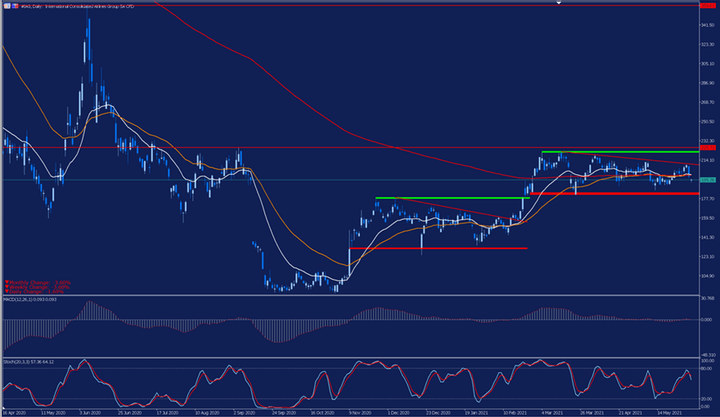

If we look at the daily chart, we can see how this company, after marking lows, began an uptrend that has led it to perform two strong sideways similar price consolidation patterns after experiencing a strong rebound.

The first of these side ranges was surpassed in February, where the price was finally able to overcome the high band of that channel after exceeding 200 GBX per share and its average of 200 sessions. Following that move, the price again began another sideways move between the March highs and an area near the upper band of the previous channel acting as the main support level.

A possible bullish trigger could be the possible inclusion of Spain and other countries to the UK green list within the next three weeks, which could lead to a bullish break of this new channel, opening the doors to a strong momentum that could take the price to levels not seen since last summer, thus confirming the change of trend.

Source: IAG daily chart of Admiral Markets' MetaTrader 5 platform from March 17, 2020 to April 26, 2021. Held on April 26 at 13:00 hours CET. Note: Past performance is not a reliable indicator of future results or future performance.

Evolution of the last 5 years:

- 2020: -61,40%

- 2019: 1,20%

- 2018: -5,07%

- 2017: 47,65%

- 2016: -27,78%

Disclaimer: The given data provides additional information regarding all analysis, estimates, prognosis, forecasts or other similar assessments or information (hereinafter ...

more